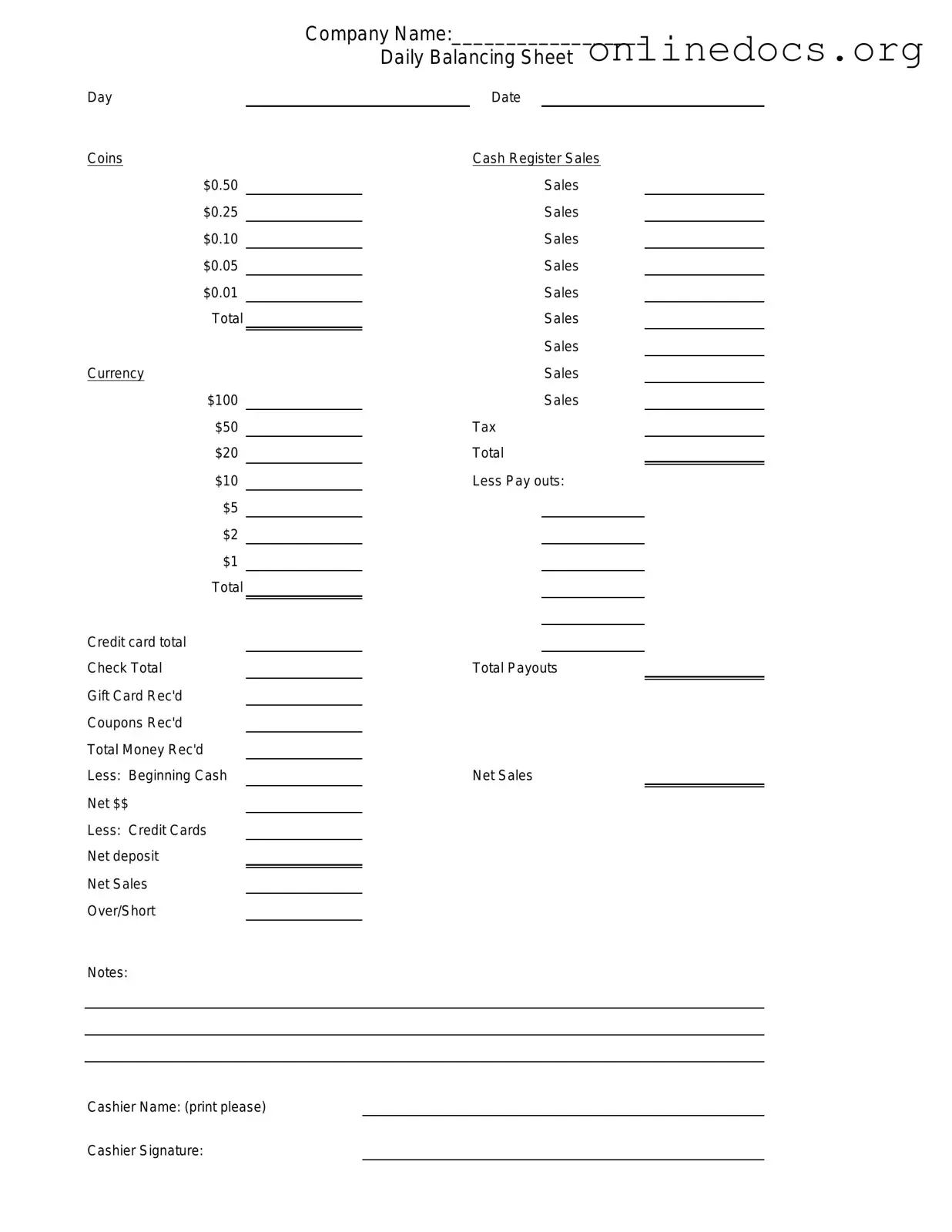

Filling out the Cash Drawer Count Sheet form accurately is crucial for maintaining financial integrity. However, many individuals make common mistakes that can lead to discrepancies. One frequent error is failing to double-check the starting cash balance. This figure is essential, and inaccuracies can skew the entire count.

Another mistake is not recording all transactions that occurred during the cash handling period. Omitting sales or refunds can create confusion and affect the overall cash count. It is important to ensure that every transaction is documented to reflect an accurate cash flow.

Some people may also miscalculate the total cash on hand. Simple arithmetic errors can occur, especially when adding or subtracting multiple amounts. Taking time to carefully review calculations can prevent these mistakes.

In addition, neglecting to account for change given to customers can lead to inaccuracies. If change is not recorded properly, it may appear that there is more or less cash than actually present in the drawer.

Another common oversight is using incorrect denominations when listing cash amounts. For example, mixing up the values of bills or coins can distort the count. It is vital to verify that the denominations match what is physically in the drawer.

Some individuals also fail to sign and date the form after completing it. This step is necessary for accountability and helps to track who completed the count. Without a signature, it may be unclear who is responsible for any discrepancies.

Moreover, not following the established procedures for filling out the form can lead to inconsistencies. Each organization may have specific guidelines that must be adhered to for accuracy and compliance.

People sometimes leave sections of the form blank, which can create confusion. Every section should be filled out completely to ensure that all relevant information is captured. Leaving blanks can lead to questions and further investigation.

Additionally, failing to review the completed form before submission is a common mistake. Taking a moment to go over the information can help catch errors that might have been overlooked initially.

Finally, not keeping a copy of the Cash Drawer Count Sheet for personal records can be problematic. Retaining a copy allows for easy reference in case discrepancies arise later. It is always wise to maintain documentation for accountability.