When filling out an LLC Share Purchase Agreement form, individuals often encounter several common mistakes that can lead to complications down the line. Understanding these pitfalls can help ensure a smoother process and protect the interests of all parties involved.

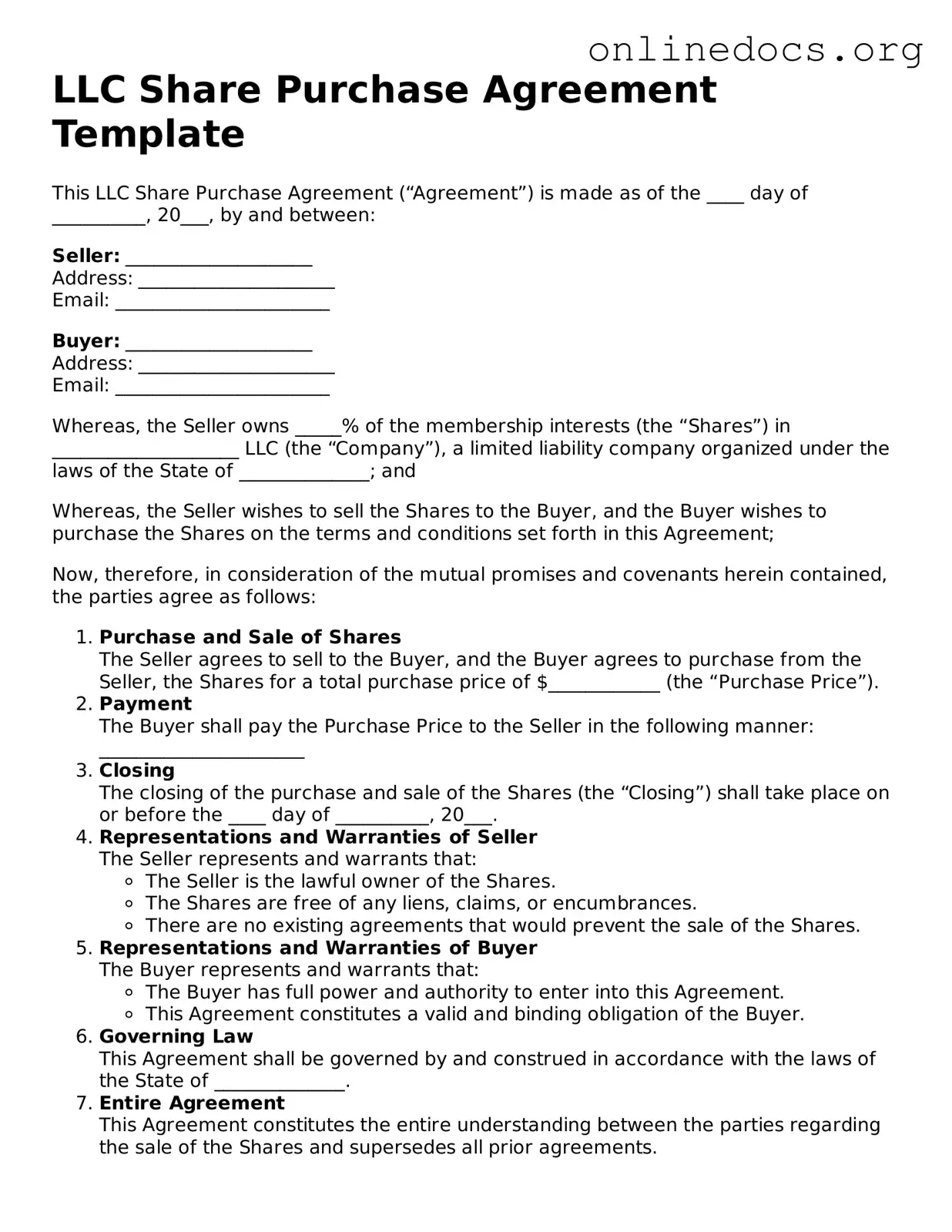

One frequent error is failing to accurately identify the parties involved in the agreement. It is crucial to include the full legal names of both the seller and the buyer. Omitting middle names or using nicknames can create confusion and may lead to disputes later on. Precision in identifying the parties helps establish clear ownership and rights.

Another common mistake is neglecting to specify the purchase price and payment terms. The agreement should clearly outline how much is being paid for the shares and the method of payment, whether it be a lump sum or installments. Without this clarity, misunderstandings can arise regarding financial obligations.

People also often overlook the importance of detailing the rights and obligations of the parties. This includes any restrictions on the transfer of shares or obligations for future contributions. By not addressing these elements, individuals may find themselves in situations where expectations are not met, leading to potential conflicts.

Additionally, some individuals fail to include necessary representations and warranties. These statements serve to assure the buyer about the condition of the business and the shares being purchased. Omitting this section can leave the buyer vulnerable to undisclosed liabilities or issues with the business.

Finally, many overlook the need for signatures and dates. An unsigned agreement, or one that lacks proper dating, may not hold up in a legal context. Both parties must sign the document to validate the agreement and demonstrate mutual consent.

By being mindful of these common mistakes, individuals can create a more effective and legally sound LLC Share Purchase Agreement. Taking the time to review and clarify each section can save significant trouble in the future.