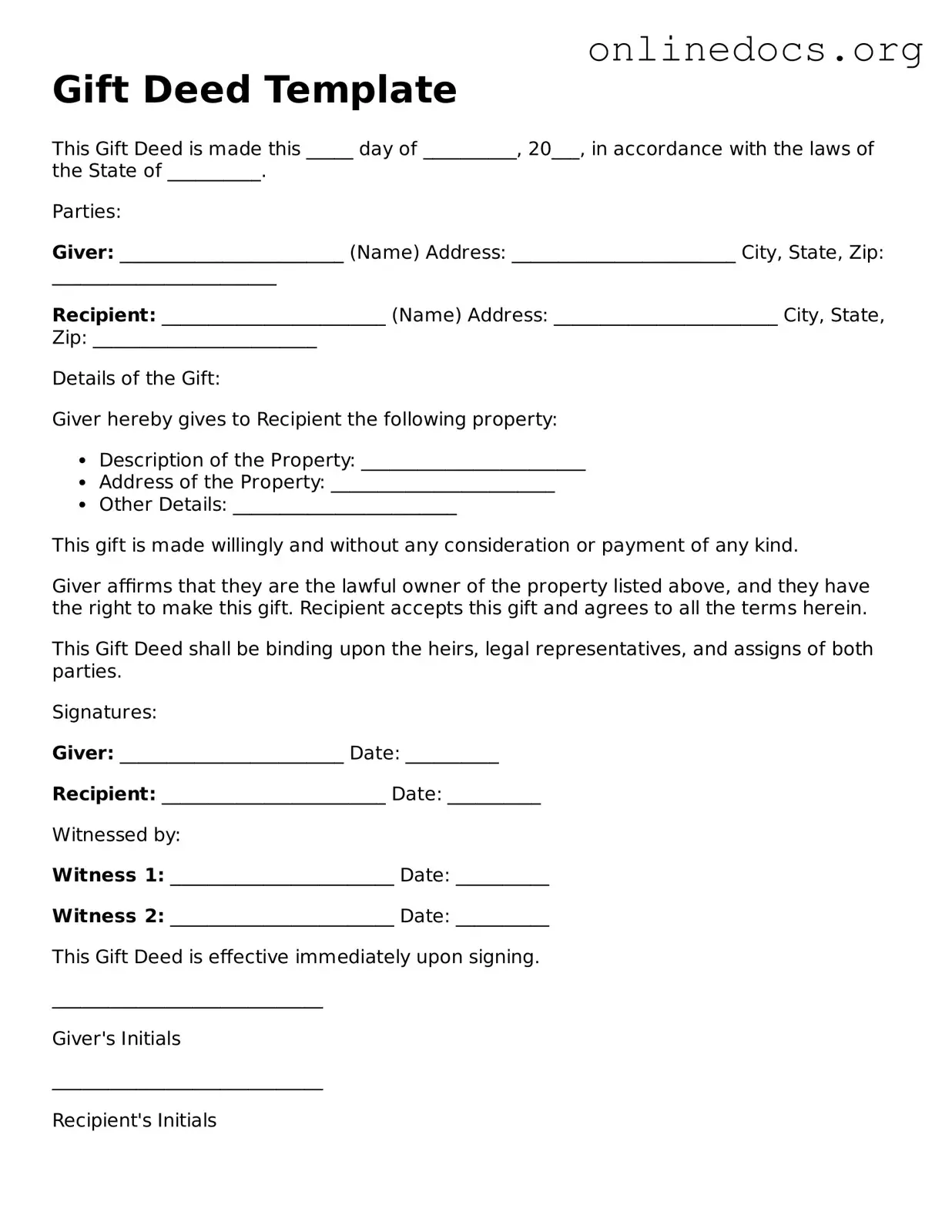

Filling out a Gift Deed form can seem straightforward, but many people make common mistakes that can lead to complications later on. One frequent error is failing to include all required information. It’s essential to provide complete details about both the giver and the recipient. Omitting names, addresses, or other crucial data can render the deed invalid.

Another mistake is not properly identifying the property being gifted. Whether it’s real estate, personal belongings, or financial assets, clarity is key. Vague descriptions can lead to disputes or misunderstandings down the line. Always ensure that the property is described in detail, including its location and any identifying features.

People often overlook the need for signatures. A Gift Deed typically requires the signatures of both the giver and the recipient. Without these signatures, the deed may not hold up in court. Additionally, some individuals forget to have the document notarized. While not always mandatory, notarization adds a layer of authenticity and can help prevent future challenges to the deed.

Another common error involves the date. Failing to date the Gift Deed can create confusion regarding when the transfer took place. This can be particularly important for tax purposes or if any legal questions arise. Always remember to include the date clearly on the form.

Some people mistakenly think that a Gift Deed is the same as a Will. While both involve the transfer of assets, they serve different purposes. A Gift Deed is intended for immediate transfer, whereas a Will only takes effect after the person’s death. Understanding this distinction can prevent misunderstandings about the intentions behind the document.

Additionally, individuals may not consider tax implications when completing a Gift Deed. Depending on the value of the gift, it may be subject to gift taxes. Consulting with a tax professional can help clarify any potential tax liabilities, ensuring that the giver is fully informed.

Another mistake involves not keeping copies of the Gift Deed. After signing and notarizing, it’s vital to retain copies for both parties. This ensures that everyone has access to the agreement should any questions arise in the future.

Lastly, some people fail to communicate openly about the gift. Discussing the intent and details of the Gift Deed with the recipient can help avoid misunderstandings. Clear communication ensures that both parties are on the same page and can help maintain a positive relationship.