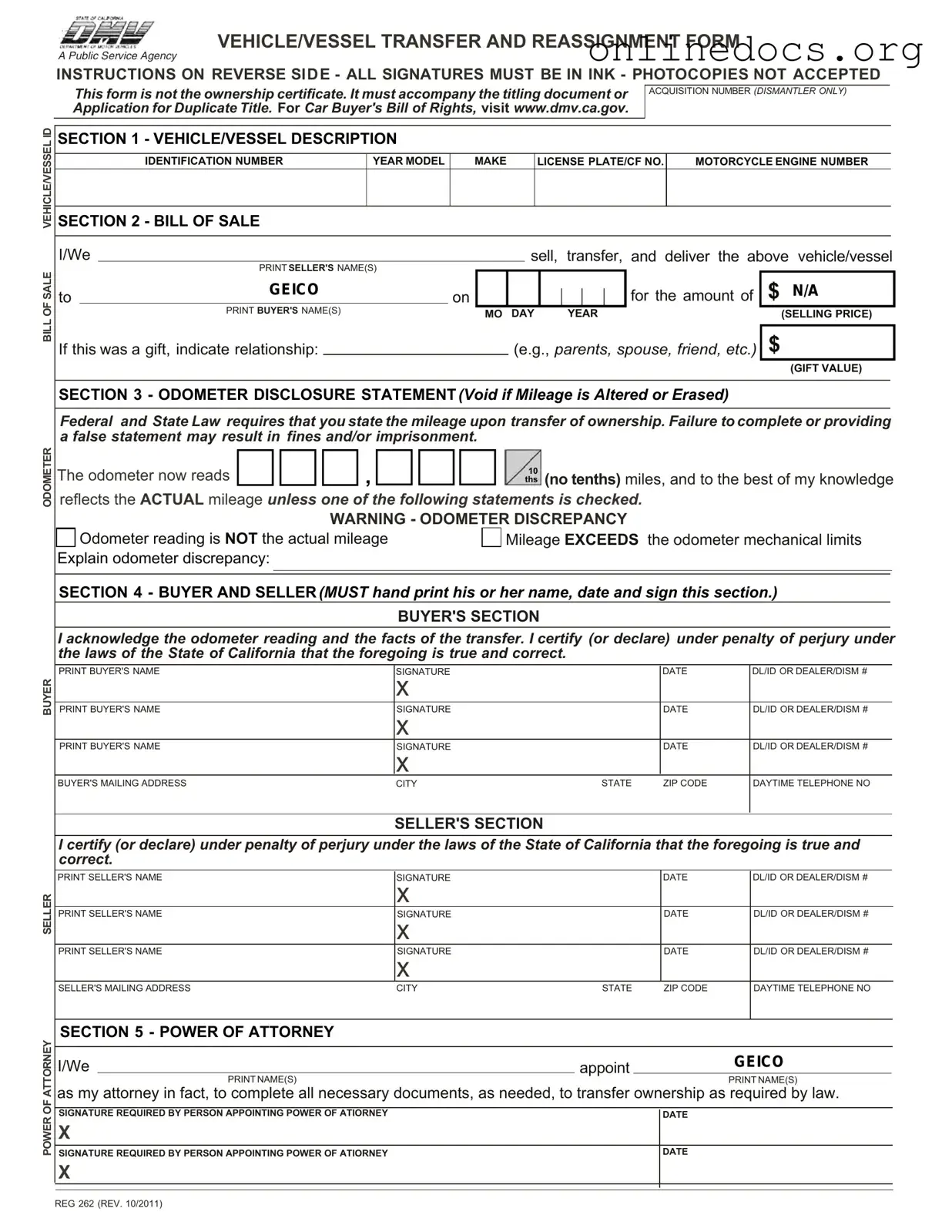

The California Form REG 262 is similar to the Bill of Sale, a fundamental document in vehicle transactions. A Bill of Sale serves as a written record of the sale between a buyer and a seller. It typically includes details such as the names of both parties, the vehicle's identification number, the sale price, and the date of the transaction. Like REG 262, the Bill of Sale is crucial for proving ownership transfer. It also provides legal protection for both parties by documenting the terms of the sale, thereby minimizing disputes that may arise after the transaction.

Another document that bears similarity to the REG 262 is the Odometer Disclosure Statement. This statement is a legal requirement in many vehicle sales, ensuring that the seller accurately reports the vehicle's mileage at the time of sale. The REG 262 includes an Odometer Disclosure section, emphasizing the importance of truthful reporting. Both documents aim to prevent fraud related to odometer readings, protecting buyers from purchasing vehicles that may have had their mileage tampered with. They require signatures from both parties, thereby reinforcing accountability in the transaction.

The Power of Attorney form is also akin to the REG 262 in that it allows one party to act on behalf of another in legal matters, including vehicle transfers. In the context of vehicle transactions, a Power of Attorney can enable a designated individual to complete necessary paperwork for the transfer of ownership. The REG 262 contains a section specifically for granting Power of Attorney, ensuring that the appointed individual can legally sign documents required for the vehicle transfer. Both documents are essential for facilitating smooth transactions, especially when one party cannot be present.

In order to ensure that all legal requirements are met when beginning the homeschooling journey in Tennessee, parents must submit the Intent to Homeschool, which serves as a pivotal document notifying the local school district of their decision. This form, along with understanding its requirements, lays the foundation for a smooth homeschooling experience.

The Application for Duplicate Title shares similarities with the REG 262 as well. This application is used when a vehicle's title has been lost or damaged, allowing the owner to obtain a new title. Like REG 262, it must be filled out accurately and submitted to the appropriate state agency. Both documents play critical roles in maintaining proper vehicle registration and ownership records. They ensure that ownership is legally recognized, which is vital for the buyer's protection and for the seller's release of liability.

Lastly, the Vehicle/Vessel Title Transfer form is another document comparable to the REG 262. This form is specifically designed to officially transfer ownership of a vehicle or vessel from one party to another. Similar to REG 262, it requires the completion of details regarding the vehicle, the buyer, and the seller. Both forms must be submitted to the Department of Motor Vehicles to finalize the transfer process. They are essential for establishing clear ownership records and ensuring that all legal requirements are met during the transfer of a vehicle or vessel.