The New York Deed form shares similarities with a Quitclaim Deed. Both documents are used to transfer ownership of property from one party to another. However, a Quitclaim Deed does not guarantee that the person transferring the property has clear title to it. Instead, it simply conveys whatever interest the grantor has in the property, if any. This makes it a quicker, less formal option for property transfers, often used among family members or in situations where the parties know each other well.

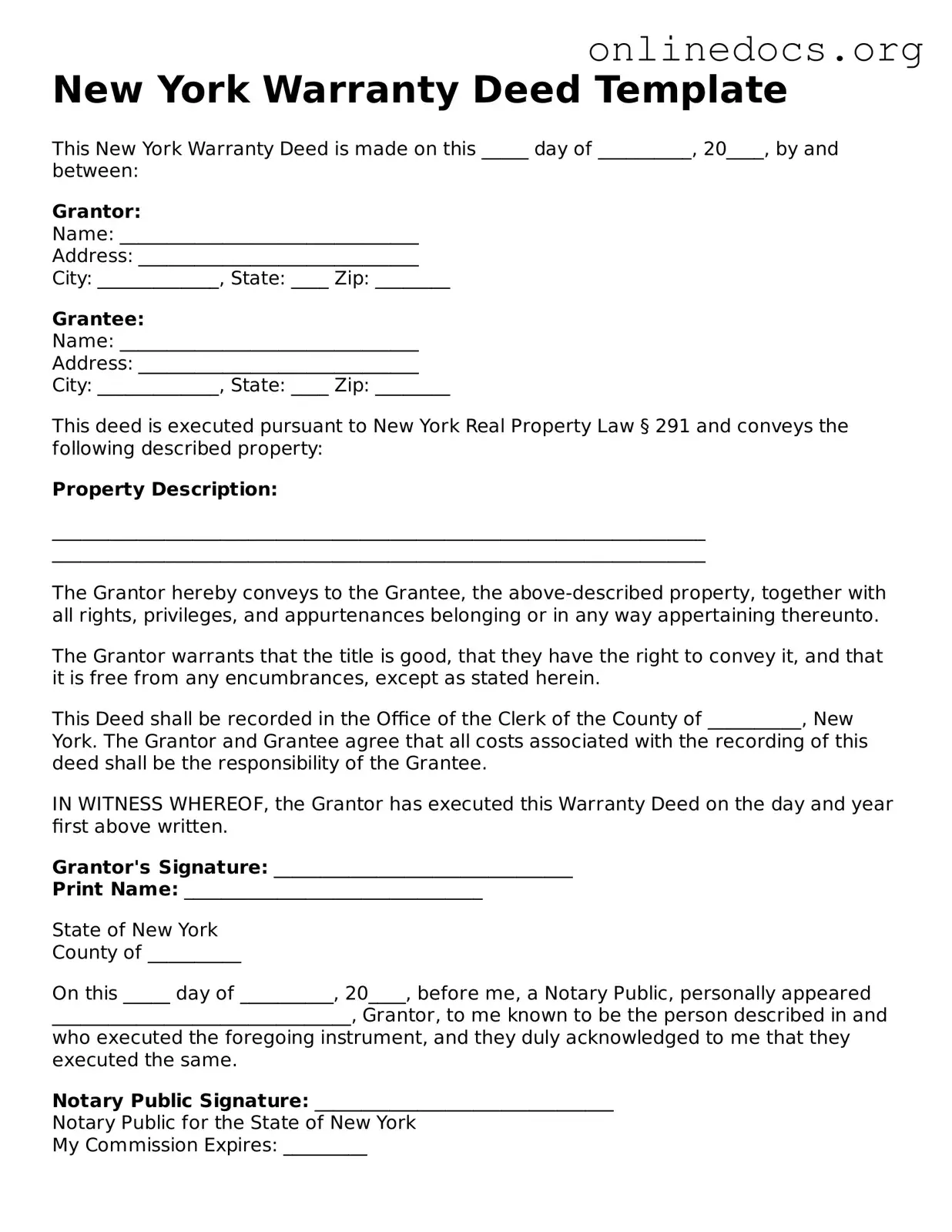

Another document similar to the New York Deed is the Warranty Deed. This type of deed provides a stronger guarantee to the buyer. The seller assures that they hold clear title to the property and have the right to sell it. If any issues arise regarding the title after the sale, the seller may be held responsible. This added layer of protection is often preferred in real estate transactions where buyers want assurance about their investment.

The Bargain and Sale Deed also resembles the New York Deed. This document transfers property ownership but does not include any warranties about the title. It is often used in transactions involving foreclosures or tax sales. While it conveys ownership, it leaves the buyer to conduct their own due diligence regarding the property's title, which can be a riskier option.

In some cases, a Special Purpose Deed may come into play. This type of deed is used for specific purposes, such as transferring property into a trust or during a divorce settlement. While it serves a unique function, it still operates on the basic principle of transferring property ownership, similar to the New York Deed.

A Deed of Trust is another document that bears resemblance to the New York Deed. This document is used primarily in some states as a way to secure a loan with real estate. It involves three parties: the borrower, the lender, and a trustee. The property is transferred to the trustee, who holds it until the loan is paid off. Although its primary purpose is different, it still involves the transfer of property rights.

The Grant Deed is also comparable to the New York Deed. This document is used to transfer property ownership and provides some assurances about the title. The grantor guarantees that the property has not been sold to anyone else and that there are no undisclosed encumbrances. This offers a bit more protection to the buyer than a Quitclaim Deed, but not as much as a Warranty Deed.

A Leasehold Deed can sometimes be confused with a traditional deed. This document grants a leasehold interest in a property rather than full ownership. While it may not transfer title outright, it does establish rights to use and occupy the property for a specified period. This can be particularly relevant in commercial real estate transactions.

When completing a transaction involving a motorcycle, it's essential to utilize the appropriate legal documents to ensure a smooth transfer of ownership. One crucial form in this process is the California Motorcycle Bill of Sale, which helps facilitate this transfer, detailing important information about the motorcycle and the parties involved. To access this form easily, you can visit fillpdf-forms.com/ for a streamlined experience in documenting your motorcycle sale.

Lastly, a Mortgage Deed is similar in that it involves real property but serves a different function. This document secures a loan by placing a lien on the property. While it does not transfer ownership, it establishes the lender's interest in the property until the debt is paid off. Understanding the distinctions among these documents can help individuals navigate property transactions more effectively.