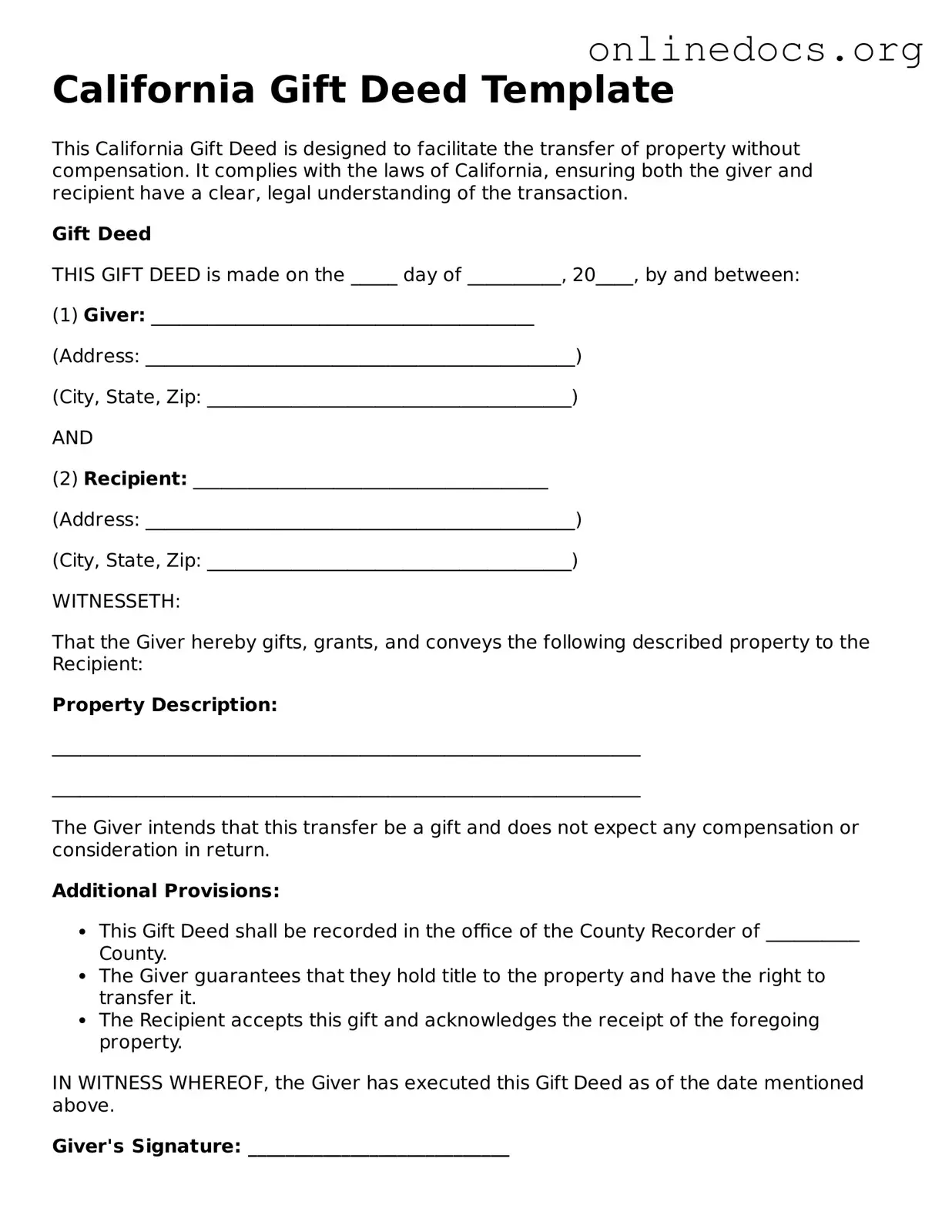

Filling out the California Gift Deed form can be a straightforward process, but mistakes can lead to complications. One common error occurs when the grantor and grantee names are misspelled or incorrectly listed. It is essential to ensure that the names match exactly with the legal documents. Any discrepancies can cause delays or even invalidate the deed.

Another frequent mistake is failing to include a proper description of the property. The description should be clear and specific, detailing the property's location and boundaries. Omitting this information can lead to confusion about what is being transferred and may result in legal disputes.

People often overlook the need for signatures. Both the grantor and grantee must sign the form for it to be valid. In some cases, the grantor might forget to sign, or the grantee may not realize they also need to provide their signature. Without these signatures, the deed cannot be legally executed.

Additionally, individuals sometimes neglect to have the deed notarized. In California, notarization is a crucial step in the process. A notary public must witness the signing of the deed to verify the identities of the parties involved. Failing to complete this step can render the deed ineffective.

Another mistake involves the timing of the gift. Some people may not understand that the deed should be executed while the grantor is alive. If the grantor passes away before the deed is finalized, the property may be subject to probate, complicating the transfer.

People may also misinterpret the tax implications of gifting property. While California does not impose a gift tax, the transfer could still have implications for property tax reassessment. It is crucial to understand these potential consequences to avoid unexpected financial burdens.

Lastly, individuals sometimes forget to keep copies of the completed Gift Deed. After filing, it is wise to retain a copy for personal records. This documentation can be essential for future reference, especially if questions arise about the gift or its terms.