The Notice of Commencement is a document that serves as a formal declaration of the start of construction on a property. It must be filed with the local county clerk and provides important information about the project, including the property owner, contractor, and a description of the work. Similar to the Intent to Lien form, it protects the rights of contractors and subcontractors by ensuring they are notified of the project and can assert their claims for payment if necessary. Both documents aim to establish a clear communication line between parties involved in property improvements.

The Notice of Non-Payment is issued when a contractor or subcontractor has not received payment for their work. This document is similar to the Intent to Lien because it serves as a warning to the property owner that payment is overdue and that legal action may follow. By sending this notice, the contractor hopes to prompt the property owner to settle the outstanding balance before further legal steps are taken, thereby avoiding the need for a lien.

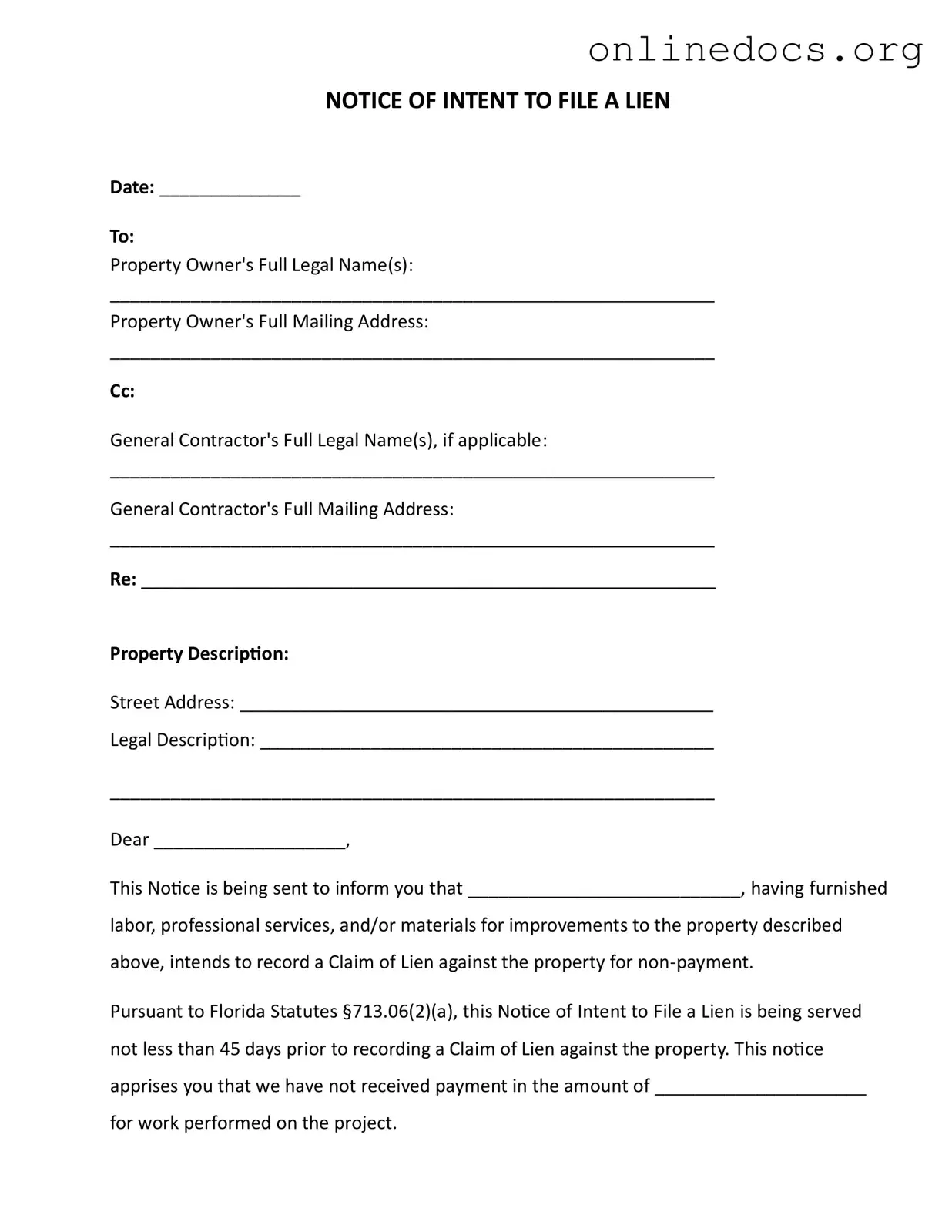

A Claim of Lien is a legal claim against a property for unpaid work or materials. Once the Notice of Intent to Lien is sent, if payment is not received, the contractor can file a Claim of Lien. This document formally asserts the contractor’s right to seek payment through the property itself. Both documents are part of the same process, with the Intent to Lien serving as a precursor to the more formal Claim of Lien.

The Waiver of Lien is a document that relinquishes a contractor’s right to file a lien against a property. It is often provided in exchange for payment. This is similar to the Intent to Lien in that both documents deal with the rights of contractors regarding payment. While the Intent to Lien warns of potential action for non-payment, the Waiver of Lien indicates that payment has been made and the contractor no longer has a claim against the property.

For those looking to buy or sell a motorcycle in Arizona, it's important to understand the legal requirements surrounding the transaction. Completing the necessary paperwork is essential to ensure the transfer of ownership is recognized by the state. To learn more about the Arizona Motorcycle Bill of Sale and to access the template needed for the sale, read here.

The Release of Lien is a document that confirms that a previously filed lien has been satisfied. This is similar to the Intent to Lien because both documents address the status of payment and the rights of contractors. When a contractor receives payment, they file a Release of Lien to clear the property of any claims. The Intent to Lien, on the other hand, serves as a notice that a lien may be filed if payment is not received.

The Notice of Default is typically used in mortgage situations but can be relevant in construction contexts as well. It informs a property owner that they are in default on their obligations, similar to the Intent to Lien. Both documents aim to prompt action from the property owner to rectify a financial situation before it escalates into more serious legal consequences.

The Demand for Payment is a straightforward request for payment that can be sent to a property owner when a contractor has not been paid. This document is similar to the Intent to Lien in that it serves as a formal notice of an outstanding debt. Both documents aim to resolve payment issues before more drastic measures, such as filing a lien, are taken. The Demand for Payment is often the first step in the process of seeking compensation for work performed.