Filling out the California Marital Separation Agreement form can be a daunting task. Many individuals overlook critical details, leading to potential complications down the line. One common mistake is failing to provide complete and accurate personal information. This includes not just names and addresses, but also essential identification details like Social Security numbers. Incomplete information can delay the processing of the agreement.

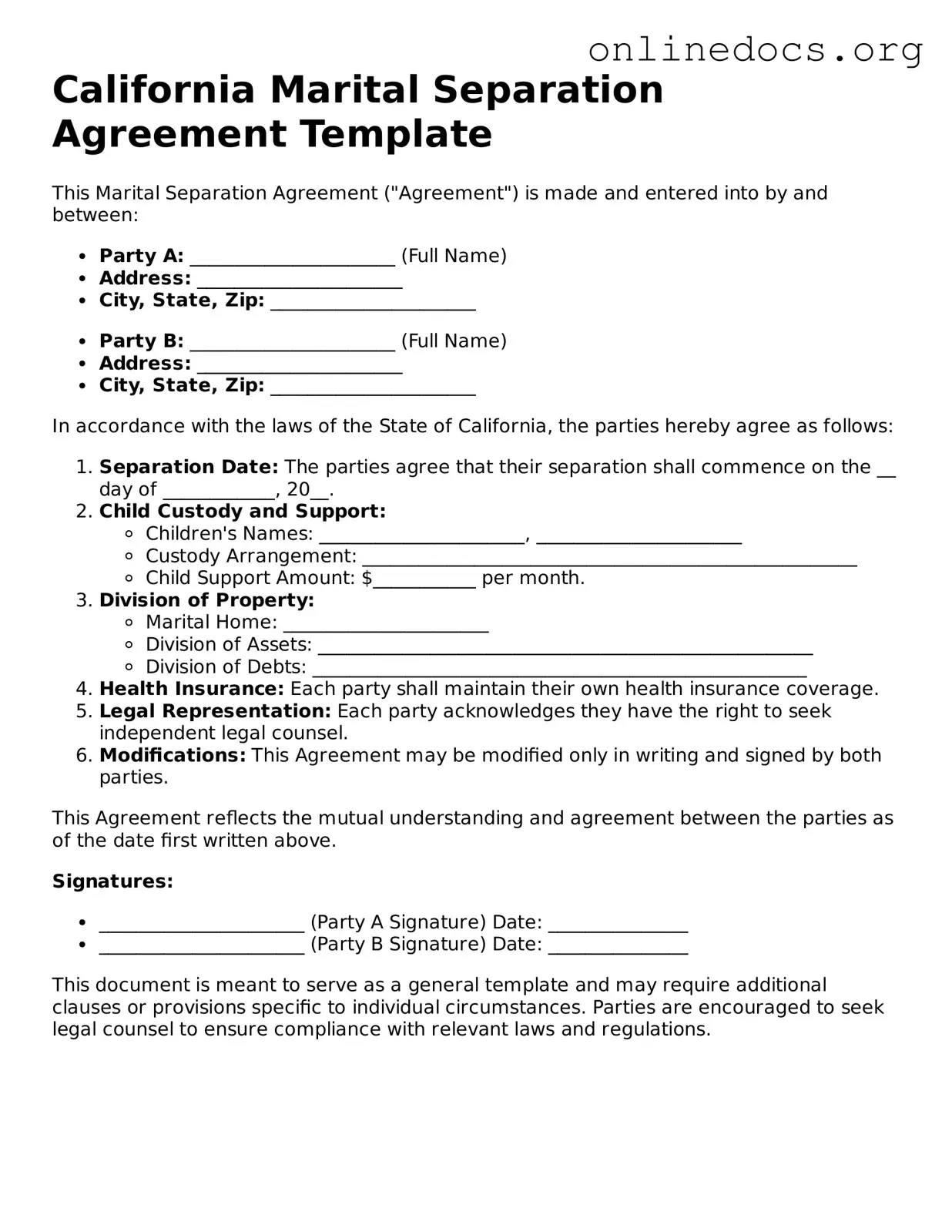

Another frequent error involves neglecting to specify the date of separation. This date is crucial as it can affect property division, spousal support, and other legal matters. Without a clearly defined separation date, disputes may arise later, complicating the situation further.

People often make the mistake of not discussing or agreeing on the division of property and debts before filling out the form. It’s essential to have a clear understanding of what belongs to whom. Failing to address this can lead to misunderstandings and resentment, which can be detrimental to future interactions, especially if children are involved.

Additionally, many individuals do not account for spousal support in their agreements. Whether one party will receive support or not should be clearly stated. Omitting this information can result in financial hardships or disputes later on.

It’s also common for people to overlook the importance of including child custody and visitation arrangements. If children are involved, it’s vital to outline parenting plans clearly. Vague language can lead to confusion and disagreements, which can have lasting impacts on family dynamics.

Another mistake is not seeking legal advice before finalizing the agreement. While it may seem tempting to handle everything independently, the complexities of marital law can be overwhelming. Consulting with a legal professional can help ensure that all aspects of the agreement are fair and legally sound.

Some individuals fail to keep copies of the completed agreement. Once signed, this document becomes a critical part of the legal record. Without copies, proving the terms of the agreement can become challenging if disputes arise in the future.

Many people also forget to consider tax implications when filling out the form. The division of assets, especially retirement accounts, can have significant tax consequences. Ignoring these factors may lead to unexpected financial burdens later on.

Another common oversight is not updating the agreement if circumstances change. Life events, such as a new job or a change in living arrangements, can affect the terms of the separation. Keeping the agreement current is essential for it to remain relevant and enforceable.

Finally, individuals sometimes rush through the signing process without fully understanding the terms of the agreement. Taking the time to read and comprehend every section is crucial. Rushing can lead to mistakes or agreements that do not truly reflect the wishes of both parties.