The California Death of a Joint Tenant Affidavit is similar to the Affidavit of Heirship. Both documents serve to establish the rightful heirs of a deceased individual. The Affidavit of Heirship is often used when there is no will, allowing heirs to claim ownership of property without going through probate. It provides a clear statement of the deceased's family relationships and can help streamline the transfer of assets.

Another similar document is the Grant Deed. A Grant Deed is used to transfer property ownership and can include language that addresses the death of a joint tenant. When one joint tenant passes away, a Grant Deed can help formalize the transfer of property rights to the surviving tenant. This document ensures that the surviving owner has clear title to the property without needing to go through probate.

The Transfer on Death Deed (TOD) also shares similarities with the California Death of a Joint Tenant Affidavit. This deed allows individuals to designate a beneficiary who will receive property upon their death, bypassing probate. Like the affidavit, it simplifies the transfer process and ensures that the property goes directly to the intended recipient without legal complications.

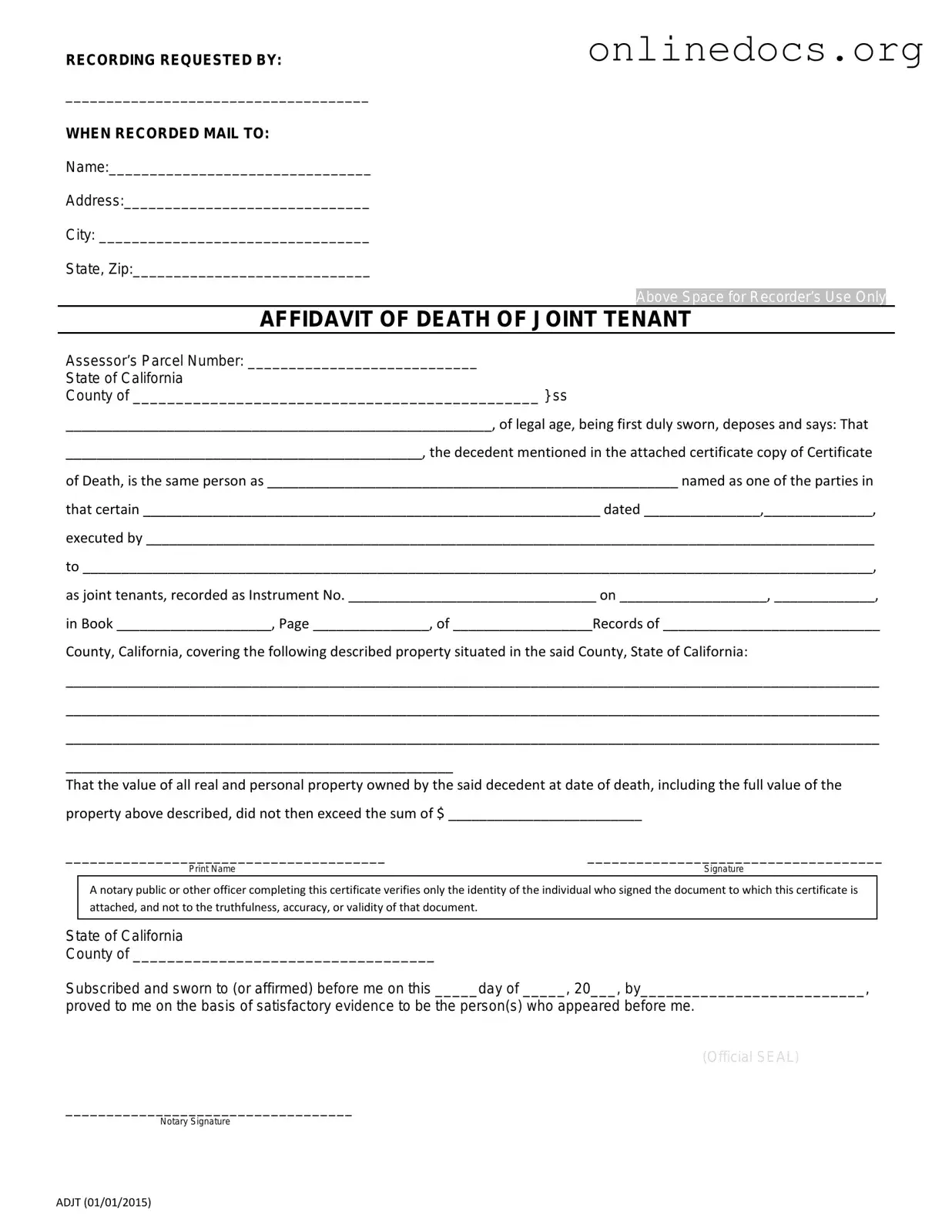

The California Death of a Joint Tenant Affidavit serves a specific purpose in verifying the death of one tenant in a joint tenancy. A similar document is the Affidavit of Death of Spouse. This form is used when one spouse passes away, and the surviving spouse needs to establish that the deceased spouse's interest in property has shifted solely to them. Both documents facilitate the transfer of property rights while minimizing complications in ownership after a death. They streamline the process, allowing for changes in property titles without going through probate court, thus simplifying the affairs of the bereaved party. For more information, the Notice to Quit form can be accessed at https://californiapdfforms.com/notice-to-quit-form.

The Living Trust document is another related form. A Living Trust allows individuals to place their assets into a trust while they are alive, with instructions on how those assets should be managed or distributed after death. This can prevent the need for probate and can be especially useful for joint tenants who want to ensure a smooth transition of property ownership upon death.

The Affidavit of Death is also comparable. This document is used to formally announce the death of an individual and can be utilized in various legal contexts, including property transfers. It serves as proof of death, which is necessary for executing the transfer of ownership in real estate and other assets.

Additionally, the Will is a fundamental document that outlines how a person's assets should be distributed upon their death. While the Death of a Joint Tenant Affidavit specifically addresses joint tenancy, a Will can include joint tenancy provisions and dictate how property should be handled if joint tenants pass away. Both documents work together to facilitate the transfer of property in accordance with the deceased's wishes.

The Certificate of Title is another document that relates to property ownership. It serves as legal evidence of ownership and can be affected by the death of a joint tenant. When one joint tenant dies, the Certificate of Title may need to be updated to reflect the change in ownership, similar to how the affidavit functions in confirming the status of joint tenancy.

The Deed of Trust is also relevant. This document secures a loan with real property and may involve joint tenants. If one joint tenant dies, the Deed of Trust may need to be reviewed to determine how the loan and property ownership are impacted, paralleling the purpose of the Death of a Joint Tenant Affidavit in clarifying ownership status.

Lastly, the Affidavit of Survivorship is similar in its intent to clarify ownership after the death of a joint tenant. This affidavit serves to confirm that the surviving tenant is now the sole owner of the property. It simplifies the process of transferring property rights and ensures that the surviving tenant's ownership is recognized legally, much like the Death of a Joint Tenant Affidavit.