The W-2 form is a key document that employees receive from their employers at the end of each tax year. It summarizes an employee's total earnings, tax withholdings, and other deductions for the year. Like the ADP pay stub, the W-2 provides a detailed breakdown of earnings and withholdings. However, while the pay stub reflects information for a specific pay period, the W-2 encompasses the entire year’s financial activity, making it essential for annual tax filings.

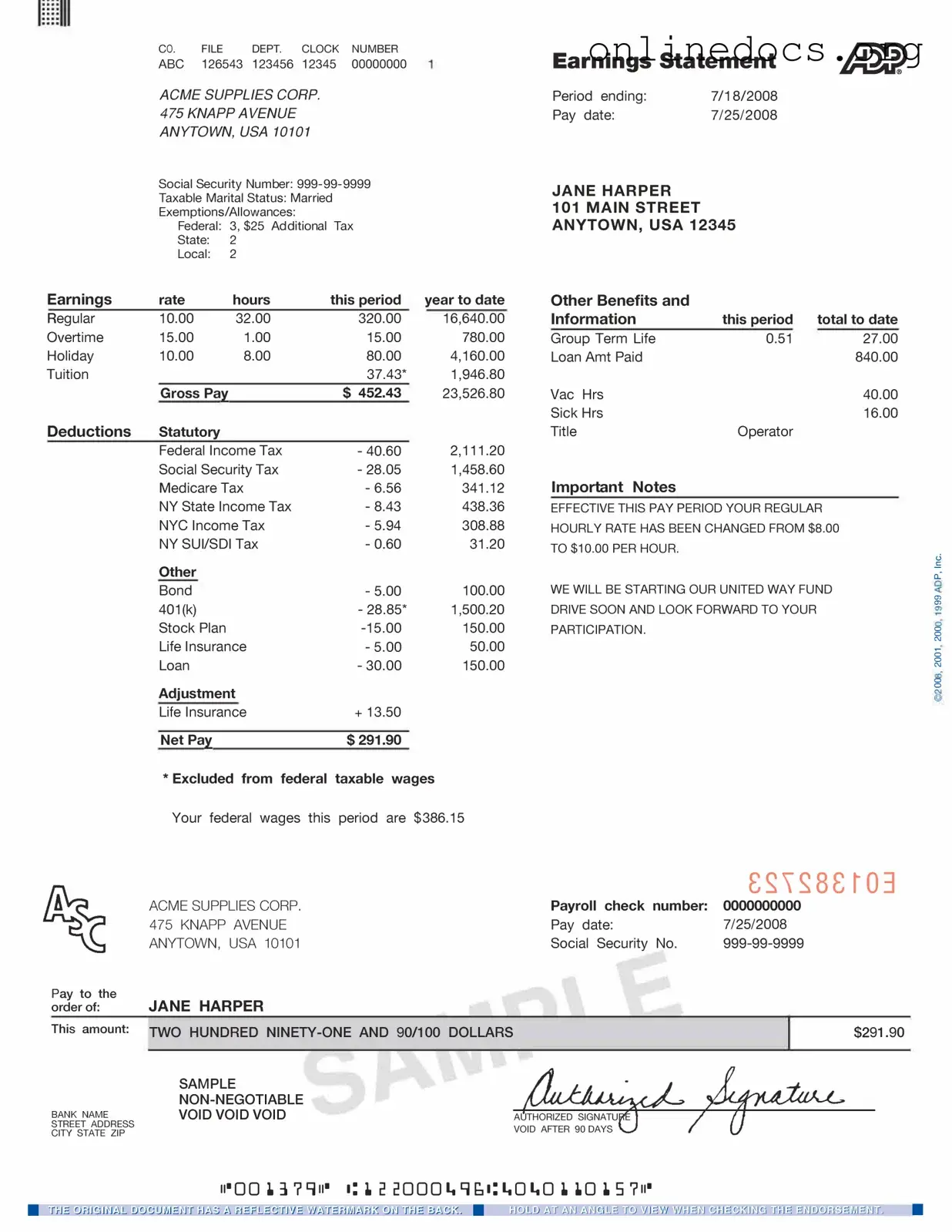

The pay statement, often used interchangeably with the pay stub, serves a similar purpose by providing a detailed account of an employee's earnings and deductions for a specific pay period. It includes information such as gross pay, net pay, and various deductions. While the ADP pay stub may be generated electronically, traditional pay statements can be printed or provided in physical form, but both documents aim to inform employees about their compensation and deductions.

The 1099 form is another document that bears similarity to the ADP pay stub, particularly for independent contractors and freelancers. This form reports income received outside of traditional employment, such as freelance work or other non-employee compensation. Like the pay stub, the 1099 provides a clear summary of earnings, but it does not include withholding information, as independent contractors are responsible for their own tax payments.

The pay register is a record maintained by employers that outlines payroll information for all employees during a specific pay period. This document is similar to the ADP pay stub in that it details gross pay, deductions, and net pay. However, the pay register is typically an internal document used for payroll processing, while the ADP pay stub is issued directly to employees for their personal records.

To ensure the proper governance of your LLC, consider utilizing a well-structured Operating Agreement template that clearly defines roles and responsibilities. This essential document can help prevent disputes and streamline operations. For more information on how to create your own, you can visit this comprehensive Operating Agreement resource.

The earnings statement is often issued alongside the pay stub and provides a comprehensive overview of an employee's earnings over a specified period. It details wages, bonuses, and any other compensation. The earnings statement, much like the ADP pay stub, helps employees track their financial progress and understand their compensation structure, although it may not always include as much detail regarding deductions.

The payroll ledger is a financial document that records all payroll transactions for a company. It includes information about employee wages, deductions, and employer contributions. Similar to the ADP pay stub, the payroll ledger helps ensure accurate tracking of employee compensation. However, the ledger serves primarily as an accounting tool for the employer, while the pay stub is designed to inform the employee.