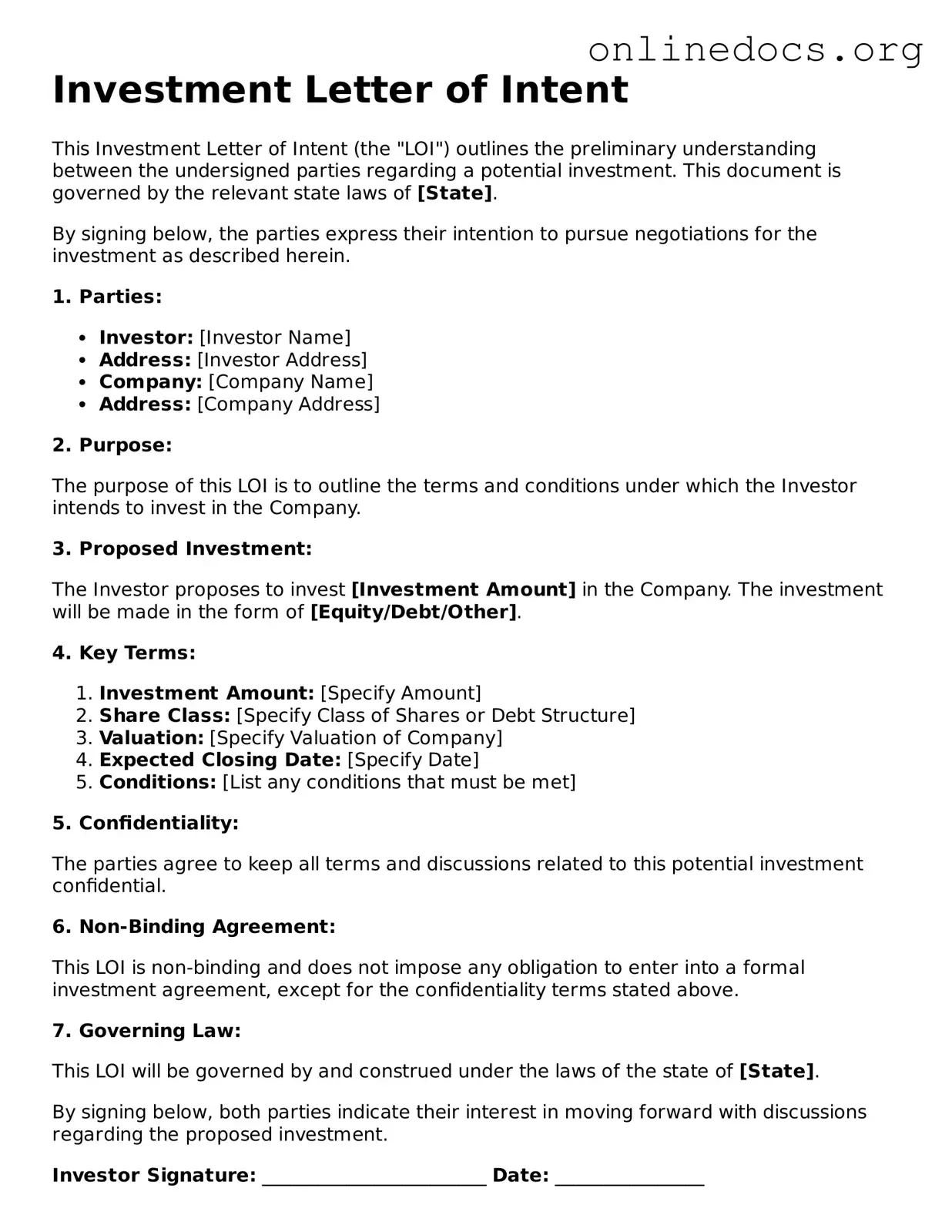

When individuals fill out the Investment Letter of Intent form, several common mistakes can hinder the process. One frequent error is providing incomplete information. Each section of the form is designed to capture specific details about the investment and the investor. Omitting any required fields can lead to delays or even rejection of the application.

Another mistake is failing to double-check for accuracy. Numbers, names, and dates must be correct. A simple typo can create confusion or misinterpretation. For instance, if the investment amount is incorrectly stated, it may affect the terms of the investment or lead to misunderstandings about the investor's intentions.

Some individuals neglect to read the instructions thoroughly. The form often comes with guidelines that outline how to fill it out correctly. Skipping this step can result in misinterpretation of what is required, leading to errors that could have been easily avoided.

Moreover, individuals sometimes forget to sign and date the form. A signature signifies agreement and intent, while the date indicates when the form was completed. Without these, the form may be considered incomplete, causing further delays in processing.

Additionally, people may not keep copies of their submitted forms. This can create difficulties if there are questions or issues later on. Having a record allows investors to reference their submissions and clarify any discrepancies that may arise.

Finally, failing to follow up after submission is a common oversight. After sending the form, it is essential to confirm receipt and check on the status of the application. This proactive approach can help ensure that everything is on track and that any potential issues are addressed promptly.