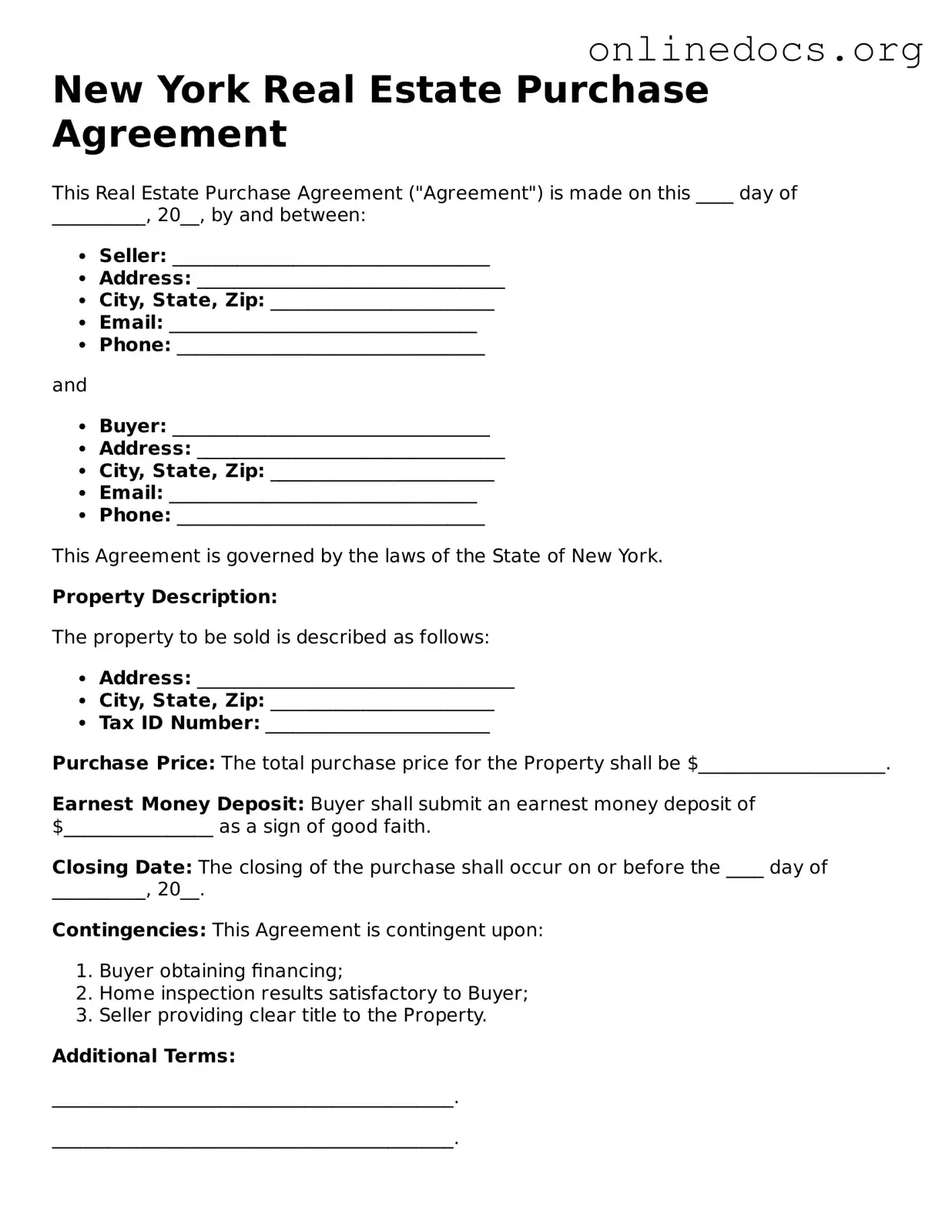

The Residential Purchase Agreement is a common document used in real estate transactions. Like the New York Real Estate Purchase Agreement, it outlines the terms of sale, including the purchase price, closing date, and contingencies. Both documents serve as a binding contract between the buyer and seller, ensuring that both parties understand their rights and obligations throughout the transaction.

The Commercial Purchase Agreement is similar in structure to the New York Real Estate Purchase Agreement but is tailored for commercial properties. It includes specific clauses related to zoning, property use, and lease agreements. Both documents aim to protect the interests of the buyer and seller while providing a clear framework for the transaction.

The Offer to Purchase is a preliminary document that expresses a buyer's intent to purchase a property. This document is similar to the New York Real Estate Purchase Agreement in that it sets forth the terms of the offer, including price and conditions. However, the Offer to Purchase is typically less detailed and may not be legally binding until the seller accepts the offer.

If you are in the process of buying or selling a vehicle, it is important to familiarize yourself with the relevant documentation. The comprehensive Motor Vehicle Bill of Sale form streamlines the transfer of ownership and ensures all essential details are recorded accurately to protect both parties involved in the transaction.

The Counteroffer is a response to an initial Offer to Purchase. It modifies the terms proposed by the buyer, similar to how the New York Real Estate Purchase Agreement can be negotiated. Both documents reflect the ongoing negotiation process between the buyer and seller until an agreement is reached.

The Lease Agreement is another relevant document, particularly for rental properties. While it serves a different purpose, it shares similarities with the New York Real Estate Purchase Agreement in that it outlines the terms of use for a property. Both documents detail the responsibilities of each party, including payment terms and maintenance obligations.

The Seller's Disclosure Statement is a document that sellers provide to disclose any known issues with the property. This document complements the New York Real Estate Purchase Agreement by ensuring that buyers are informed of potential problems before finalizing the sale. Both documents aim to promote transparency and protect the interests of the buyer.

The Title Report is a crucial document in real estate transactions. It provides information about the property's ownership and any liens or encumbrances. Similar to the New York Real Estate Purchase Agreement, it plays a vital role in ensuring that the buyer is aware of any issues that could affect their ownership rights.

The Closing Statement, also known as the HUD-1 Settlement Statement, summarizes the final financial details of the transaction. It is similar to the New York Real Estate Purchase Agreement in that it outlines costs and fees associated with the sale. Both documents ensure that all parties are aware of the financial obligations before the transaction is finalized.

The Escrow Agreement outlines the terms under which funds and documents are held by a third party during the transaction. Like the New York Real Estate Purchase Agreement, it serves to protect the interests of both the buyer and seller until all conditions of the sale are met. Both documents are essential for a smooth closing process.

The Property Management Agreement is used when a property owner hires a management company to oversee rental properties. This document shares similarities with the New York Real Estate Purchase Agreement in that it defines the responsibilities and obligations of both parties. Both agreements aim to clarify expectations and ensure effective property management.