Filling out the New Jersey Employment Verification form can be a straightforward process, but several common mistakes often occur. One frequent error is not providing accurate personal information. Individuals sometimes overlook details such as their full name, Social Security number, or address. Inaccurate information can lead to delays in processing or even denial of benefits.

Another mistake involves incomplete employment history. Applicants may fail to include all relevant employers or may provide incorrect dates of employment. This omission can create confusion and may result in the form being returned for correction.

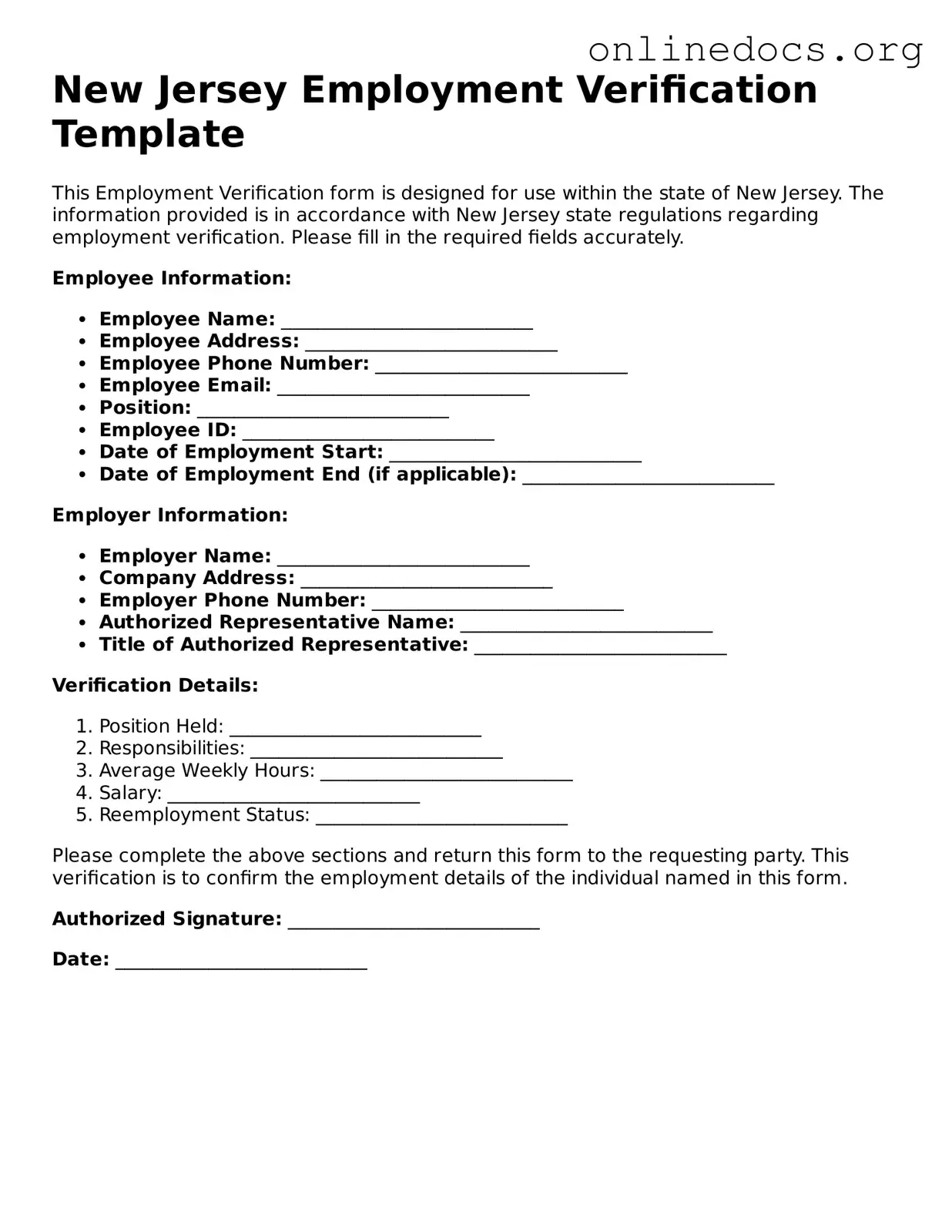

In addition, people often neglect to sign and date the form. A signature is crucial as it verifies that the information provided is true and accurate. Without a signature, the form is considered incomplete and cannot be processed.

Some individuals also misinterpret the instructions provided on the form. Misunderstanding what is required for each section can lead to errors. For example, applicants might provide too much or too little information in response to specific questions.

Another common issue is the failure to attach necessary documentation. Supporting documents, such as pay stubs or tax forms, may be required to substantiate the information provided. Not including these documents can result in delays.

People sometimes use incorrect or outdated forms. It is essential to ensure that the most current version of the Employment Verification form is used. Using an old version can lead to complications in processing.

Additionally, applicants may overlook the importance of providing a valid contact number. A missing or incorrect phone number can hinder communication between the employer and the verifying agency, causing further delays.

Errors in formatting can also pose problems. For instance, using illegible handwriting or unconventional abbreviations can make it difficult for the reviewer to understand the information provided. Clear and concise writing is crucial.

Lastly, individuals may not review their completed forms before submission. Failing to double-check for typos or inaccuracies can lead to unnecessary complications. Taking the time to review the form can help prevent these mistakes and ensure a smoother verification process.