Filling out a California Prenuptial Agreement form can be a daunting task. Many people make common mistakes that can lead to complications down the road. Understanding these pitfalls can help ensure that the agreement is valid and enforceable.

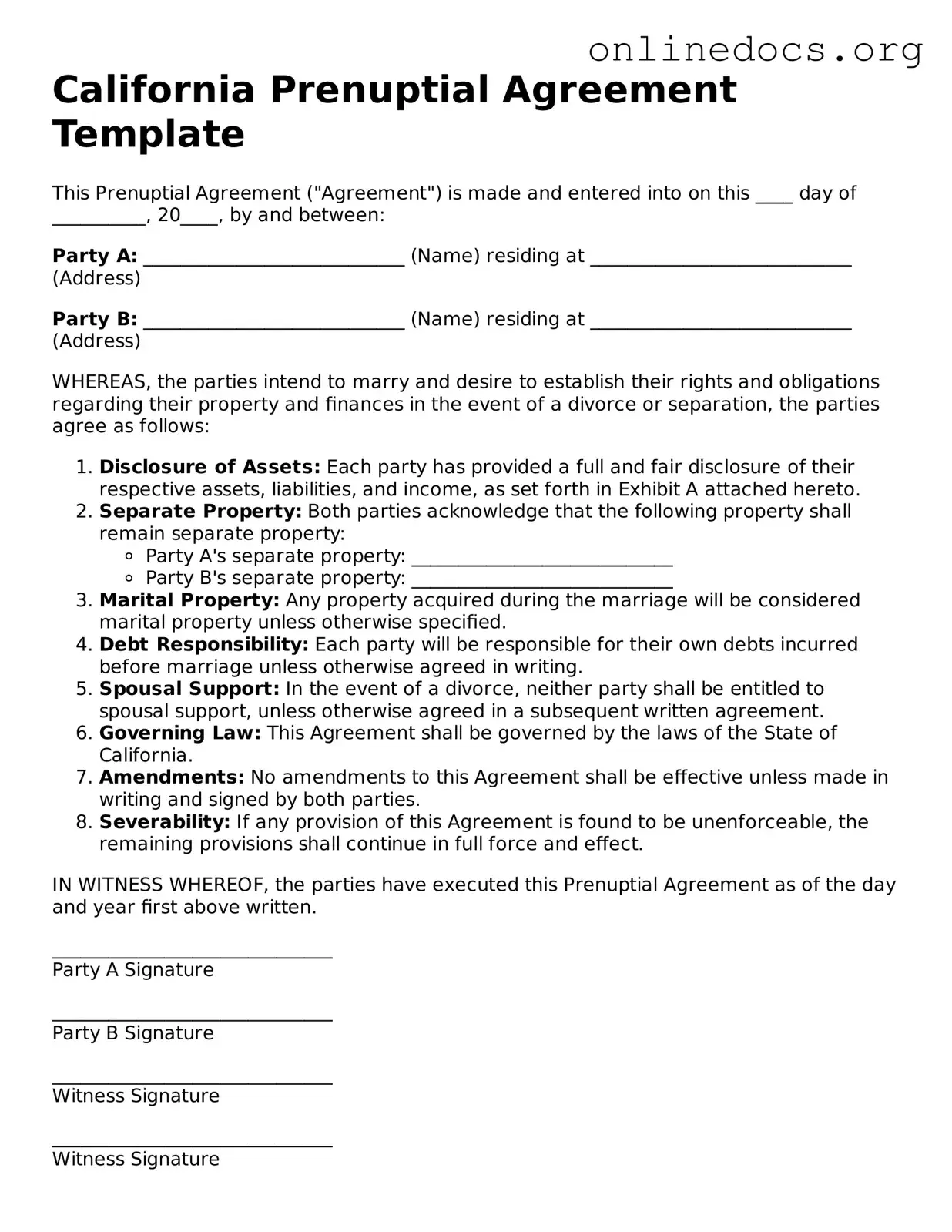

One frequent mistake is failing to disclose all assets and debts. Transparency is crucial in a prenuptial agreement. If one party hides financial information, it could lead to the agreement being challenged in court. Both parties should provide a complete list of their assets and liabilities.

Another common error is neglecting to have the agreement reviewed by an attorney. While it may seem straightforward, legal language can be complex. An attorney can help clarify terms and ensure that the agreement complies with California law.

Many couples also overlook the importance of timing. It’s essential to complete the prenuptial agreement well before the wedding date. Waiting until the last minute can create pressure and may lead to mistakes or rushed decisions.

Additionally, some individuals fail to consider future changes. A prenuptial agreement should account for potential life changes, such as the birth of children or significant income changes. Not addressing these possibilities can lead to disputes later on.

Another mistake is using vague language. Specificity is key in legal documents. Ambiguous terms can lead to different interpretations, which can cause confusion and conflict in the future.

Couples sometimes forget to include provisions for dispute resolution. It’s wise to outline how disagreements will be handled, whether through mediation or arbitration. This can save time and money if issues arise later.

Some individuals also fail to sign the agreement in front of a notary. A notarized signature adds an extra layer of authenticity and can help validate the document in court. Not taking this step can weaken the agreement’s enforceability.

Finally, neglecting to revisit the agreement periodically can be a mistake. Life circumstances change, and it’s important to ensure that the prenuptial agreement remains relevant. Regular reviews can help both parties stay aligned and avoid misunderstandings.