Filling out the New Jersey Real Estate Purchase Agreement can be a daunting task, especially for first-time buyers. Mistakes can easily happen, and they can lead to confusion or even legal issues down the line. Here are ten common mistakes people make when completing this important document.

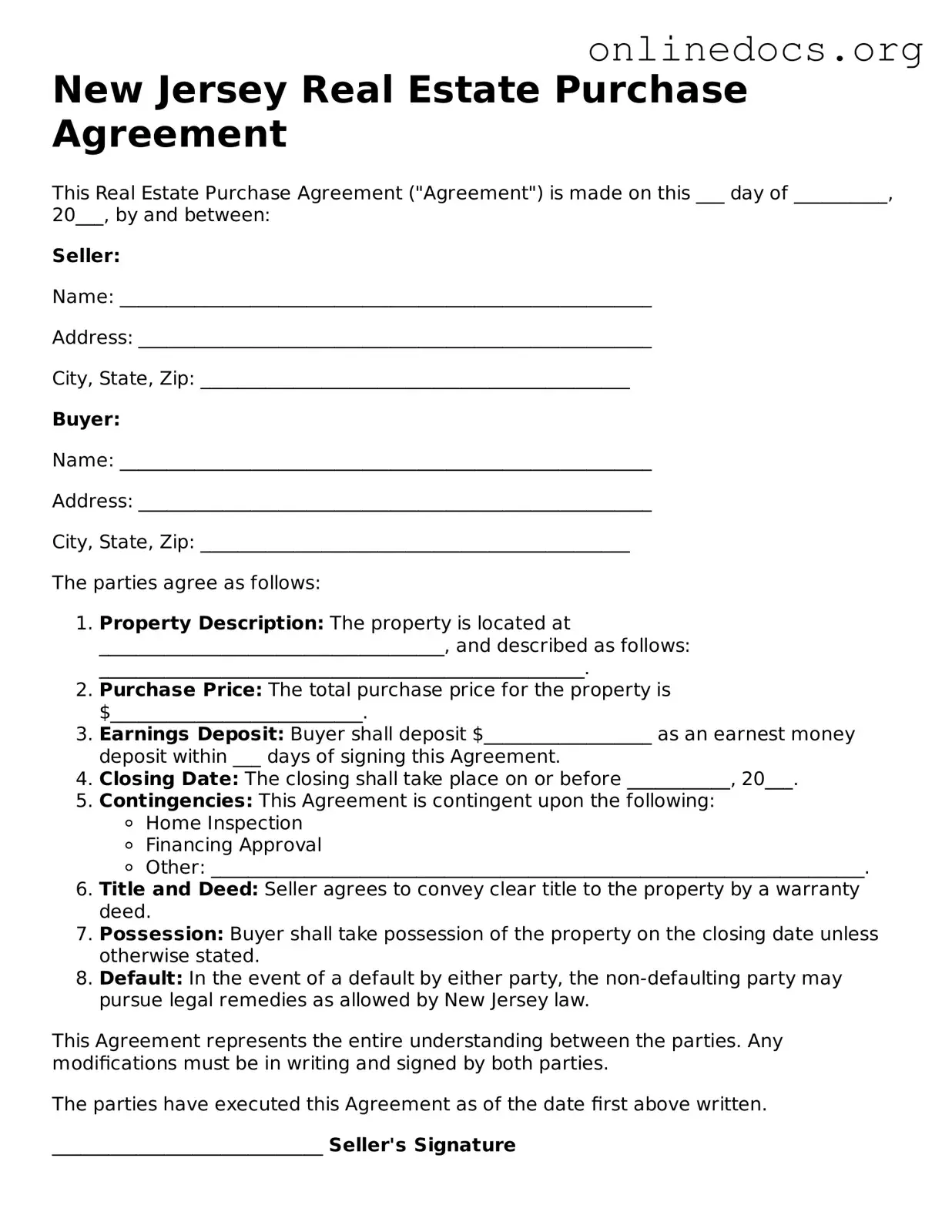

One frequent error is not providing accurate property details. It’s essential to ensure that the property address, legal description, and other identifying information are correct. A simple typo can lead to significant complications later on.

Another mistake involves failing to specify the purchase price clearly. It’s vital to write the price in both numerical and written form. This redundancy helps prevent misunderstandings about the agreed amount.

Many buyers overlook the inclusion of contingencies. These are conditions that must be met for the sale to proceed, such as financing or home inspections. Omitting them can leave buyers vulnerable to unforeseen issues.

People often forget to review the closing date. Setting a realistic timeline is crucial. If the date is too rushed or not feasible, it can lead to stress and complications as the closing day approaches.

Another common oversight is neglecting to include earnest money details. This deposit shows the seller that the buyer is serious about the purchase. Clearly stating the amount and terms can help protect both parties.

Buyers sometimes skip over reviewing the property disclosures. Sellers are required to disclose certain information about the property’s condition. Not paying attention to this section can lead to unpleasant surprises after the sale.

Additionally, many individuals make the mistake of not understanding the terms of the agreement. Each section of the purchase agreement has specific implications. Taking the time to read and comprehend these terms can save a lot of headaches later.

Another area of concern is incomplete signatures. Every party involved in the transaction needs to sign the agreement. Missing signatures can invalidate the contract and create legal challenges.

Buyers often forget to consider additional costs. The purchase agreement should outline who is responsible for various fees, such as closing costs or repairs. Being clear about these responsibilities can prevent disputes.

Lastly, many people fail to consult with a real estate professional before finalizing the agreement. Having an expert review the document can provide valuable insights and help avoid costly mistakes.

In conclusion, filling out the New Jersey Real Estate Purchase Agreement requires careful attention to detail. By being aware of these common mistakes, buyers can approach the process with greater confidence and clarity.