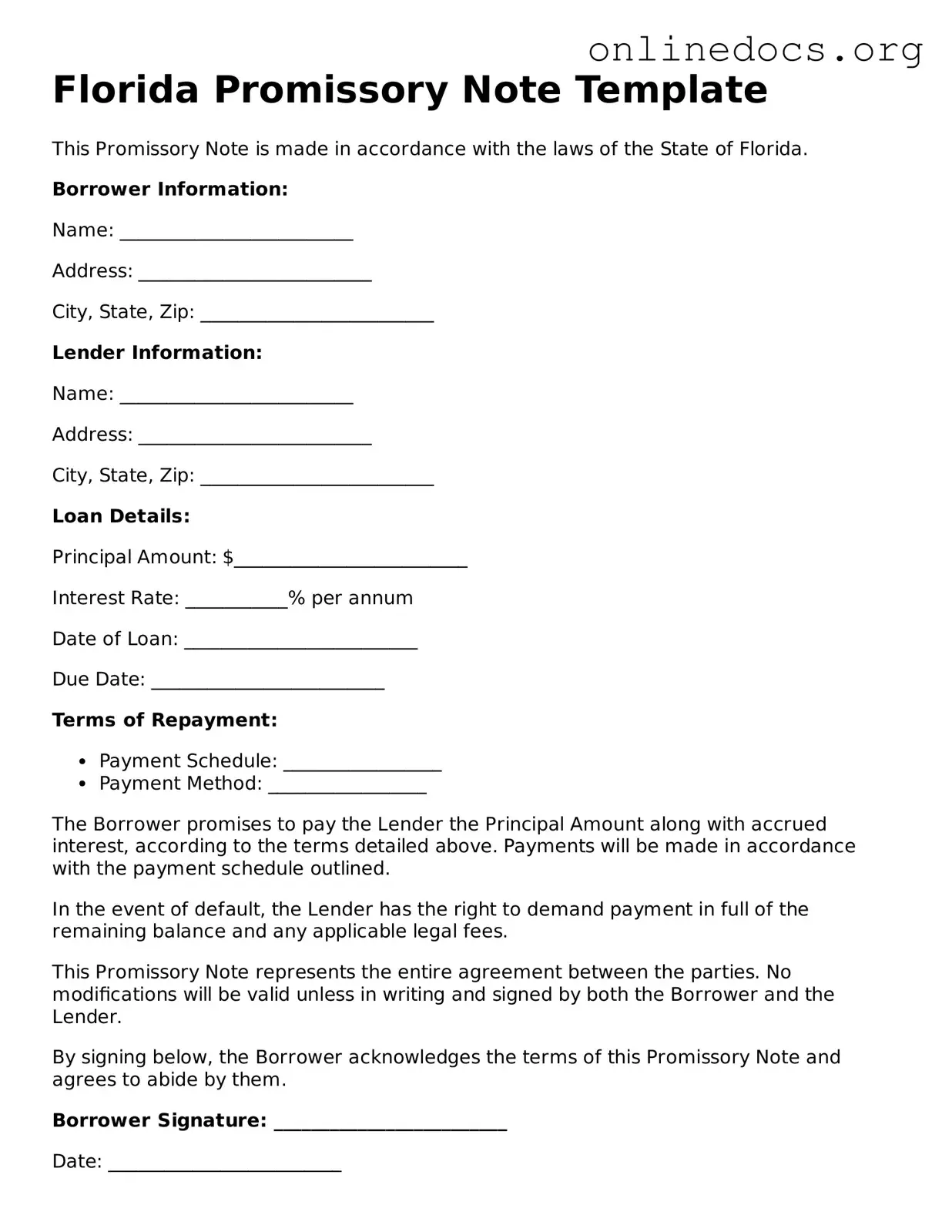

Completing a Florida Promissory Note form requires careful attention to detail. One common mistake is failing to include the correct names of the parties involved. It is essential that the borrower and lender's names are accurately spelled and reflect their legal identities. Any discrepancies can lead to confusion or disputes later on.

Another frequent error is neglecting to specify the loan amount clearly. This figure should be prominently stated, as it defines the total amount owed by the borrower. Omitting this detail or writing it incorrectly can create significant issues regarding repayment expectations.

People often overlook the importance of detailing the interest rate. The form must indicate whether the loan is interest-bearing and, if so, the exact rate. Without this information, both parties may have differing interpretations of the terms, which can lead to conflicts.

Additionally, many individuals fail to outline the repayment schedule. A clear timeline for payments, including due dates and the frequency of payments, should be established. Ambiguity in this area can result in misunderstandings regarding when payments are expected.

Another mistake is not including a provision for late fees. If the borrower fails to make a payment on time, having a specified late fee can incentivize timely payments. Omitting this clause may lead to financial losses for the lender.

Some individuals neglect to sign the document. A Promissory Note must be signed by both the borrower and the lender to be legally binding. Without signatures, the note lacks enforceability, rendering it ineffective in a legal context.

Inaccurate dates are another common issue. The date of execution should be included, as it marks the beginning of the loan agreement. Incorrect or missing dates can complicate the timeline of payments and obligations.

Furthermore, failing to provide a clear description of the loan purpose can create complications. Whether the funds are intended for personal use, business expenses, or another purpose, clarity in this area is beneficial for both parties.

Another oversight is not considering the inclusion of a default clause. This clause outlines the actions that will be taken if the borrower fails to meet their obligations. Without it, the lender may face challenges in enforcing their rights.

Lastly, individuals may not seek legal advice before finalizing the document. Consulting with a legal professional can help ensure that all necessary details are included and that the note complies with Florida law. This step can prevent potential issues and safeguard the interests of both parties.