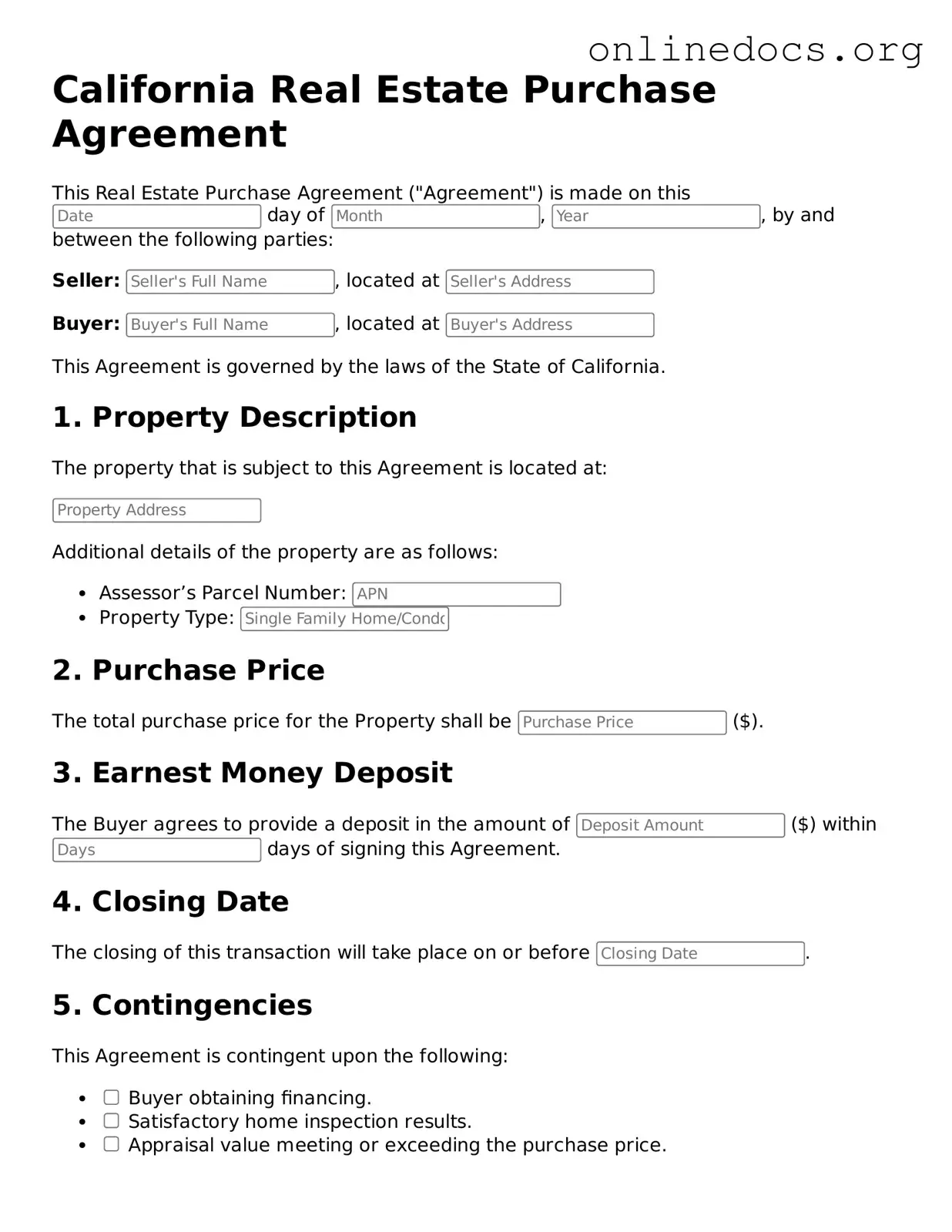

When filling out the California Real Estate Purchase Agreement form, many people make common mistakes that can lead to complications later on. One frequent error is failing to provide accurate property details. Buyers and sellers must ensure that the property address, legal description, and other identifying information are correct. Inaccuracies can cause confusion and may even derail the transaction.

Another mistake is neglecting to specify the purchase price clearly. It’s crucial to state the exact amount being offered or accepted. Vague language can lead to misunderstandings between parties. Always double-check that the purchase price is clearly outlined in the designated section of the agreement.

Many individuals overlook the importance of contingencies. Failing to include contingencies, such as financing or inspection clauses, can leave buyers vulnerable. These contingencies protect the buyer and allow them to back out of the deal under certain conditions. Always consider what contingencies are necessary and include them in the agreement.

Additionally, some people forget to sign the document. A purchase agreement is not legally binding unless all parties involved have signed it. Ensure that both the buyer and seller sign and date the agreement to validate it. An unsigned contract can lead to significant delays or even nullification of the agreement.

Another common oversight is not providing the necessary disclosures. California law requires sellers to disclose certain information about the property, including known defects or hazards. Failing to include these disclosures can lead to legal issues down the line. It’s essential to be transparent and provide all required information to avoid potential disputes.

Many buyers and sellers also neglect to clarify the closing date. This date is critical for both parties as it marks when the transaction is finalized. Without a specified closing date, confusion may arise, leading to frustration and delays. Clearly outline this date in the agreement to keep the process on track.

People often misunderstand the role of earnest money. Some fail to specify the amount of earnest money being deposited, while others do not include it at all. This deposit shows the seller that the buyer is serious about the purchase. Clearly state the amount and terms regarding the earnest money in the agreement.

Another mistake is not reviewing the entire document before submission. Rushing through the form can lead to missed errors or omissions. Take the time to carefully review the entire agreement to ensure all information is accurate and complete. A thorough review can save time and prevent complications later.

Lastly, individuals sometimes fail to seek professional advice. Real estate transactions can be complex, and having a qualified agent or attorney review the agreement can provide valuable insights. Don’t hesitate to reach out for help to ensure that the purchase agreement is filled out correctly and protects your interests.