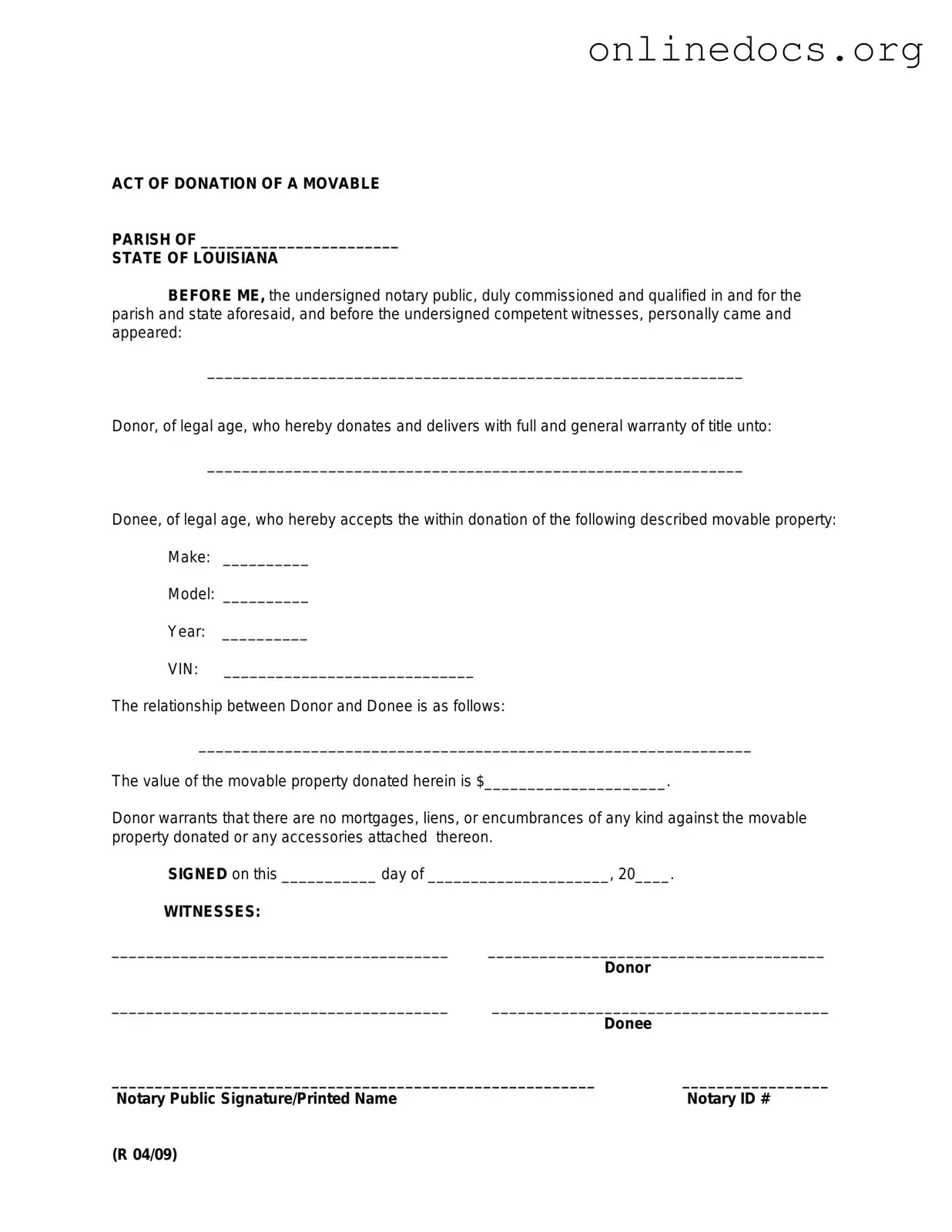

Filling out the Louisiana Act of Donation form can be a straightforward process, but many individuals make common mistakes that can lead to complications. One frequent error is failing to provide accurate descriptions of the property being donated. It is crucial to be specific about what is being transferred to avoid disputes later on.

Another mistake involves not including all required signatures. The form mandates that both the donor and the donee sign the document. Omitting one of these signatures can render the act invalid. Ensure that both parties review the form thoroughly before submission.

Many people overlook the importance of including the date of the donation. This date serves as a reference point for legal purposes. Without it, the timing of the donation may become unclear, potentially leading to legal challenges.

Inaccurate identification of the parties involved is another common error. It is essential to use full legal names and correct addresses. This information helps to establish clear ownership and prevents confusion about who is involved in the transaction.

Some individuals mistakenly believe that the Act of Donation does not need to be notarized. In Louisiana, notarization is often required to ensure the document's authenticity. Failing to have the form notarized can lead to issues in its enforcement.

Additionally, people sometimes forget to include a statement of intent. This statement clarifies the donor's wishes and intentions regarding the donation. Without it, the purpose of the act may be questioned, leading to potential disputes.

Another mistake involves not retaining copies of the completed form. It is vital for both the donor and the donee to keep copies for their records. This practice ensures that both parties have access to the same information in the future.

Some individuals also neglect to check for any outstanding debts associated with the property. If the property has liens or mortgages, these issues must be addressed before the donation can proceed. Ignoring this step can lead to complications for the donee.

Lastly, people often fail to consult with a legal professional before completing the form. While it may seem simple, the implications of a donation can be significant. Seeking legal advice can help avoid pitfalls and ensure that the donation is executed correctly.