The New York Health Care Proxy is a document that allows an individual to appoint someone to make medical decisions on their behalf if they become unable to do so. Similar to the Durable Power of Attorney, it grants authority to another person, but it is specifically focused on health care matters. This ensures that the appointed individual can make decisions regarding medical treatment, end-of-life care, and other health-related issues, reflecting the wishes of the individual who is incapacitated.

The Living Will is another important document that parallels the Durable Power of Attorney. It outlines an individual's preferences regarding medical treatment and interventions in situations where they cannot communicate their wishes. While the Durable Power of Attorney grants authority to a person to make decisions, the Living Will serves as a guide for those decisions, ensuring that the appointed agent acts in accordance with the individual's values and desires.

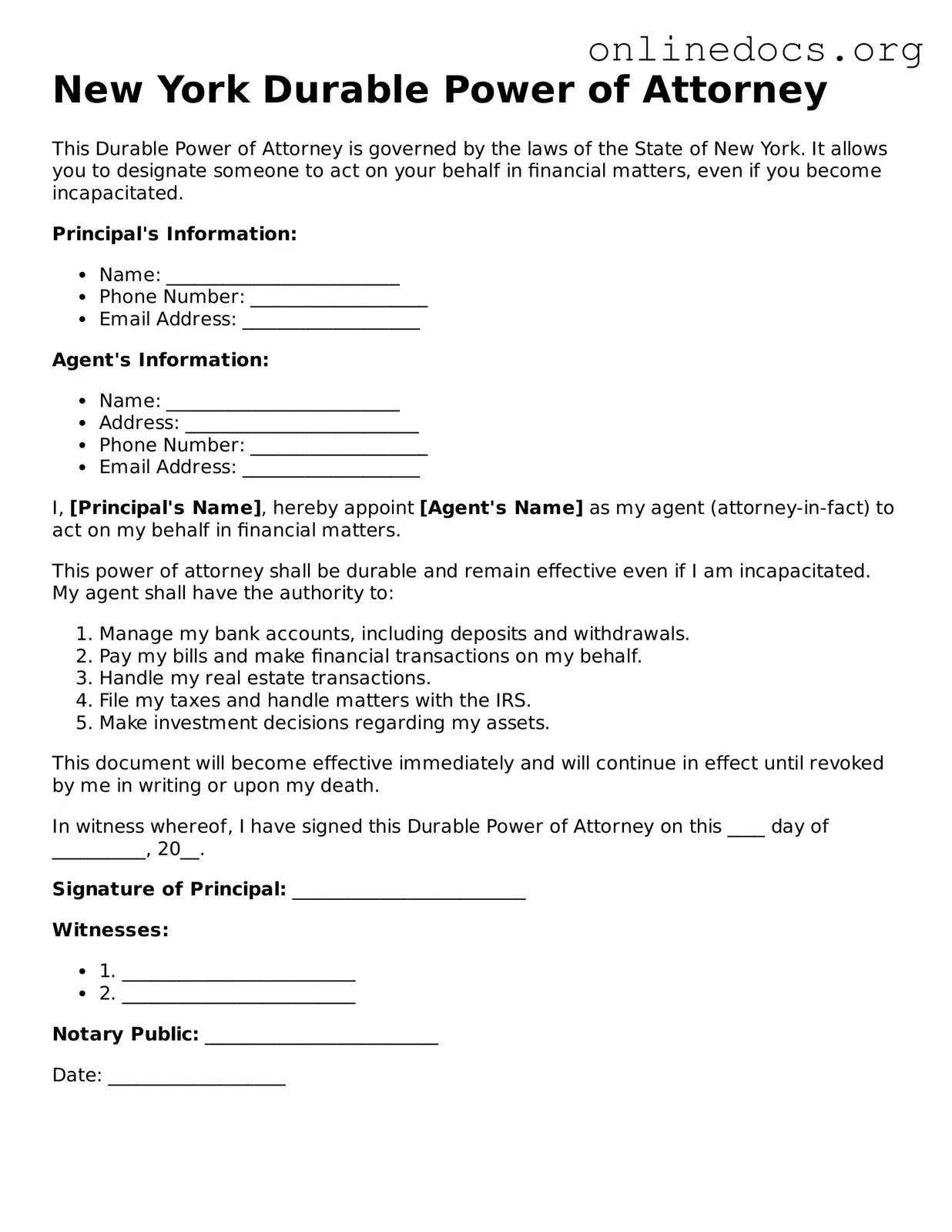

The Financial Power of Attorney is closely related to the Durable Power of Attorney but focuses specifically on financial matters. This document allows an individual to designate someone to manage their financial affairs, such as paying bills, managing investments, and handling property transactions. Like the Durable Power of Attorney, it provides a way for individuals to ensure their financial interests are protected when they are unable to manage them themselves.

The Revocable Trust is a legal arrangement that allows an individual to place their assets into a trust while retaining control over them during their lifetime. Similar to the Durable Power of Attorney, it provides a mechanism for asset management and can facilitate the distribution of assets upon death. A revocable trust can help avoid probate, making it a popular choice for individuals looking to streamline their estate planning.

To ensure a smooth rental experience, it is advisable to familiarize yourself with key rental agreements. The Lease Agreement form, for example, is vital for clarifying the expectations between landlords and tenants. For further assistance, consider reviewing the essential terms in a Lease Agreement Overview.

The Advance Directive is a broader term that encompasses both the Health Care Proxy and Living Will. It allows individuals to communicate their preferences regarding medical treatment and appoint someone to make health care decisions on their behalf. Like the Durable Power of Attorney, it ensures that an individual's wishes are respected when they are unable to voice them, providing peace of mind for both the individual and their loved ones.

The Guardianship document is another legal instrument that can be compared to the Durable Power of Attorney. It is typically used when an individual is unable to make decisions for themselves due to incapacity. A court appoints a guardian to make decisions on behalf of the individual. While the Durable Power of Attorney allows individuals to choose their representatives, guardianship is a more formal process that requires court involvement, often leading to more oversight.

The Will is a foundational estate planning document that dictates how an individual's assets will be distributed upon their death. While the Durable Power of Attorney is effective during an individual's lifetime, a Will only takes effect after death. Both documents are essential for comprehensive estate planning, ensuring that an individual's wishes are honored both during their life and after they pass away.

Lastly, the Medical Records Release form allows individuals to authorize the release of their medical information to designated parties. This document is similar to the Durable Power of Attorney in that it grants authority to another person, but it specifically pertains to access to medical records. This ensures that the appointed individual can obtain necessary health information, which can be crucial for making informed medical decisions on behalf of someone who is incapacitated.