When filling out a California Quitclaim Deed form, individuals often make several common mistakes that can lead to complications down the line. One prevalent error is failing to provide complete and accurate information about the property. This includes not specifying the correct legal description of the property, which is crucial for identifying it in public records. Omitting this information can create confusion and disputes in the future.

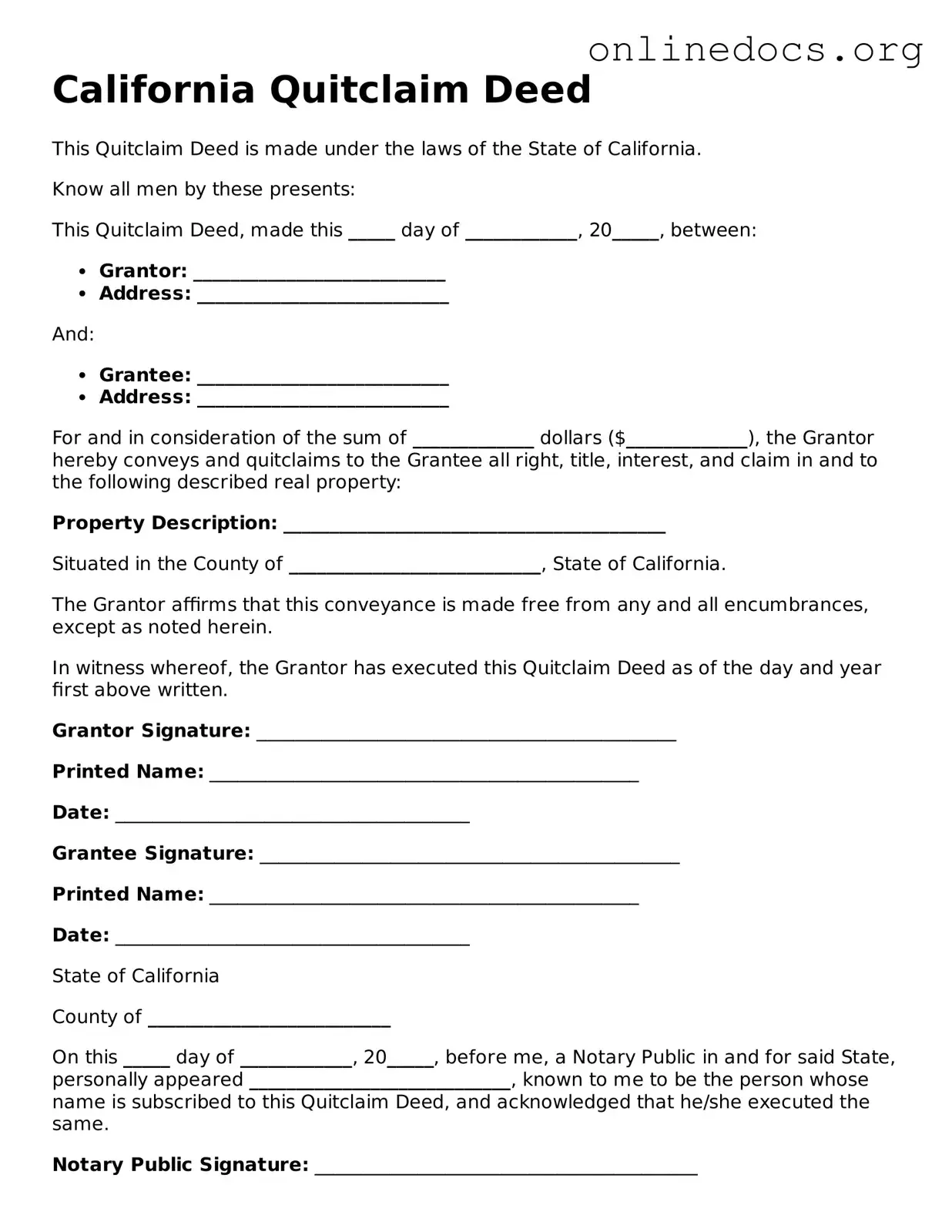

Another mistake is not properly identifying the parties involved. The grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly stated. Errors in names, such as misspellings or using nicknames instead of legal names, can render the deed invalid. It is essential to ensure that the names match exactly with the individuals' identification documents.

Many people also overlook the importance of signing the deed in the presence of a notary public. A Quitclaim Deed must be notarized to be legally binding. Without a proper notarization, the document may not be accepted by the county recorder’s office, which can delay the transfer process and create legal complications.

Additionally, individuals sometimes forget to include the date of the transaction. While this may seem minor, the date is important for establishing the timeline of ownership. Without it, there could be disputes regarding when the property was transferred, potentially affecting property taxes and other legal matters.

Another frequent error involves the failure to record the Quitclaim Deed with the county recorder's office. Recording the deed is essential for making the transfer public. If the deed is not recorded, the grantee may face challenges in proving ownership, especially in cases of disputes or claims from third parties.

People may also neglect to check for any existing liens or encumbrances on the property before executing the deed. If the property has outstanding debts or legal claims against it, the grantee may inherit these issues, leading to unexpected financial burdens.

Moreover, some individuals do not understand the implications of using a Quitclaim Deed. They may assume it provides the same level of protection as a warranty deed. However, a Quitclaim Deed transfers whatever interest the grantor has in the property without any guarantees. This lack of warranty can lead to misunderstandings about the rights being conveyed.

In addition, mistakes can arise from not seeking legal advice when necessary. Individuals may feel confident filling out the form themselves, but the nuances of property law can be complex. Consulting with a real estate attorney can help clarify any uncertainties and ensure that the deed is completed correctly.

Lastly, failing to keep copies of the completed and recorded Quitclaim Deed is a common oversight. Having a personal copy is essential for future reference and can help avoid disputes regarding ownership or terms of the transfer.