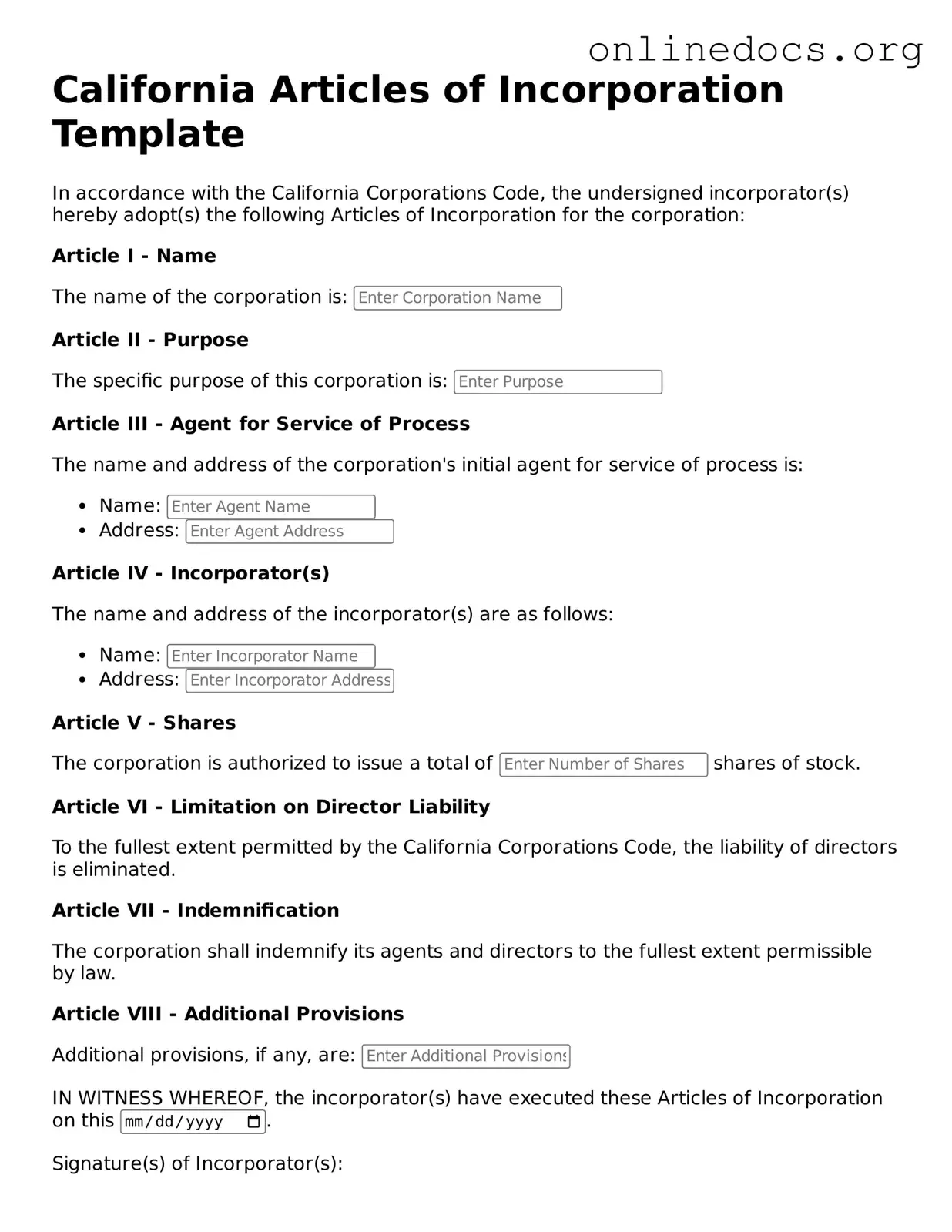

The California Articles of Incorporation form is similar to the Certificate of Incorporation, commonly used in other states. Both documents serve the primary purpose of establishing a corporation as a legal entity. They include essential information such as the corporation's name, purpose, and registered agent. While the format may vary slightly by state, the core requirements remain consistent across jurisdictions, ensuring that the corporation is recognized under state law.

The Bylaws of a corporation also share similarities with the Articles of Incorporation. While the Articles outline the basic structure and purpose of the corporation, the Bylaws provide detailed rules and procedures for the internal governance of the corporation. Both documents are critical in defining the corporation's framework, but the Bylaws focus more on operational aspects, such as meeting protocols and voting procedures.

The Limited Liability Company (LLC) Articles of Organization is another document that parallels the Articles of Incorporation. Both documents are used to form a legal business entity, but the Articles of Organization are specific to LLCs. They typically require information about the LLC's name, address, and management structure, similar to the information required in the Articles of Incorporation for corporations.

The Partnership Agreement is akin to the Articles of Incorporation in that it establishes a formal business relationship among partners. This agreement outlines each partner's contributions, responsibilities, and profit-sharing arrangements. While the Articles of Incorporation focus on corporate structure, the Partnership Agreement addresses the dynamics of a partnership, ensuring clarity in the business relationship.

To ensure that your LLC operates smoothly, having a well-structured comprehensive Operating Agreement form is essential. This important document not only outlines the management and operational procedures but also protects member interests by minimizing potential disputes.

The Certificate of Good Standing is a document that confirms a corporation’s legal existence and compliance with state requirements. Similar to the Articles of Incorporation, this certificate is essential for conducting business legally. Both documents validate the corporation's status, but the Certificate of Good Standing is typically issued after the Articles of Incorporation have been filed and accepted.

The Statement of Information is required in California and serves a purpose similar to the Articles of Incorporation. This document provides updated information about the corporation, such as its officers and address. While the Articles establish the corporation, the Statement of Information maintains transparency and compliance with state regulations over time.

The Certificate of Incorporation from Delaware shares similarities with California’s Articles of Incorporation. Both documents are foundational for establishing a corporation and require similar information, such as the corporation’s name and purpose. Delaware's Certificate is often preferred for its business-friendly laws, but both documents ultimately fulfill the same legal function of creating a corporation.

The Nonprofit Articles of Incorporation is a comparable document for organizations intending to operate as nonprofits. Like the standard Articles of Incorporation, this form establishes the organization as a legal entity but includes specific provisions related to nonprofit status, such as the purpose and distribution of assets. Both documents require filing with the state to obtain legal recognition.

The Foreign Corporation Registration is similar to the Articles of Incorporation in that it allows a corporation incorporated in one state to operate in another state. This registration requires information similar to that found in the Articles of Incorporation, such as the corporation's name and the state of incorporation. Both documents are crucial for compliance with state laws when conducting business across state lines.

Lastly, the Trade Name Registration is comparable to the Articles of Incorporation in that both establish a business identity. While the Articles of Incorporation create a legal entity, the Trade Name Registration allows that entity to operate under a specific name. Both documents are necessary for protecting the business's identity and ensuring compliance with state regulations.