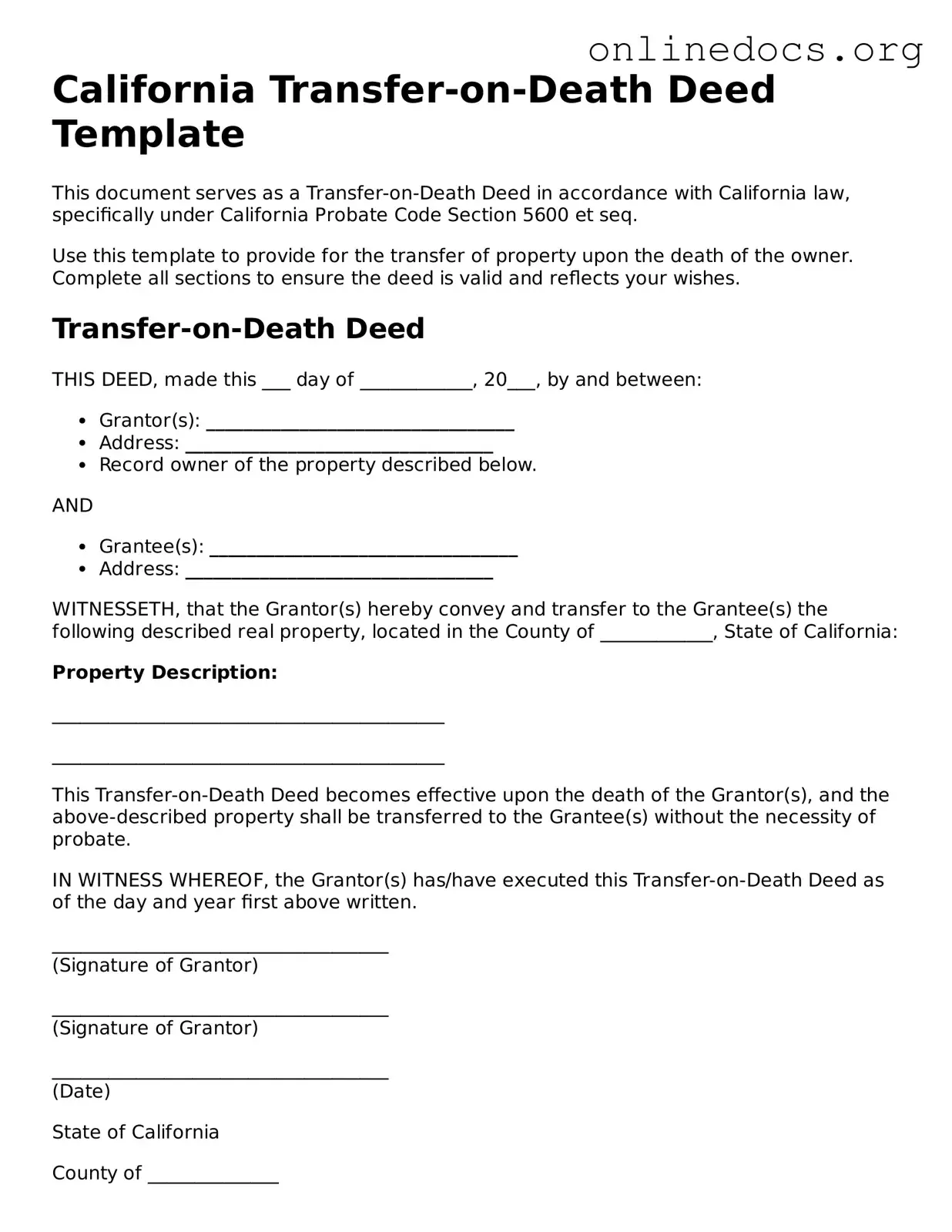

Filling out a California Transfer-on-Death Deed form can seem straightforward, but many individuals encounter pitfalls that can complicate the process. One common mistake is failing to properly identify the property. When listing the property, it’s crucial to include the correct legal description. Relying solely on the address can lead to confusion and potential legal issues down the line. The legal description ensures that the property is unmistakably identified, preventing disputes among heirs.

Another frequent error involves not naming the beneficiaries correctly. It’s important to ensure that the names of the beneficiaries are spelled correctly and that their relationship to the property owner is clear. Omitting a middle name or using an incorrect last name can create complications during the transfer process. In some cases, it may even lead to a beneficiary being unable to claim their inheritance.

People often overlook the need for signatures. A Transfer-on-Death Deed must be signed by the property owner, and in some cases, witnesses may be required. Neglecting to sign the form or to have it properly notarized can render the deed invalid. This means that even if all other information is correct, the deed may not fulfill its intended purpose.

Many individuals also fail to record the deed with the county recorder’s office. Simply completing the form is not enough; it must be filed with the appropriate local authority to be legally effective. Without this step, the transfer of property will not take place upon the owner’s death, potentially leading to complications and disputes among heirs.

Another mistake is not considering the implications of the deed on existing debts. While a Transfer-on-Death Deed allows for the property to pass directly to beneficiaries, it does not shield the property from creditors. If the property owner has outstanding debts, those creditors may still have claims against the property, which can affect the beneficiaries' inheritance.

Lastly, many overlook the importance of reviewing the deed periodically. Life changes, such as marriage, divorce, or the birth of children, may necessitate updates to the beneficiaries listed on the deed. Failing to keep the deed current can result in unintended consequences, such as leaving out a loved one or including someone who should no longer be a beneficiary.