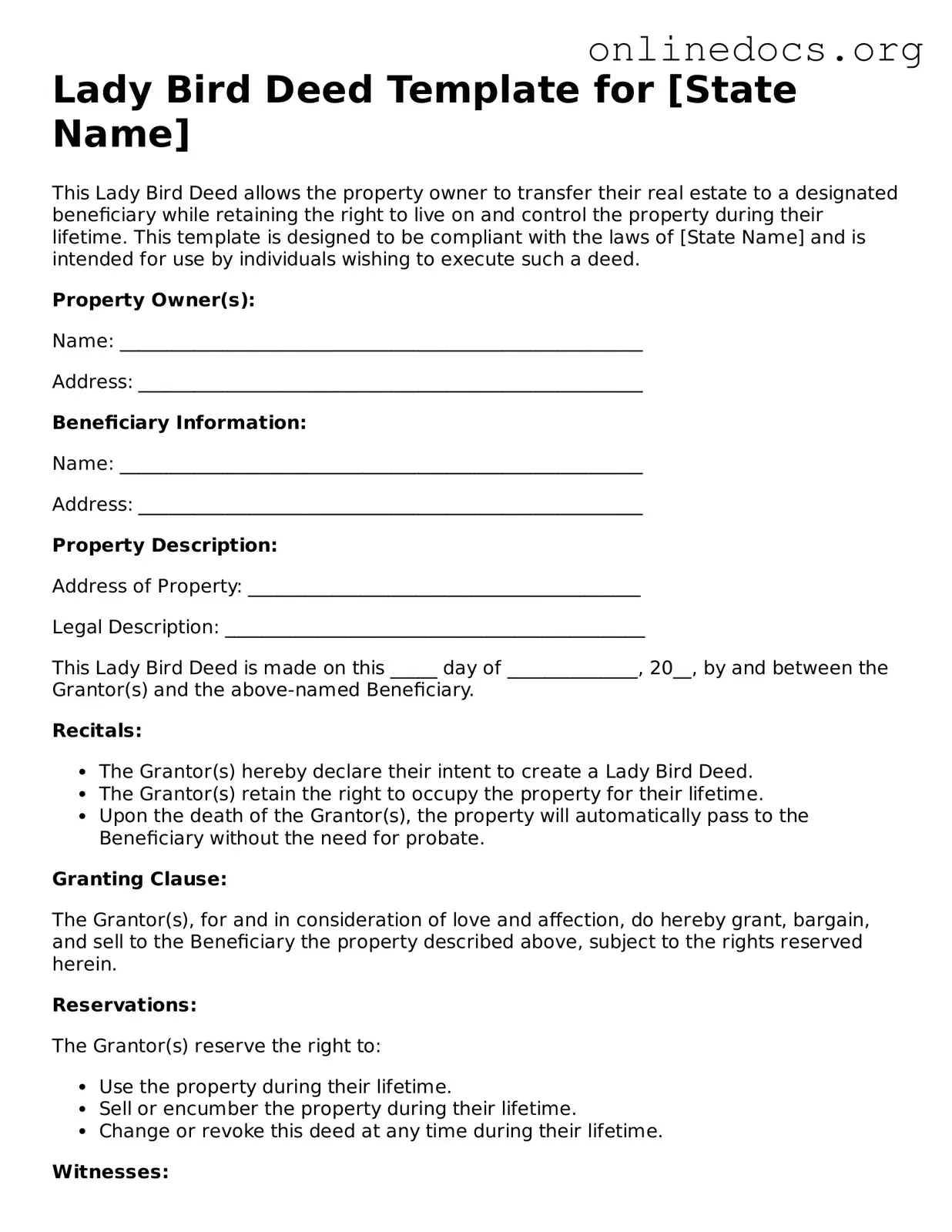

When completing a Lady Bird Deed form, individuals often make several common mistakes that can lead to complications in property transfer. One frequent error is failing to include all necessary information about the property. It is essential to provide a complete legal description of the property, not just the address. Omitting this detail can create ambiguity and may invalidate the deed.

Another mistake is not properly identifying the beneficiaries. Many people assume that their intentions are clear, but it is crucial to specify the names of the beneficiaries accurately. Errors in spelling or incorrect names can lead to disputes or delays in the transfer process.

In some cases, individuals neglect to consider the implications of the deed on their estate plan. A Lady Bird Deed allows property to pass outside of probate, but it can also affect Medicaid eligibility and tax implications. Failing to consult with a professional about these factors can result in unintended consequences.

People also often overlook the need for proper execution of the deed. A Lady Bird Deed must be signed and notarized to be valid. If these steps are not completed correctly, the deed may not hold up in court, potentially causing issues for the beneficiaries.

Additionally, some individuals mistakenly believe that once the deed is signed, it cannot be changed. While a Lady Bird Deed does grant certain rights to the beneficiaries, the grantor retains control over the property during their lifetime. Understanding this can help avoid confusion about the rights of both parties.

Finally, individuals sometimes fail to record the deed with the appropriate county office. Recording the deed is a crucial step in ensuring that the transfer is legally recognized. Without proper recording, the deed may not be enforceable, leading to potential legal disputes in the future.