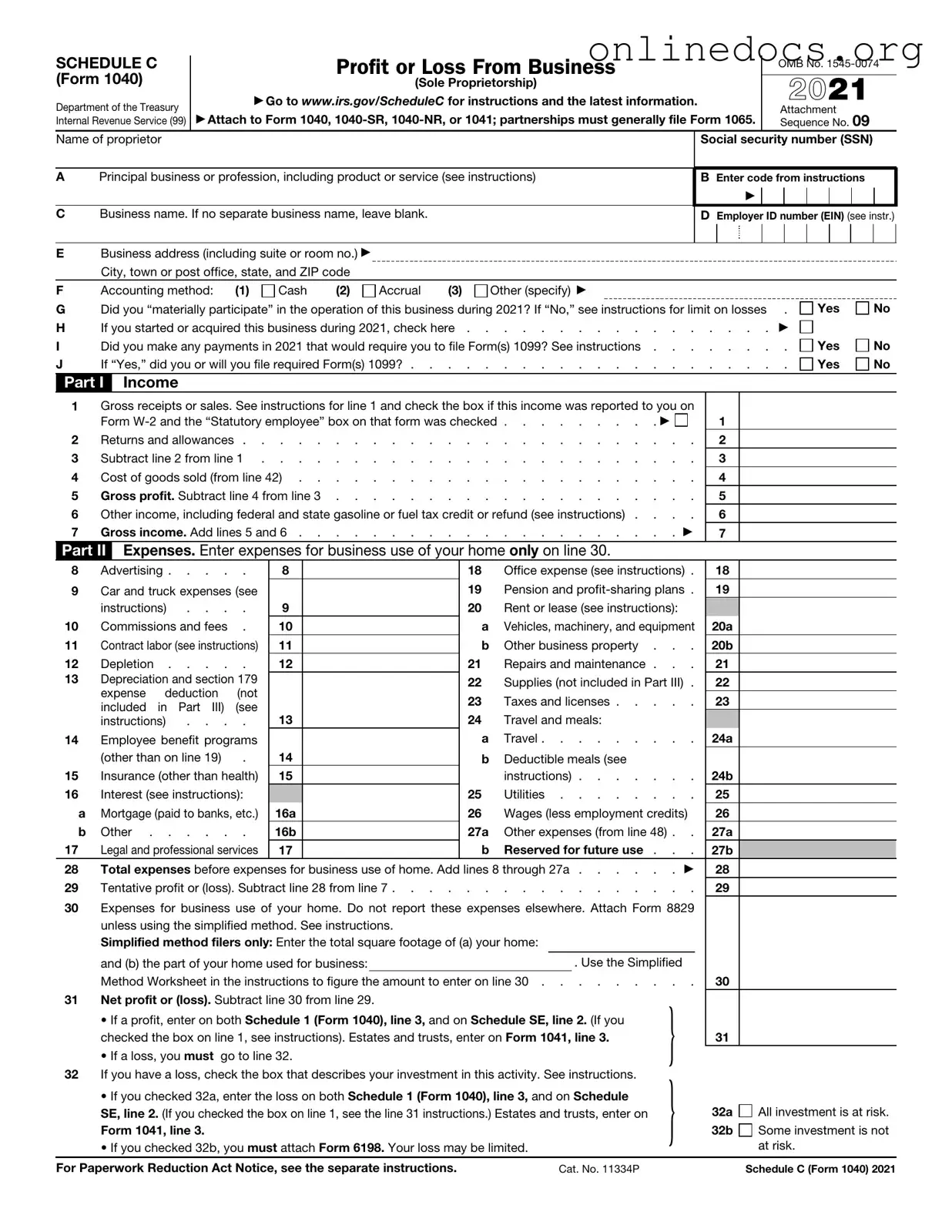

The IRS Schedule C (Form 1040) is similar to the IRS Form 1065, which is used for partnerships. Both forms require detailed reporting of income and expenses. Schedule C is for sole proprietors, while Form 1065 is designed for partnerships. Each form allows the reporting of business income, deductions, and net profit or loss. The information gathered helps the IRS assess the tax liability of the business entity, whether it is a single owner or a group of partners.

For those involved in boat sales, it is crucial to understand the legal aspects associated with such transactions, including the necessity of a proper bill of sale. This documentation not only protects both buyers and sellers but also clarifies the transfer of ownership, making the process straightforward. To find the necessary form and ensure compliance, it's helpful to visit https://fillpdf-forms.com/ for more details.

Another document that resembles Schedule C is the IRS Form 1120, which is used by corporations. Like Schedule C, Form 1120 requires a comprehensive account of income and expenses. However, while Schedule C is for individual business owners, Form 1120 caters to corporate entities. Both forms ultimately serve the purpose of calculating taxable income, but they differ in terms of business structure and tax obligations.

IRS Schedule E is also comparable to Schedule C. Schedule E is used for reporting income from rental properties, partnerships, and S corporations. Both documents require the reporting of income and expenses, but they focus on different types of income. Schedule C addresses income from self-employment, while Schedule E deals with passive income sources. The similarities lie in the need for accurate reporting to determine tax liability.

The IRS Form 1040 itself shares similarities with Schedule C, as it is the main individual income tax return form. Both documents are integral to reporting income, deductions, and credits. Schedule C is a supplementary form that provides specific details about business income, which is then transferred to the main Form 1040. Together, they give a complete picture of an individual's financial situation for tax purposes.

Lastly, IRS Form 990 is akin to Schedule C in that it reports financial information, but it is specifically for tax-exempt organizations. Both forms require detailed reporting of income and expenses. However, Form 990 is used by non-profits, while Schedule C is for individuals running a business. The commonality lies in the need for transparency in financial reporting, ensuring that all income and expenses are accounted for, regardless of the entity type.