Filling out a Florida Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are handled according to your wishes. However, many individuals make common mistakes that can lead to complications down the road. Understanding these pitfalls can help you avoid them and create a more effective document.

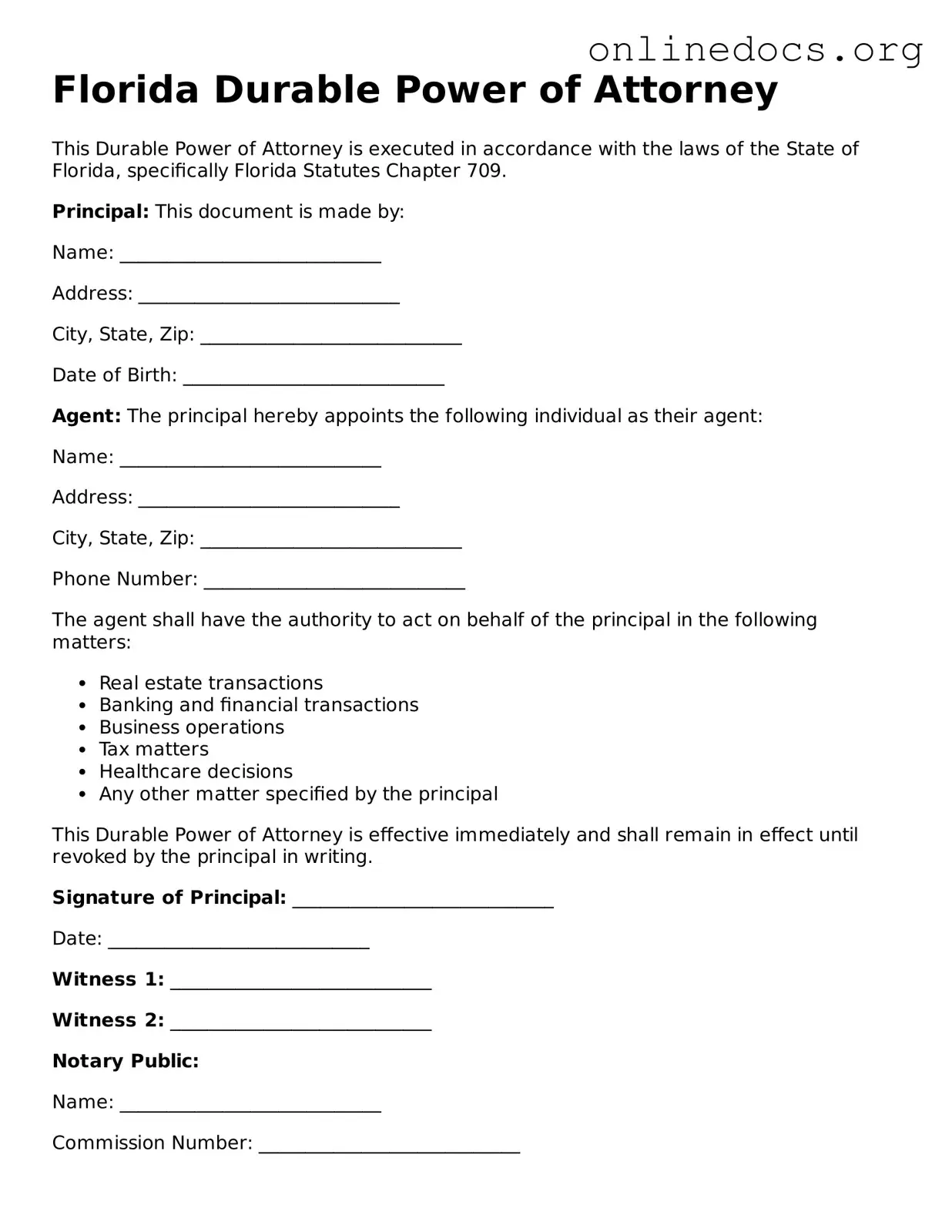

One frequent mistake is not clearly identifying the agent. The person you choose to act on your behalf should be someone you trust completely. Failing to specify their full name and relationship to you can lead to confusion and potential disputes later. Make sure to provide accurate information to avoid any issues regarding their authority.

Another common error is neglecting to specify the powers granted to the agent. Some individuals simply check off all the options without considering what is truly necessary. This can lead to an overreach of authority or, conversely, insufficient powers to manage your affairs effectively. Take the time to think through which powers are essential for your situation.

Additionally, many people overlook the importance of signing and dating the document properly. A Durable Power of Attorney is not valid without your signature. Moreover, if you do not date it, there may be questions about when it became effective. Ensure that you complete this step thoroughly to avoid any legal challenges.

Failing to have the document notarized or witnessed is another mistake that can invalidate the form. Florida law requires that a Durable Power of Attorney be signed in the presence of a notary public or two witnesses. Skipping this step can render the document unenforceable, so make sure to follow these requirements carefully.

Some individuals also forget to review the form after it is completed. Errors or omissions may go unnoticed, which can create problems later. Take the time to read through the entire document to ensure that all information is accurate and complete. This simple step can save you from significant issues in the future.

Finally, not discussing your intentions with your chosen agent can lead to misunderstandings. It is crucial to have an open conversation about your wishes and the responsibilities you are assigning. This discussion can help ensure that your agent is prepared to act in your best interest when the time comes.

By being aware of these common mistakes, you can take the necessary steps to create a Durable Power of Attorney that accurately reflects your wishes and protects your interests. Careful attention to detail will provide peace of mind for you and your loved ones.