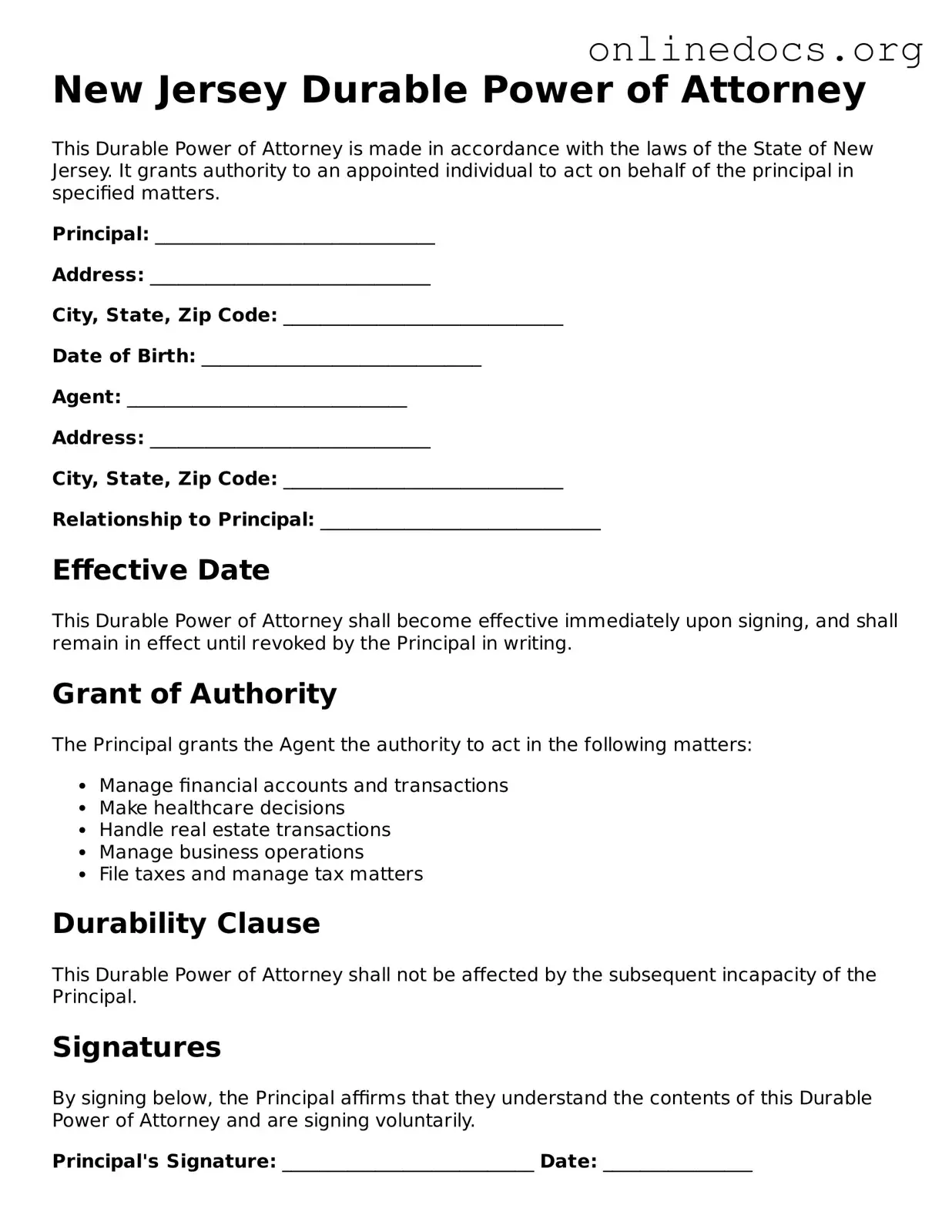

Filling out a Durable Power of Attorney (DPOA) form in New Jersey can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to specify the powers granted. It’s essential to clearly outline what decisions your agent can make on your behalf. Without this clarity, your agent may not have the authority to act when needed.

Another mistake is not signing the document in the presence of a notary or witnesses. In New Jersey, the DPOA must be notarized to be valid. Skipping this step can render the entire document useless. Similarly, people often overlook the importance of choosing the right agent. Selecting someone who may not understand your wishes or lacks the ability to handle financial matters can create issues when it’s time for them to act.

Additionally, some individuals forget to update their DPOA when their circumstances change. Life events, such as divorce or the death of a trusted agent, necessitate a review and possible revision of the document. Ignoring this can lead to outdated information that doesn’t reflect your current wishes.

Another common pitfall is not discussing the DPOA with the chosen agent beforehand. It’s crucial that your agent knows their responsibilities and feels comfortable taking on this role. A lack of communication can lead to confusion and reluctance when it’s time for them to step in.

People also sometimes neglect to include alternate agents. Having a backup can be vital if your primary agent is unable or unwilling to serve. This oversight can leave you without representation during critical times.

Moreover, failing to keep copies of the DPOA can be a significant mistake. Once the document is completed, it’s important to distribute copies to your agent, any alternate agents, and relevant financial institutions. Without access to the document, your agent may face challenges in executing their duties.

Some individuals also forget to specify the duration of the DPOA. It’s wise to indicate whether the powers are effective immediately or only in the event of incapacitation. Without this specification, there may be confusion about when the agent can act.

Another error involves using outdated forms. Laws can change, and using an old version of the DPOA may lead to invalidation. Always ensure you’re using the most current form, which reflects New Jersey’s legal requirements.

Lastly, many people underestimate the importance of legal advice. While it’s possible to fill out the DPOA on your own, consulting with a legal professional can help you avoid mistakes and ensure that your document meets all legal standards.