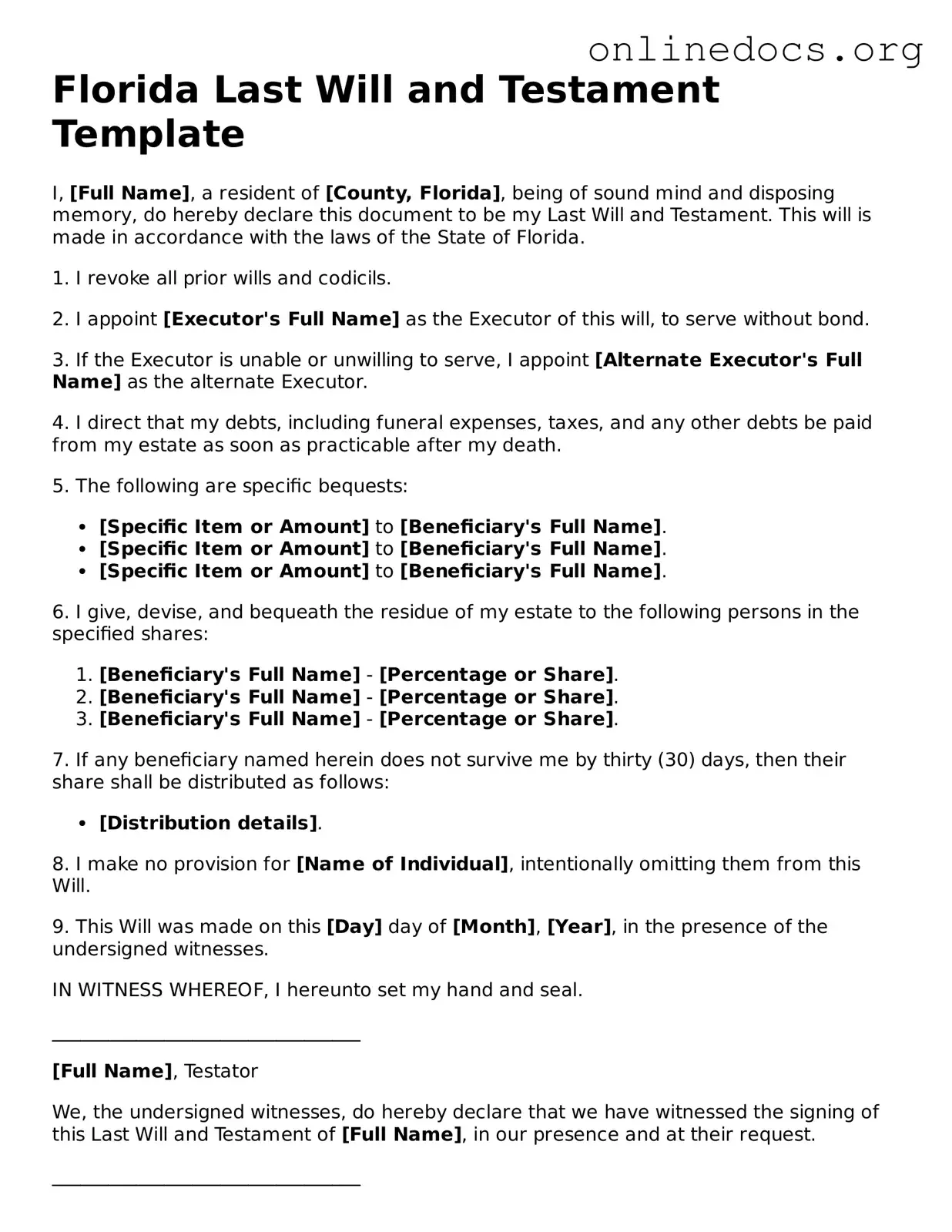

Fillable Last Will and Testament Form for Florida

A Florida Last Will and Testament form is a legal document that outlines an individual's wishes regarding the distribution of their assets after death. This form ensures that personal property is transferred according to the deceased's desires, providing clarity and direction for loved ones. Understanding how to properly complete this document is essential for anyone looking to secure their legacy.

Access Editor Now