A Short Sale Agreement is similar to a Deed in Lieu of Foreclosure because both processes allow homeowners to avoid foreclosure. In a short sale, the homeowner sells the property for less than what is owed on the mortgage, with the lender's approval. This option can be less damaging to a homeowner's credit score compared to foreclosure, and it provides a way to settle the debt without the lengthy foreclosure process.

A Mortgage Release or Satisfaction of Mortgage document is also comparable. This document is issued by a lender when a mortgage is fully paid off. In the context of a Deed in Lieu of Foreclosure, the lender may agree to release the homeowner from the mortgage obligation in exchange for the property. This allows the homeowner to walk away without further debt, similar to the outcome of a deed in lieu.

A Loan Modification Agreement can be seen as a related document. In this case, the lender and borrower agree to change the terms of the existing mortgage to make it more affordable. While a Deed in Lieu of Foreclosure involves transferring ownership, a loan modification keeps the homeowner in their property, making it a different but related option for struggling borrowers.

Understanding the various alternatives to foreclosure is crucial for homeowners facing financial difficulties. Options such as a Deed in Lieu of Foreclosure, a loan modification, and forbearance agreements can provide different pathways to navigate the challenges of mortgage payments. For those considering a quick and straightforward transfer of property interests, familiarizing oneself with a Texas Quitclaim Deed can be beneficial. Resources such as legalformspdf.com offer valuable information on these legal documents, aiding homeowners in making informed decisions about their property and financial commitments.

An Affidavit of Forgiveness may also be relevant. This document states that a lender forgives a portion of the debt owed by the borrower. In a Deed in Lieu of Foreclosure, the lender may forgive the remaining balance after taking ownership of the property. This can provide relief to homeowners who owe more than their property is worth.

A Bankruptcy Filing is another document that shares similarities. When homeowners file for bankruptcy, they can potentially eliminate or reduce their debts, including mortgage obligations. A Deed in Lieu of Foreclosure can serve as an alternative to bankruptcy for those looking to avoid the complexities and long-lasting effects of a bankruptcy on their credit.

A Forbearance Agreement is also worth mentioning. This document allows homeowners to temporarily pause or reduce their mortgage payments. While a Deed in Lieu of Foreclosure involves giving up the property, forbearance can help homeowners keep their homes during financial hardship. Both options aim to provide relief but take different paths.

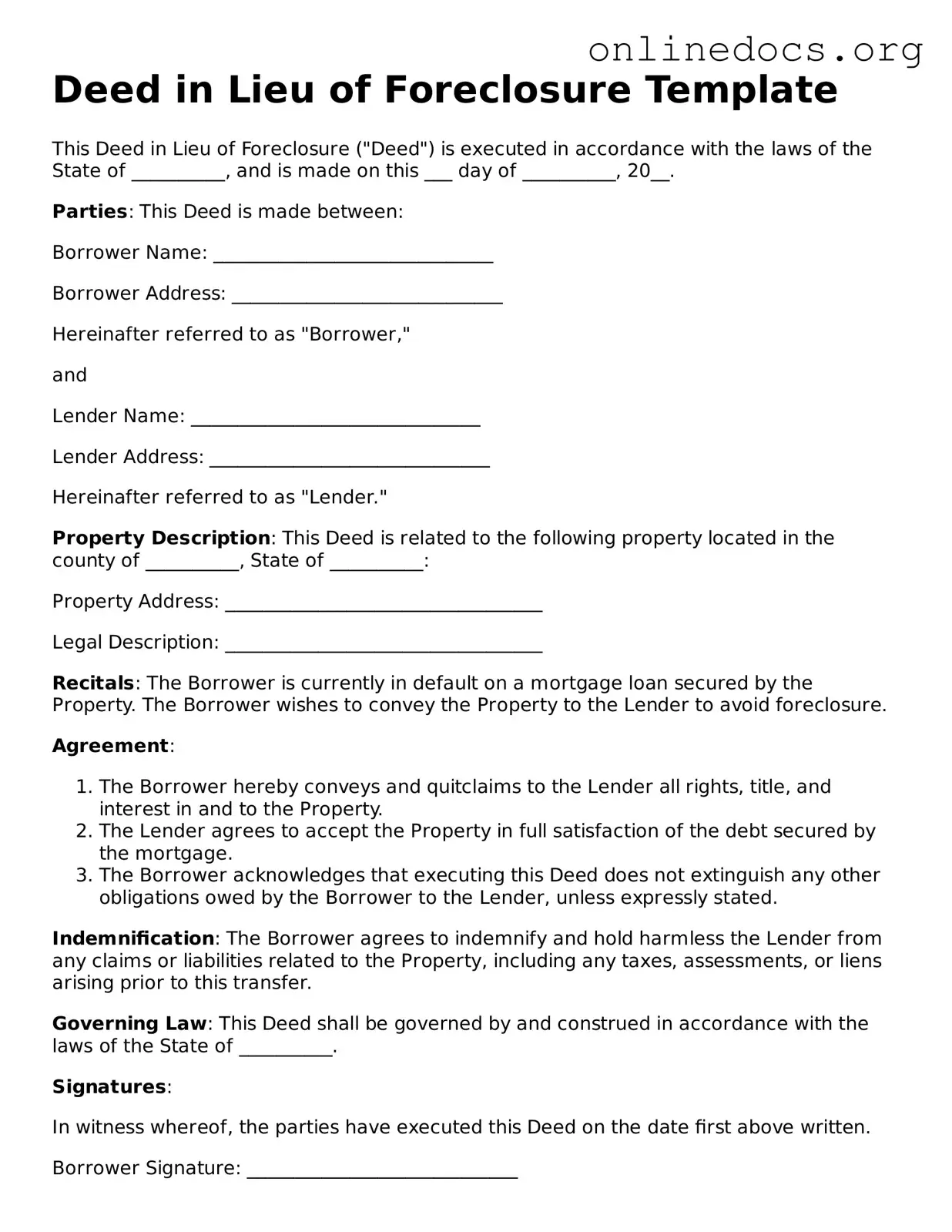

A Property Deed Transfer can be similar as well. This document involves the transfer of property ownership from one party to another. In the case of a Deed in Lieu of Foreclosure, the homeowner willingly transfers the property to the lender. Both documents facilitate a change in ownership, but the motivations and circumstances differ.

A Quitclaim Deed is another document that resembles a Deed in Lieu of Foreclosure. This type of deed transfers whatever interest the owner has in a property to another party without any guarantees. In a deed in lieu scenario, the homeowner is effectively using a quitclaim deed to transfer ownership to the lender, thereby relinquishing their claim to the property.

Lastly, a Settlement Agreement can be compared to a Deed in Lieu of Foreclosure. This document outlines the terms under which parties agree to resolve a dispute or claim. In the context of foreclosure, a settlement agreement might include terms for a deed in lieu, allowing both the lender and homeowner to come to a mutual understanding about the property's future and the homeowner's debt.