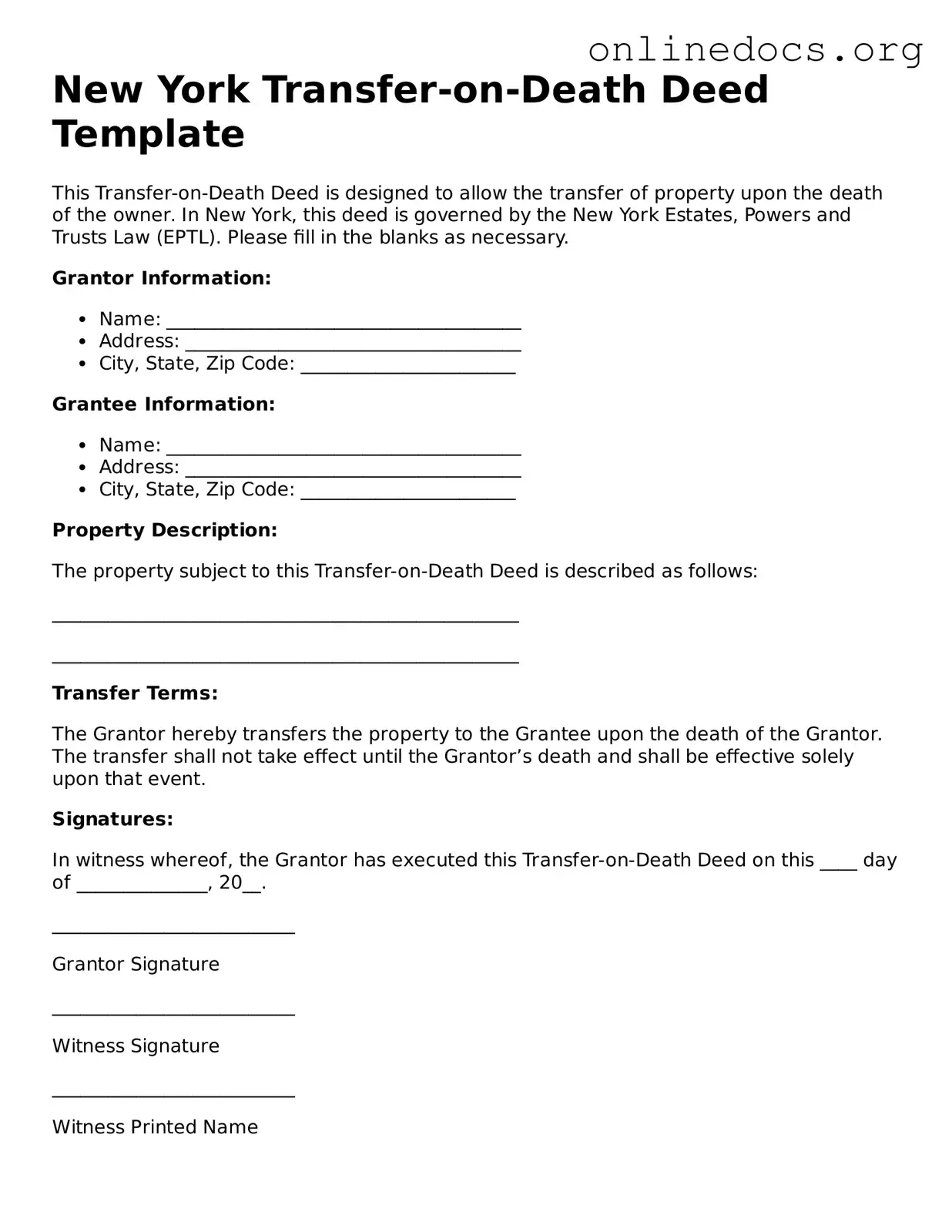

Filling out the New York Transfer-on-Death Deed form is an important step for individuals looking to transfer property upon their passing. However, many people encounter pitfalls that can complicate this process. One common mistake is failing to include all required information. Each section of the form must be completed accurately to ensure the deed is valid. Omitting essential details can lead to delays or even the invalidation of the deed.

Another frequent error involves the designation of beneficiaries. Individuals sometimes name more than one beneficiary without clearly specifying how the property should be divided. This can create confusion and disputes among heirs. It is crucial to outline the intended distribution clearly, whether it is equal shares or specific percentages.

Additionally, many people overlook the importance of proper notarization. The Transfer-on-Death Deed must be signed in the presence of a notary public. Failing to do so renders the document ineffective. It is advisable to double-check that the notary has completed their part before submitting the form.

Some individuals mistakenly believe that simply filling out the form is sufficient for the deed to take effect. However, the deed must be recorded with the county clerk’s office where the property is located. Neglecting this step can result in the deed not being recognized, leaving the property subject to probate.

Another error involves the use of outdated forms. Laws and regulations can change, and using an obsolete version of the Transfer-on-Death Deed form may lead to complications. Always ensure that the most current form is being used to avoid any legal issues.

People also sometimes misinterpret the implications of the deed. A Transfer-on-Death Deed does not remove the property from the owner’s estate during their lifetime. Understanding this distinction is vital to avoid misunderstandings regarding estate planning and tax implications.

Lastly, neglecting to communicate intentions with beneficiaries can lead to significant problems. It is essential to discuss the deed with those named, ensuring they understand their future responsibilities and rights. Open communication can prevent disputes and foster a smoother transition of property ownership.