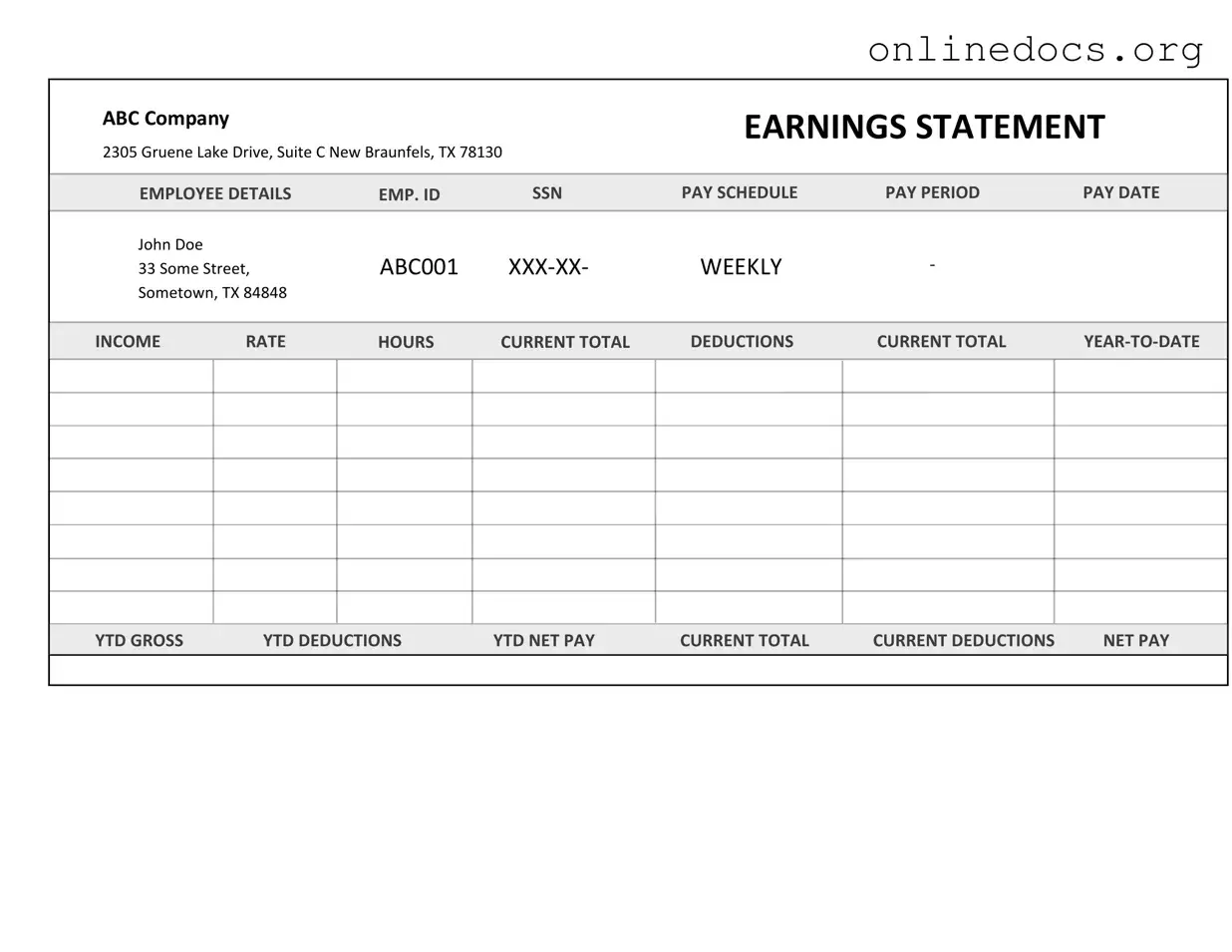

Filling out the Independent Contractor Pay Stub form can be a straightforward process, but several common mistakes can lead to complications. One frequent error is failing to include accurate personal information. It is essential to provide your full name, address, and taxpayer identification number. Omitting or misrepresenting this information can result in delays in payment or tax issues.

Another common mistake is not clearly detailing the services rendered. When completing the pay stub, the description of work performed should be specific and comprehensive. Vague descriptions can lead to misunderstandings with clients and may affect future payment disputes.

Many individuals also overlook the importance of accurately calculating hours worked. Whether you charge hourly or on a project basis, precise record-keeping is crucial. Errors in this area can lead to underpayment or overpayment, both of which can create unnecessary tension between you and your client.

Incorrectly stating the payment amount is another pitfall. Ensure that the figures match your agreement with the client. Double-checking calculations can prevent discrepancies that may require time-consuming corrections later.

Additionally, some people forget to include any applicable taxes or deductions. Depending on your location and the nature of your work, certain taxes may need to be withheld. Not accounting for these can lead to unexpected tax liabilities.

Another mistake is neglecting to sign the pay stub. A signature is often required to validate the document. Without it, the pay stub may be considered incomplete, causing delays in payment processing.

Failing to keep a copy of the completed pay stub is also a common oversight. Retaining a record can be invaluable for your personal files and for resolving any future disputes that may arise regarding payment or services rendered.

Some individuals may also forget to check the payment method. Whether you prefer direct deposit, check, or another method, it is crucial to specify this clearly on the pay stub. Miscommunication in this area can lead to delays in receiving your funds.

Moreover, neglecting to update the pay stub format can be an issue. If you have changed your business structure or personal information, using an outdated form can create confusion. Always use the most current version of the pay stub to ensure compliance with any new regulations.

Lastly, not reviewing the entire document before submission can lead to simple yet impactful mistakes. A thorough review can help catch errors that may have been overlooked during the initial filling out process. Taking the time to double-check your work can save you from potential complications down the line.