The California Deed form shares similarities with the Quitclaim Deed. Both documents are used to transfer ownership of real property. However, the Quitclaim Deed does not guarantee that the grantor has clear title to the property. Instead, it simply transfers whatever interest the grantor may have. This makes it a useful tool for situations where the parties know each other, such as family transactions or when clearing up title issues.

Another document akin to the California Deed is the Warranty Deed. Unlike the Quitclaim Deed, a Warranty Deed provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. This form is often used in traditional real estate transactions, offering more protection to the buyer by ensuring that there are no hidden claims against the property.

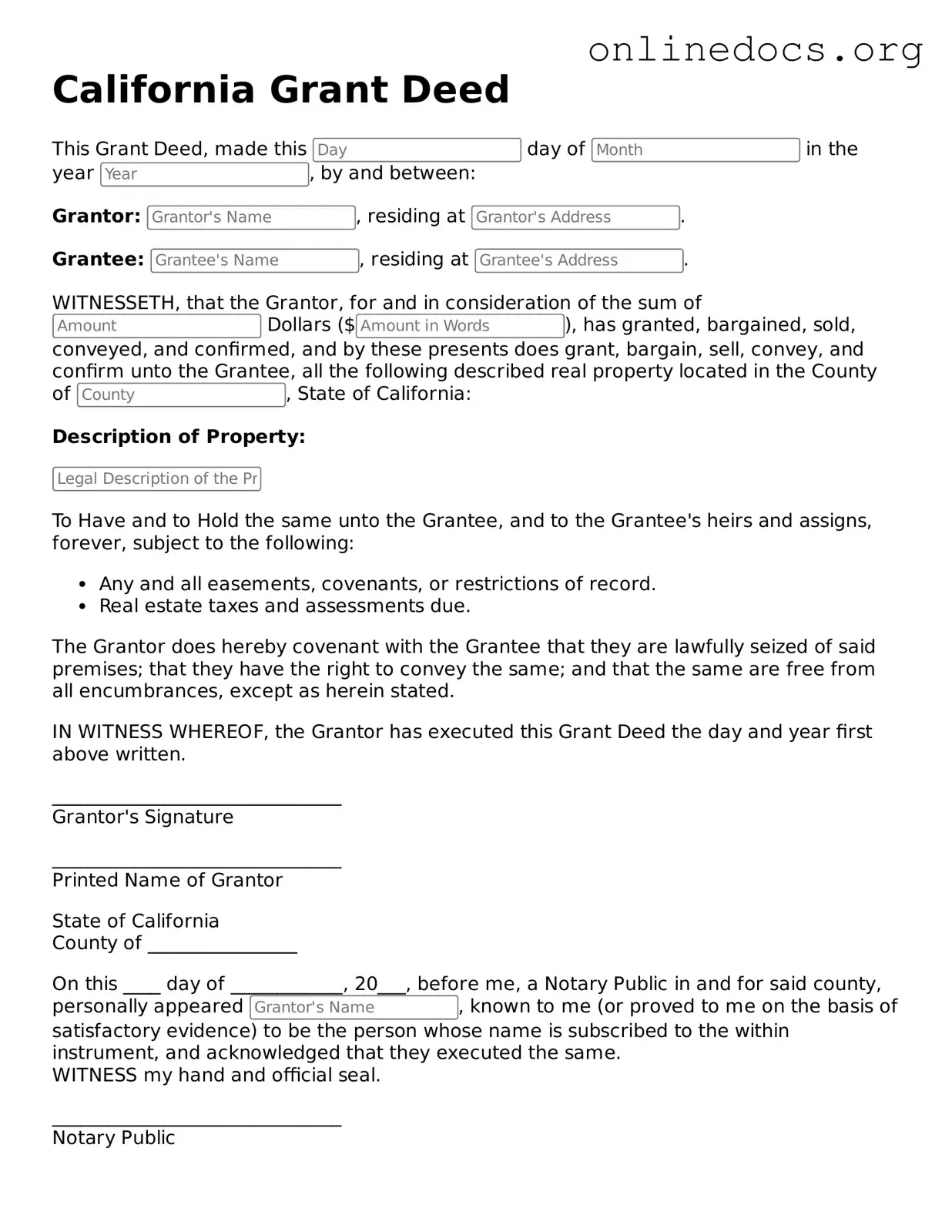

The Grant Deed is also similar to the California Deed. It conveys property ownership and includes implied warranties that the grantor has not transferred the property to anyone else and that there are no undisclosed encumbrances. This document is commonly used in California and provides a balance between the simplicity of a Quitclaim Deed and the security of a Warranty Deed.

The Bargain and Sale Deed bears resemblance to the California Deed as well. This type of deed transfers property ownership but does not provide warranties against claims. It implies that the seller has the right to sell the property but does not guarantee a clear title. This document is often utilized in foreclosure sales or tax sales, where the seller may not have complete assurance of the title.

Another related document is the Special Warranty Deed. This deed transfers property ownership while providing limited warranties. The seller guarantees that they have not caused any title issues during their ownership but does not cover any claims that existed before their ownership. This can be particularly useful in commercial transactions where the seller is not willing to assume full liability for the title.

Understanding the intricacies of property transfer documents is essential for individuals engaged in real estate transactions. For those looking into employment verification as part of their financial assessments, they may find resources that assist in verifying employment status, such as the useful documentation available at legalformspdf.com.

The Affidavit of Title also shares similarities with the California Deed. While not a deed itself, this document is often used in conjunction with a deed to affirm the seller's ownership and confirm that there are no liens or claims against the property. It serves as a declaration of the seller’s knowledge regarding the title, adding an extra layer of protection for the buyer.

Lastly, the Deed of Trust is somewhat similar, as it involves the transfer of property interests. However, it is primarily used to secure a loan. In this case, the borrower conveys the property to a trustee, who holds the title until the loan is paid off. While it serves a different purpose than the California Deed, it still involves the transfer of property rights and can be an important part of real estate transactions.