Filling out a Business Credit Application form can be a crucial step for entrepreneurs seeking to secure financing. However, many applicants make common mistakes that can hinder their chances of approval. Understanding these pitfalls can help ensure that your application is both complete and accurate.

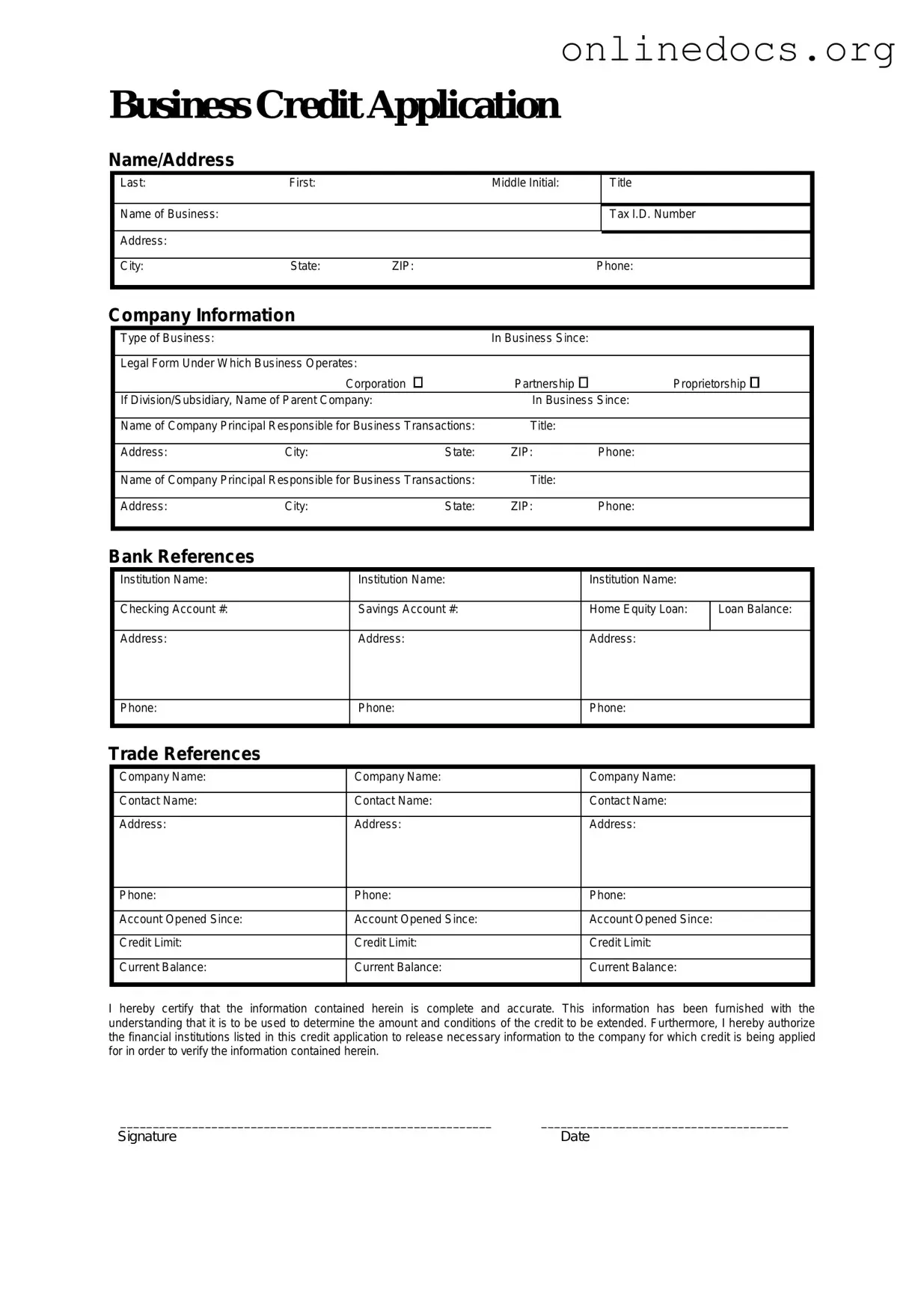

One frequent mistake is incomplete information. Many applicants fail to provide all required details, such as business address, ownership structure, or financial information. Omitting even a small piece of information can lead to delays or outright rejection of the application. Always double-check the requirements and ensure that every section is filled out thoroughly.

Another common error is inaccurate financial data. Applicants sometimes provide outdated or incorrect figures. This can misrepresent the financial health of the business and raise red flags for lenders. It’s essential to use the most recent financial statements and ensure that all numbers are accurate before submission.

Some applicants also neglect to review their credit history prior to applying. A poor credit score can significantly impact the decision-making process of lenders. It’s advisable to check your credit report for errors and take steps to improve your score before submitting the application.

Additionally, many people fail to explain the purpose of the credit clearly. Lenders want to understand how you plan to use the funds. Providing a vague or unclear explanation can lead to confusion and may result in a denial. Be specific about your needs and how the credit will benefit your business.

Another mistake involves not including supporting documentation. Many applicants forget to attach necessary documents, such as tax returns, business plans, or financial projections. These documents can provide valuable context and support your application, so make sure to include them when required.

Some individuals also ignore the fine print. It’s crucial to read all terms and conditions associated with the credit application. Overlooking important details can lead to misunderstandings about repayment terms or fees, which could create issues later on. Take the time to understand what you’re agreeing to.

Moreover, applicants sometimes rush the process. In an effort to secure funding quickly, many people fill out the application hastily, leading to mistakes. It’s vital to take your time, review your answers, and ensure everything is accurate before submitting the application.

Finally, a lack of professionalism in communication can also be a mistake. Whether it’s an email or a phone call, maintaining a professional tone is essential. Poor communication can create a negative impression and diminish your chances of approval. Always approach lenders with respect and clarity.

By avoiding these common mistakes, you can enhance your chances of a successful application. Take the time to prepare, review, and present your business in the best light possible. A well-completed Business Credit Application can pave the way for future growth and opportunities.