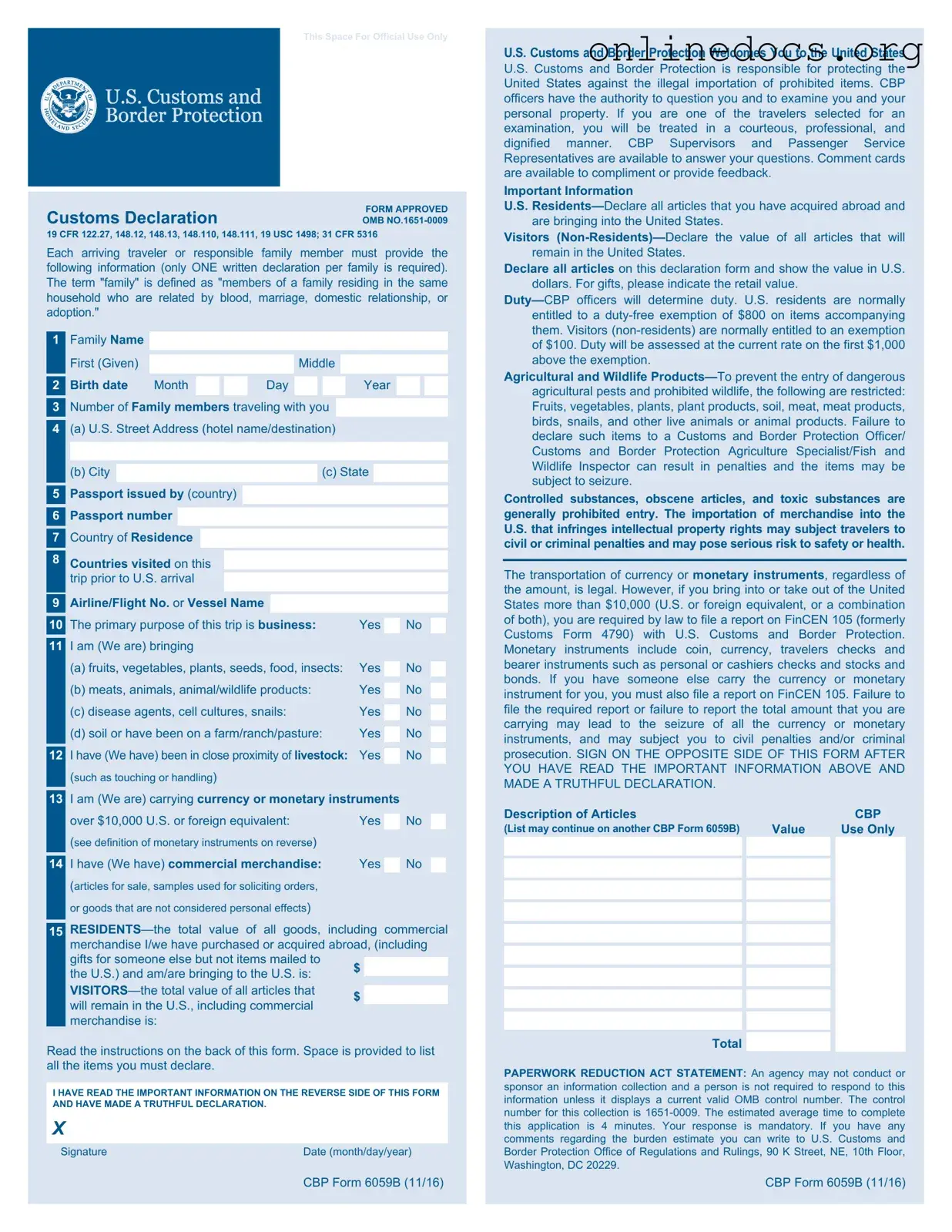

The CBP 6059B form is similar to the CBP 7507 form, also known as the Customs Declaration for U.S. Residents Returning from Abroad. Both forms are used by travelers entering the United States to declare items they are bringing back. While the 6059B focuses on the declaration of goods and currency, the 7507 specifically addresses the duty-free exemptions available to returning residents. This ensures that travelers are informed of their allowances and responsibilities regarding imports.

For those involved in transactions that require a formal bill of sale, it is essential to utilize appropriate templates that comply with state laws. For example, individuals can find various resources that guide them in creating or obtaining a New York Bill of Sale, which is crucial for ensuring legal compliance and clarity in ownership transfers. For more information and templates, visit legalformspdf.com.

Another document that shares similarities is the CBP 3461 form, which is the Entry/Immediate Delivery Application. This form is utilized by importers when goods arrive at U.S. ports. Like the 6059B, it requires detailed information about the items being imported, but it serves a different purpose by facilitating the entry of goods into the commerce of the U.S. The focus here is more on the commercial aspect rather than personal travel.

The CBP 7501 form, known as the Entry Summary, is also comparable to the CBP 6059B. This document is essential for formal customs clearance of imported goods. While the 6059B is for travelers, the 7501 is used by businesses and importers. Both require comprehensive details about the items, but the 7501 includes information relevant to tariffs and duties that are not applicable to personal travelers.

The I-94 form, or Arrival/Departure Record, is another document that travelers may encounter. It serves as proof of legal entry into the U.S. and is often filled out alongside the CBP 6059B. While the 6059B focuses on declaring goods, the I-94 records the traveler's immigration status and duration of stay, making it crucial for compliance with U.S. immigration laws.

The ESTA (Electronic System for Travel Authorization) is similar in that it is required for travelers entering the U.S. under the Visa Waiver Program. While the CBP 6059B is filled out upon arrival, ESTA must be completed online before travel. Both documents are essential for ensuring that travelers meet U.S. entry requirements, but they serve different stages of the travel process.

The CBP 6059B also resembles the Form I-20, which is used by international students. This form certifies eligibility for a student visa and is presented upon entry to the U.S. While the 6059B deals with personal goods, the I-20 focuses on the educational status of the traveler, highlighting different aspects of entry into the country.

The Form DS-160, which is the Online Nonimmigrant Visa Application, shares some similarities with the CBP 6059B in that both require travelers to provide personal information. However, the DS-160 is for visa applicants and focuses on the purpose of the trip, whereas the 6059B is a customs declaration that pertains to items being brought into the U.S.

The Form 8840, also known as the Closer Connection Exception Statement for Aliens, is relevant for certain travelers. It is used by individuals who want to claim a closer connection to a foreign country for tax purposes. While it doesn’t directly relate to customs declarations like the 6059B, both forms address compliance with U.S. regulations and require detailed information from the traveler.

The Form 1040, U.S. Individual Income Tax Return, may also be viewed as somewhat similar. Although it pertains to tax obligations rather than customs, both documents require individuals to disclose information about their financial activities. The 6059B focuses on goods being brought into the U.S., while the 1040 is about income earned, illustrating the broader theme of regulatory compliance.

Lastly, the Form 8843, Statement for Exempt Individuals and Individuals with a Medical Condition, is relevant for certain non-resident aliens. It must be filed to explain the individual’s presence in the U.S. for tax purposes. While the CBP 6059B is concerned with customs declarations, both forms require individuals to provide information that affects their status in the U.S.