Filling out a loan agreement form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to read the entire document before signing. This oversight can result in misunderstandings about the terms and conditions of the loan.

Another mistake is providing incorrect personal information. Borrowers may accidentally enter wrong names, addresses, or social security numbers. Such inaccuracies can delay the processing of the loan and may even lead to denial.

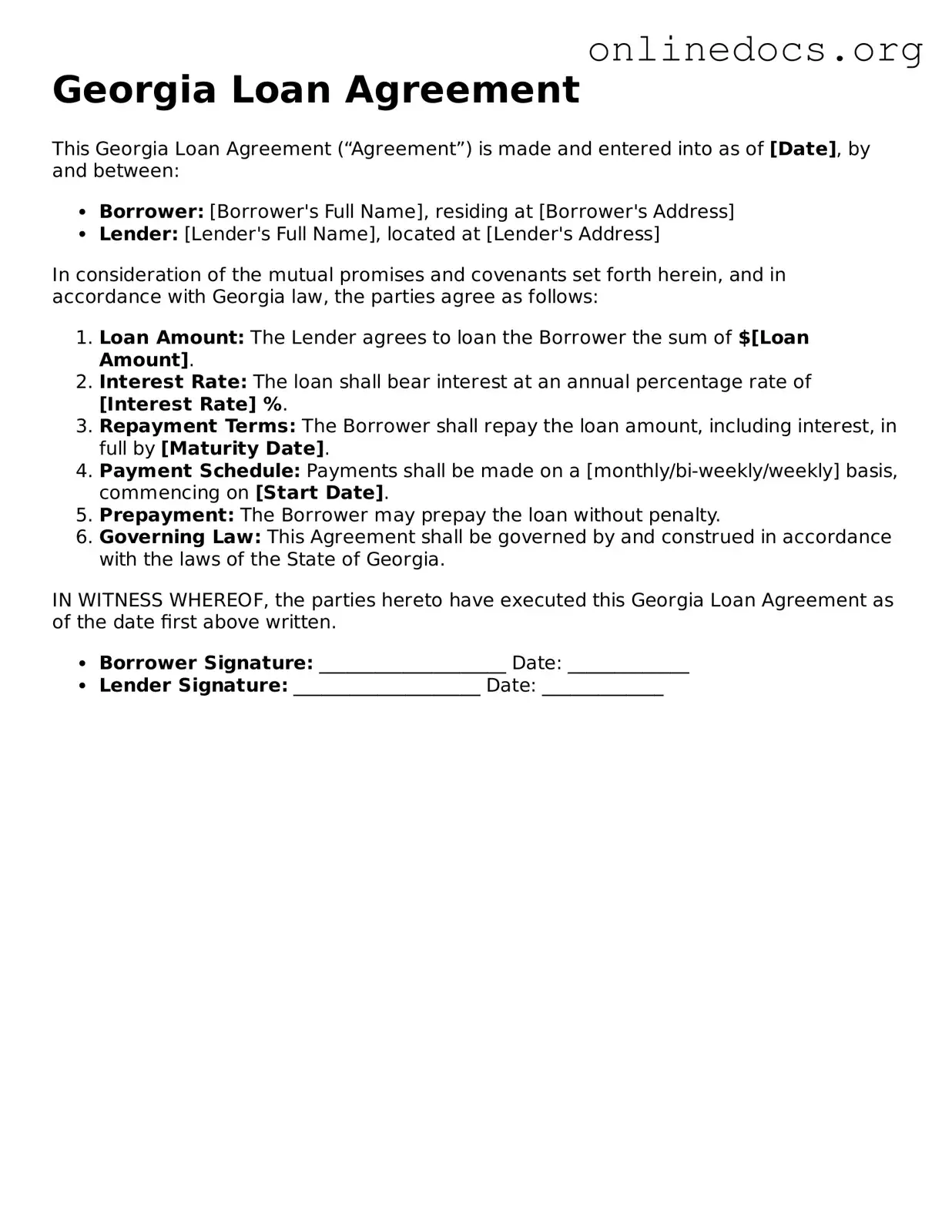

Many people overlook the importance of clearly stating the loan amount. When the requested amount is not specified or is written incorrectly, it can create confusion for both the lender and the borrower. This mistake can affect the approval process and the terms of repayment.

Additionally, some borrowers fail to include necessary documentation. Lenders often require supporting documents, such as proof of income or employment verification. Omitting these can lead to delays or a rejection of the loan application.

Another common error involves misunderstanding the repayment terms. Borrowers may not fully grasp the interest rates, payment schedules, or penalties for late payments. This lack of understanding can lead to financial strain if the borrower is unprepared for the obligations outlined in the agreement.

People also frequently neglect to keep a copy of the signed agreement for their records. Not having a personal copy can complicate matters if disputes arise in the future. It is crucial to retain this document for reference.

Lastly, some individuals rush through the process without asking questions. If any part of the loan agreement is unclear, it is essential to seek clarification from the lender. Not doing so can result in unexpected issues later on.