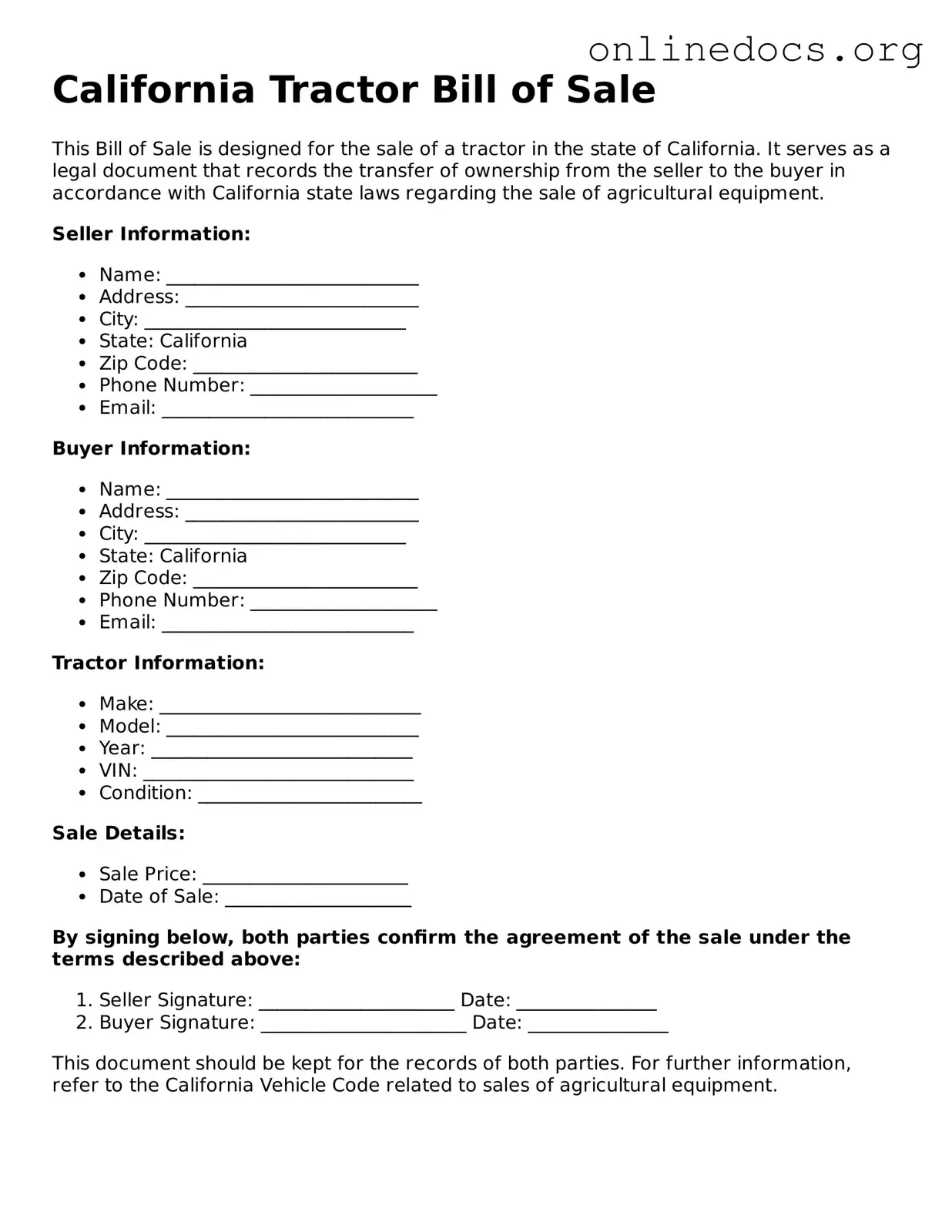

When filling out the California Tractor Bill of Sale form, many individuals inadvertently make mistakes that can complicate the transaction. One common error is failing to provide accurate and complete information about the tractor. Essential details such as the vehicle identification number (VIN), make, model, and year must be correct. Omitting or incorrectly entering this information can lead to confusion and potential legal issues down the line.

Another frequent mistake is neglecting to include the names and addresses of both the buyer and the seller. This information is crucial for establishing the identities of the parties involved. Without this clarity, proving ownership or resolving disputes may become problematic. Always ensure that both parties' information is clearly stated and legible.

People often forget to indicate the sale price of the tractor. This detail is not only important for the transaction but also for tax purposes. Leaving this field blank or entering an incorrect amount can lead to complications with the California Department of Motor Vehicles (DMV) when registering the vehicle.

In addition, some individuals overlook the need for signatures. Both the buyer and seller must sign the document to validate the sale. Failing to do so can render the bill of sale ineffective. It's advisable to double-check that all necessary signatures are present before finalizing the document.

Another common oversight is not dating the bill of sale. A date is crucial as it marks when the transaction occurred. This information can be vital for any future disputes or inquiries regarding ownership. Always ensure that the date is included and accurate.

People sometimes use outdated or incorrect forms. The California DMV may have specific requirements for the bill of sale, and using an old version can lead to rejection. It is essential to obtain the most current form from an official source to avoid any issues.

Additionally, some individuals fail to provide a clear description of the tractor's condition. Whether the tractor is sold "as is" or with warranties should be explicitly stated. This clarity helps manage expectations and protects both parties in case of future disputes regarding the tractor's performance.

Another mistake involves not keeping a copy of the completed bill of sale. Retaining a copy for personal records is important for both the buyer and seller. This document serves as proof of the transaction and can be useful for future reference, particularly if questions about ownership arise.

Furthermore, individuals may neglect to check for any liens or outstanding debts on the tractor. Before completing the sale, it's wise to ensure that the tractor is free of any financial encumbrances. This step protects the buyer from potential liabilities associated with the tractor's previous ownership.

Lastly, some people fail to understand the importance of notarization. While not always required, having the bill of sale notarized can add an extra layer of authenticity and protection. It can be beneficial in establishing the legitimacy of the transaction should any disputes arise later.