Donating to Goodwill is a generous act that supports various community programs. However, many people make mistakes when filling out the donation receipt form, which can lead to confusion or complications later on. Understanding these common errors can help ensure that your charitable contributions are properly documented.

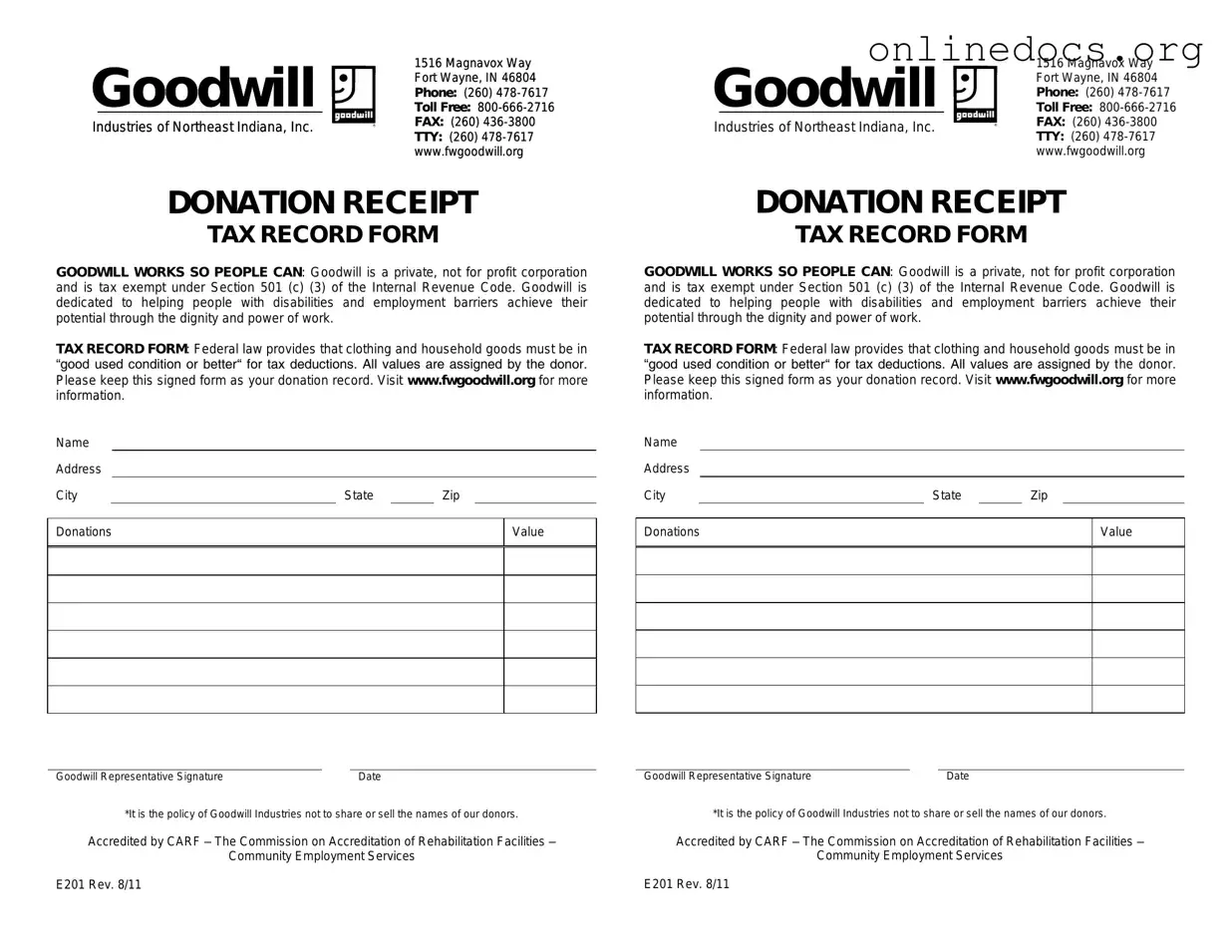

One frequent mistake is failing to provide an accurate description of the donated items. While it may seem simple, vague descriptions can cause issues when it comes to tax deductions. Instead of writing “clothes” or “household items,” be specific. For example, you might note “five pairs of jeans” or “three kitchen appliances.” This level of detail helps both you and Goodwill track the donation more effectively.

Another common error is not estimating the value of the donated items. Many people overlook this step, thinking it is unnecessary. However, the IRS requires that you provide a reasonable estimate of the value for tax purposes. Take a moment to research the fair market value of your items. This information is crucial when you file your taxes and can help you maximize your deductions.

Additionally, some donors forget to sign and date the receipt. A signature serves as proof of the donation, while the date indicates when the contribution was made. Without this information, the receipt may not hold up during an audit or when claiming a tax deduction. Always double-check that you’ve signed and dated the form before leaving.

Many people also neglect to keep a copy of the receipt for their records. This is a critical oversight. Keeping a copy ensures that you have documentation in case of any questions from the IRS or for your own reference. It’s a simple step that can save you headaches down the road.

Finally, some individuals mistakenly think that all items are tax-deductible. While most donations are, certain restrictions apply. For example, items that are not in good condition or that have been used excessively may not qualify. Familiarize yourself with Goodwill’s guidelines on acceptable donations to avoid any surprises.

By being mindful of these common mistakes, donors can ensure that their contributions are accurately documented and maximized for tax benefits. Taking the time to fill out the Goodwill donation receipt form correctly not only helps you but also supports the important work that Goodwill does in the community.