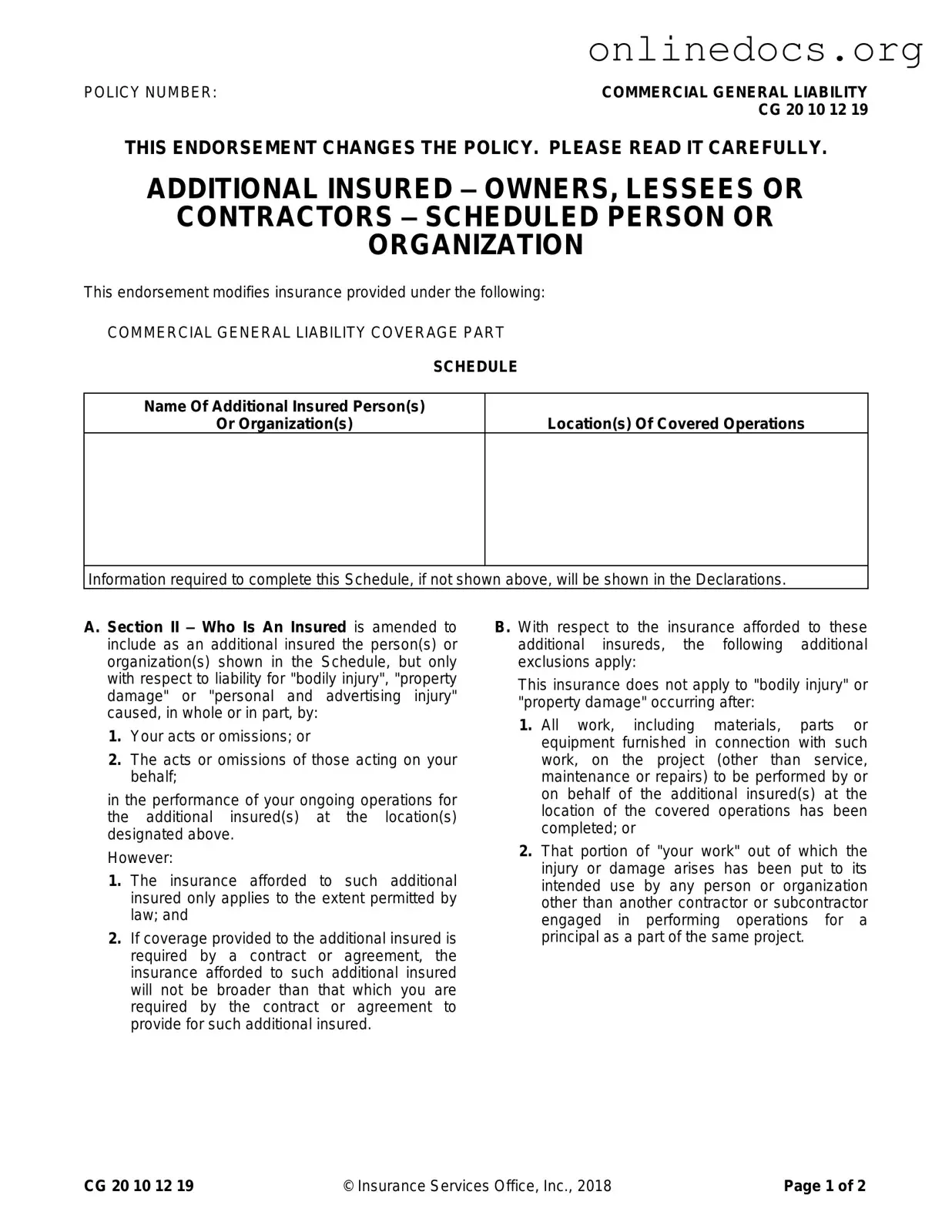

The CG 20 10 07 04 Liability Endorsement form is similar to the CG 20 10 11 13 Additional Insured – Owners, Lessees, or Contractors form. Both documents extend liability coverage to additional insured parties, typically in construction or contracting scenarios. The primary difference lies in the specific conditions under which the additional insureds are covered. The CG 20 10 11 13 form may include broader coverage for ongoing operations, while the CG 20 10 07 04 focuses on specific scheduled operations, making it essential to understand the nuances when determining coverage requirements.

Another document that shares similarities is the CG 20 10 09 01 Additional Insured – Managers or Lessors of Premises form. This endorsement specifically provides coverage for managers or lessors of premises used by the insured. Like the CG 20 10 07 04 form, it addresses liability for bodily injury or property damage. However, it is tailored to situations involving rental properties, highlighting the importance of identifying the correct endorsement based on the nature of the operations and the relationship between the parties involved.

The CG 20 37 10 01 Additional Insured – Designated Person or Organization form is also comparable. This document allows for the inclusion of specific individuals or organizations as additional insureds. Similar to the CG 20 10 07 04 form, it provides coverage for liability arising from the insured’s operations. The key difference is that the CG 20 37 10 01 form may be used in contexts where the insured is required to name specific parties in their policy, emphasizing the need for clarity in contractual agreements.

Next, the CG 20 10 10 01 Additional Insured – Completed Operations form also bears resemblance. This endorsement extends coverage to additional insureds for liabilities arising after the completion of work. While the CG 20 10 07 04 focuses on ongoing operations, the CG 20 10 10 01 form emphasizes the importance of ensuring that additional insureds are protected even after the work is finished, highlighting the different stages of coverage that may be necessary.

When renting a residential property in California, it's essential to have a clear understanding of your lease agreement and its implications, which can be achieved by utilizing resources such as the https://californiapdfforms.com/residential-lease-agreement-form. This ensures that both tenants and landlords are protected and aware of their rights and responsibilities.

The CG 20 10 08 01 Additional Insured – State or Governmental Agency form is another relevant document. This form is specifically designed for covering governmental entities as additional insureds. Similar to the CG 20 10 07 04, it provides liability coverage but is tailored to meet the unique requirements of public entities. Understanding the specific needs of governmental agencies can help in selecting the appropriate endorsement for compliance and risk management.

Additionally, the CG 20 10 06 05 Additional Insured – Owners, Lessees, or Contractors – Completed Operations form is comparable as well. This endorsement provides coverage for additional insureds specifically for completed operations, similar to the CG 20 10 10 01 form. The distinction lies in the context of the project; it is essential to choose the right form based on whether the focus is on ongoing or completed work to ensure proper coverage is in place.

Lastly, the CG 20 10 05 04 Additional Insured – Joint Venture form also shares characteristics with the CG 20 10 07 04 form. This document is tailored for joint ventures, providing coverage for parties involved in a joint project. While both forms extend liability coverage, the CG 20 10 05 04 focuses on the unique risks associated with joint ventures, making it vital to select the appropriate endorsement based on the specific project structure and relationships among the parties involved.