Filling out the New York Operating Agreement form can be a complex task, and mistakes can lead to significant issues down the line. One common error is failing to clearly define the roles and responsibilities of each member. Without a detailed outline of duties, confusion can arise, leading to disputes among members regarding their obligations.

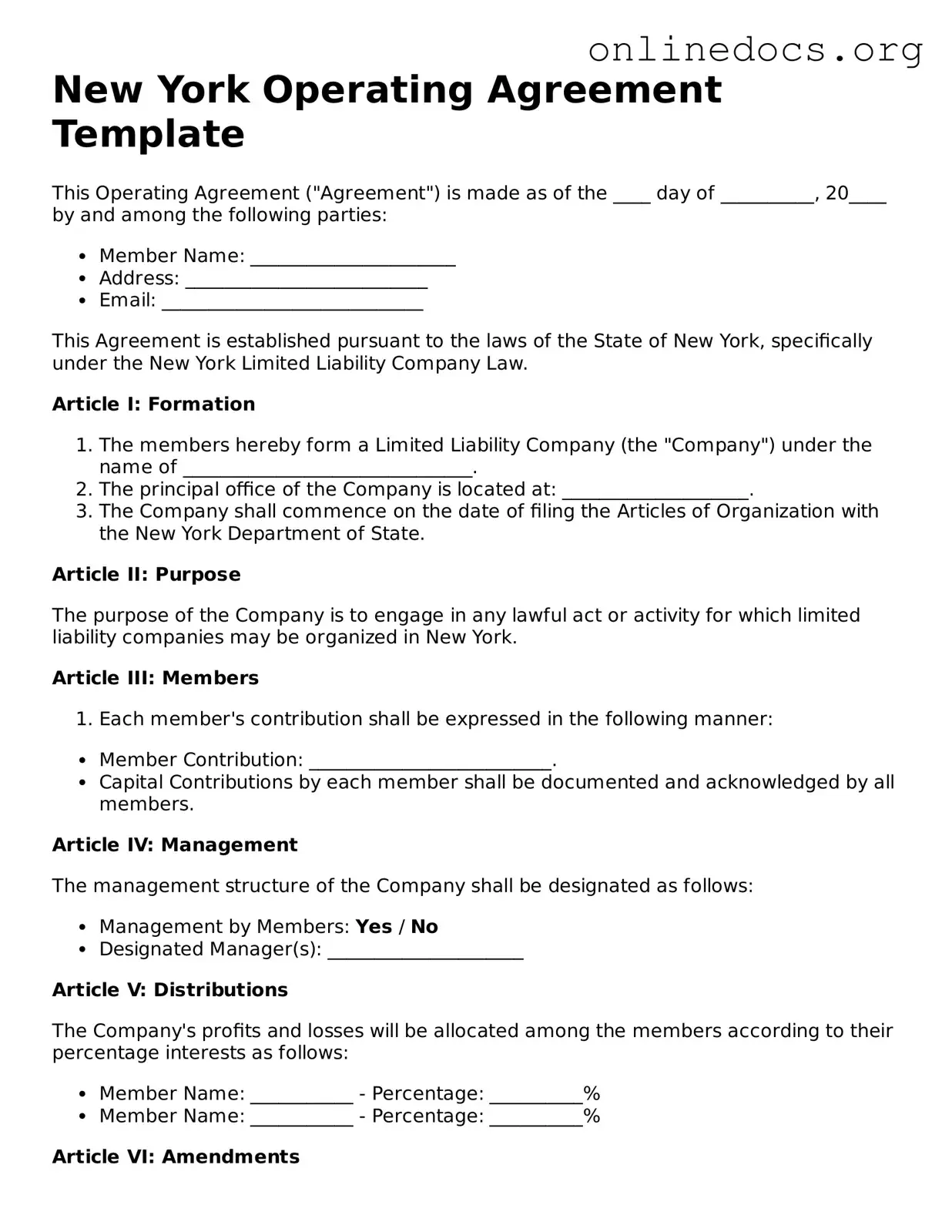

Another frequent mistake is neglecting to specify the percentage of ownership each member holds. This omission can create complications in profit distribution and decision-making processes. Clearly stating ownership percentages is essential for transparency and fairness.

Some individuals overlook the importance of including provisions for resolving disputes. Without a clear mechanism for conflict resolution, disagreements may escalate, potentially harming the business relationship. Including methods such as mediation or arbitration can provide a structured approach to handling disputes.

Inadequate attention to the voting rights of members is another common oversight. It is crucial to outline how votes will be conducted and what constitutes a majority. Failing to do so can lead to confusion during critical decision-making moments.

Many people also forget to address the procedures for adding or removing members from the agreement. This lack of clarity can create complications if a member wishes to exit the business or if new members need to be introduced. Establishing clear guidelines for membership changes is vital for maintaining stability.

Another mistake involves not detailing the process for amending the Operating Agreement. As businesses evolve, so too may the needs of the members. Without a clear amendment process, necessary changes may be difficult to implement, leading to outdated practices.

Some individuals fail to include a provision for the dissolution of the business. Planning for the potential end of the business is just as important as planning for its operation. A clear dissolution process can help protect members’ interests and facilitate a smoother transition.

Additionally, it is common for people to neglect to have the agreement reviewed by legal professionals. While it may seem like an unnecessary expense, a thorough review can help identify potential issues and ensure compliance with state laws.

Finally, many individuals do not keep a copy of the signed Operating Agreement. This oversight can lead to confusion and disputes later on. Maintaining accurate records is essential for ensuring that all members are on the same page regarding the terms of the agreement.