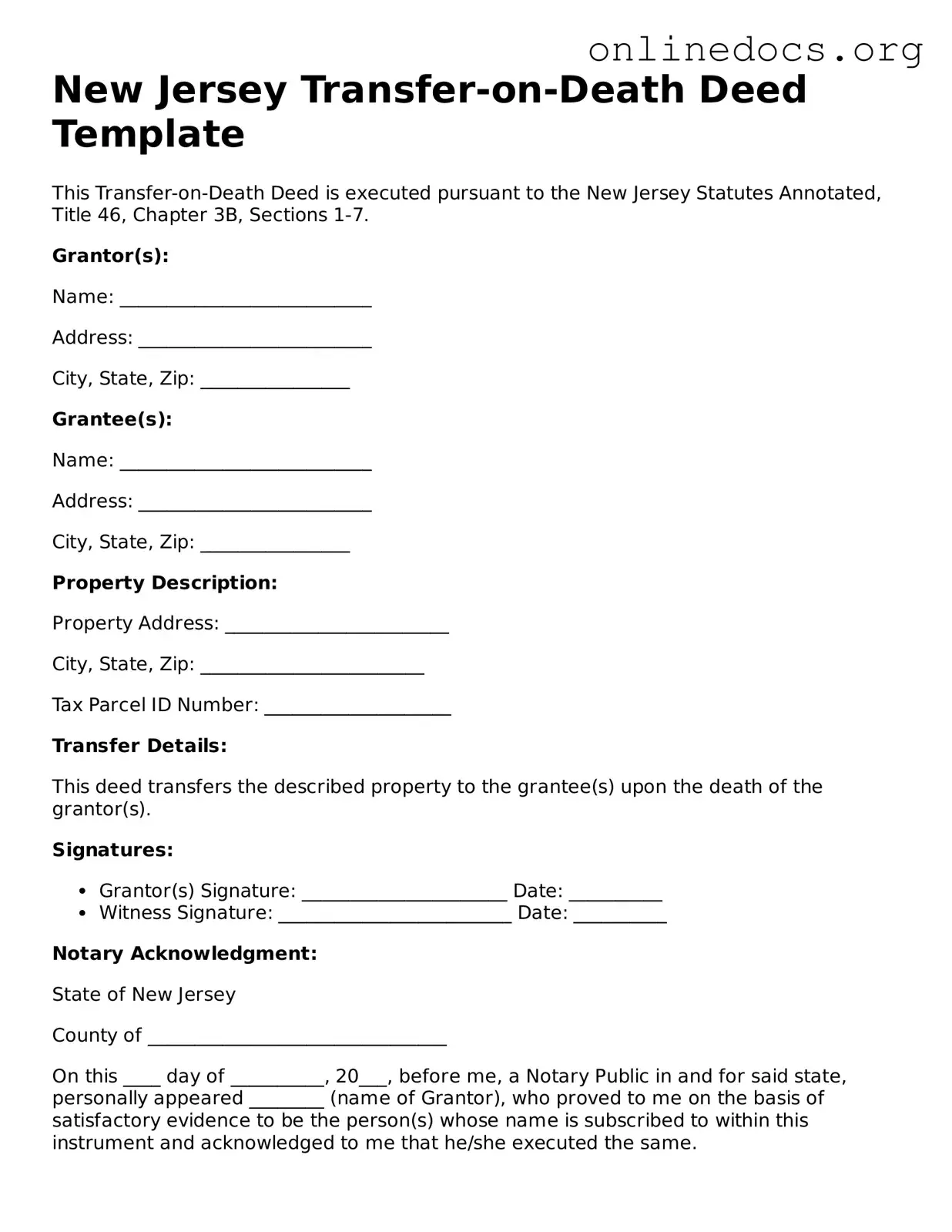

Filling out the New Jersey Transfer-on-Death Deed form can be straightforward, but many people make common mistakes that can lead to complications. One major error is failing to include all necessary information. The form requires specific details about the property, including the address and the legal description. Omitting any of this information can render the deed invalid.

Another frequent mistake involves improper signatures. All owners of the property must sign the deed. If one owner neglects to sign, the deed will not be recognized. Additionally, signatures must be notarized. Without proper notarization, the deed lacks legal validity.

Some individuals mistakenly believe that the Transfer-on-Death Deed automatically transfers property upon death. However, the deed must be recorded with the county clerk’s office to be effective. Failing to record the deed can lead to confusion and disputes among heirs.

People often overlook the importance of reviewing the form for accuracy. Typos or incorrect information can create issues down the line. A small mistake, such as misspelling a name or entering the wrong property description, can complicate the transfer process.

Another common error is not understanding the implications of the deed. Some individuals do not realize that this type of deed does not affect the property during their lifetime. It’s crucial to understand that the property remains under the control of the owner until death.

Additionally, many forget to consider the tax implications of a Transfer-on-Death Deed. While this deed avoids probate, it does not eliminate potential estate taxes. Consulting with a tax professional can help clarify any uncertainties regarding taxes and the transfer process.

Finally, people sometimes fail to communicate their intentions with family members. A lack of discussion can lead to misunderstandings and disputes after the property owner passes away. Open communication can help ensure that everyone understands the owner’s wishes and can prevent conflicts among heirs.