A Business Bill of Sale is similar to a Vehicle Bill of Sale, which serves as a record of the transfer of ownership for a motor vehicle. Just like the Business Bill of Sale, this document outlines the details of the transaction, including the buyer and seller's names, the vehicle's identification number, and the purchase price. Both documents provide legal protection for both parties by documenting the terms of the sale and confirming that the buyer has received the item in question.

Another document that resembles the Business Bill of Sale is the Equipment Bill of Sale. This form is used specifically for the sale of equipment, such as machinery or tools. Like the Business Bill of Sale, it details the specifics of the transaction, including the condition of the equipment, the sale price, and any warranties provided. This ensures that both the buyer and seller have a clear understanding of what is being sold and the terms surrounding that sale.

The Personal Property Bill of Sale is also akin to the Business Bill of Sale. This document is utilized for the sale of personal property, such as furniture or electronics. It captures essential information about the transaction, including a description of the item, the sale price, and the parties involved. This document, much like the Business Bill of Sale, serves as proof of ownership transfer and can be important for tax purposes or future disputes.

In the realm of real estate, the Real Estate Purchase Agreement shares similarities with the Business Bill of Sale. This document outlines the terms of sale for real property, including the purchase price and any contingencies. While the Business Bill of Sale is typically for tangible goods, both documents provide a framework for the transaction and protect the interests of both the buyer and seller.

The Lease Agreement is another document that resembles the Business Bill of Sale, albeit in a different context. This agreement establishes the terms under which one party can rent property from another. Like the Business Bill of Sale, it includes details such as the parties involved, the duration of the lease, and the payment terms. Both documents are essential for defining the rights and responsibilities of each party in the transaction.

A Gift Receipt can also be likened to the Business Bill of Sale, particularly when it comes to documenting the transfer of ownership. While a Gift Receipt indicates that no payment was exchanged, it still provides a record of the transaction. Both documents serve to confirm the transfer of an item from one person to another, ensuring that the new owner has proof of their possession.

The Promissory Note, while slightly different in nature, shares some characteristics with the Business Bill of Sale. This document outlines a promise to pay a specified amount of money to a lender or seller. In the context of a business sale, a Promissory Note may accompany the Business Bill of Sale if the buyer is financing the purchase. Both documents work together to clarify the terms of the transaction and protect the interests of both parties.

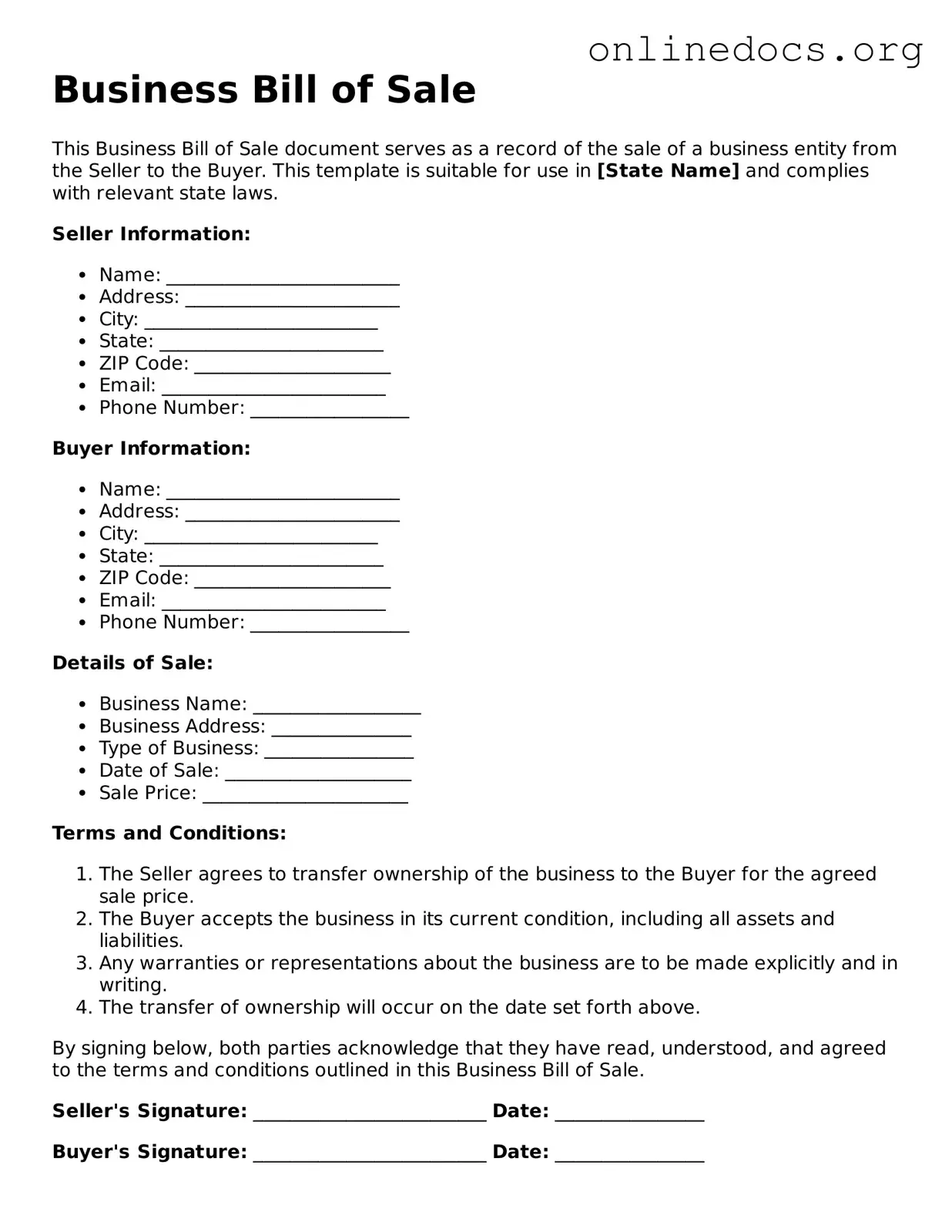

For those considering the sale of their business or business assets, it's important to utilize the appropriate documentation to ensure a smooth transaction. The Business Bill of Sale, while similar to other sales documents, serves the specific purpose of transferring ownership from the seller to the buyer. To gain insight into the necessary documentation for this process, one can visit floridapdfforms.com/bill-of-sale which provides comprehensive resources and guidelines.

Lastly, a Partnership Agreement can be considered similar to a Business Bill of Sale when it comes to the transfer of ownership interests in a business. This document outlines the terms of the partnership, including each partner's contributions and responsibilities. When a partnership is dissolved or ownership is transferred, a Business Bill of Sale may be used alongside the Partnership Agreement to formalize the sale of the business interests, ensuring clarity and legal protection for all involved.