The W-4 form is similar to the Citibank Direct Deposit form in that it requires personal information for tax purposes. Both forms ask for details such as name, address, and Social Security number. The W-4 form specifically helps employers determine the amount of federal income tax to withhold from an employee’s paycheck, while the Direct Deposit form ensures that funds are deposited directly into the employee's bank account.

The I-9 form is another document that shares similarities with the Citibank Direct Deposit form. It is used to verify a person's identity and eligibility to work in the United States. Like the Direct Deposit form, the I-9 requires personal information, including name and Social Security number. Both documents are essential for employers to maintain accurate records about their employees.

The 1099 form is a document that reports various types of income received by individuals who are not employees. It is similar to the Direct Deposit form in that both deal with financial transactions. The 1099 form provides information about income received, while the Direct Deposit form provides details on where that income should be sent. Both forms require accurate information to ensure proper processing.

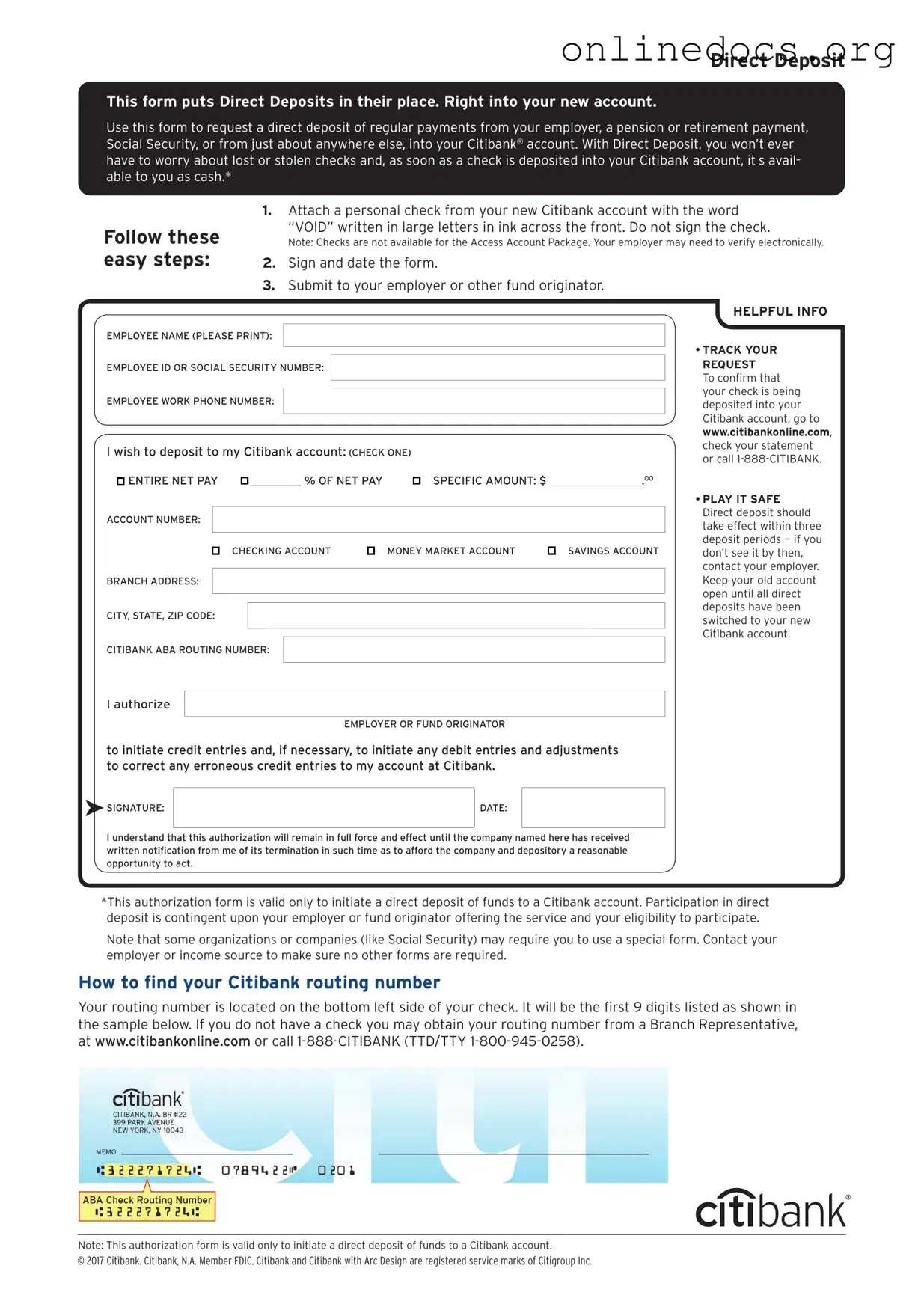

The ACH Authorization form is closely related to the Citibank Direct Deposit form. This document allows a bank or financial institution to withdraw funds from a person's account or deposit funds into it. Both forms require bank account details, including account numbers and routing numbers, to facilitate the transfer of funds securely and efficiently.

The Payroll Deduction Authorization form is another document that functions similarly to the Direct Deposit form. It allows employees to authorize deductions from their paychecks for various purposes, such as retirement contributions or health insurance premiums. Both forms require employee consent and personal information to ensure accurate processing and compliance with regulations.

The Direct Payment Authorization form is akin to the Citibank Direct Deposit form in that it allows individuals to authorize automatic payments from their bank accounts. Both documents require personal and banking information to set up the payment process. They ensure that funds are transferred seamlessly without the need for manual intervention.

To ensure that your wishes are respected after your passing, it is essential to create a valid legal document known as a comprehensive Last Will and Testament. This document outlines how your assets will be distributed and the care of any dependents, providing crucial clarity for your loved ones during a difficult time.

The Bank Account Verification form is similar to the Citibank Direct Deposit form in that it confirms the details of a bank account. This form is often used by employers to verify the account into which direct deposits will be made. Both forms require account numbers and bank routing numbers, ensuring that payments are directed to the correct accounts.

The Employment Application form also shares similarities with the Citibank Direct Deposit form. Both documents collect personal information from individuals, although the Employment Application focuses on qualifications and work history. The Direct Deposit form, on the other hand, specifically addresses how an employee wants to receive their paychecks.

The Benefits Enrollment form is another document that is similar to the Citibank Direct Deposit form. It collects personal information to enroll employees in various benefits programs. Both forms require accurate information to ensure that employees receive the correct benefits and payments, facilitating a smooth enrollment process.

Finally, the Tax Information form is comparable to the Citibank Direct Deposit form. This document gathers information needed for tax reporting purposes. Both forms require personal details, including Social Security numbers, to ensure compliance with tax regulations and to facilitate accurate financial transactions.