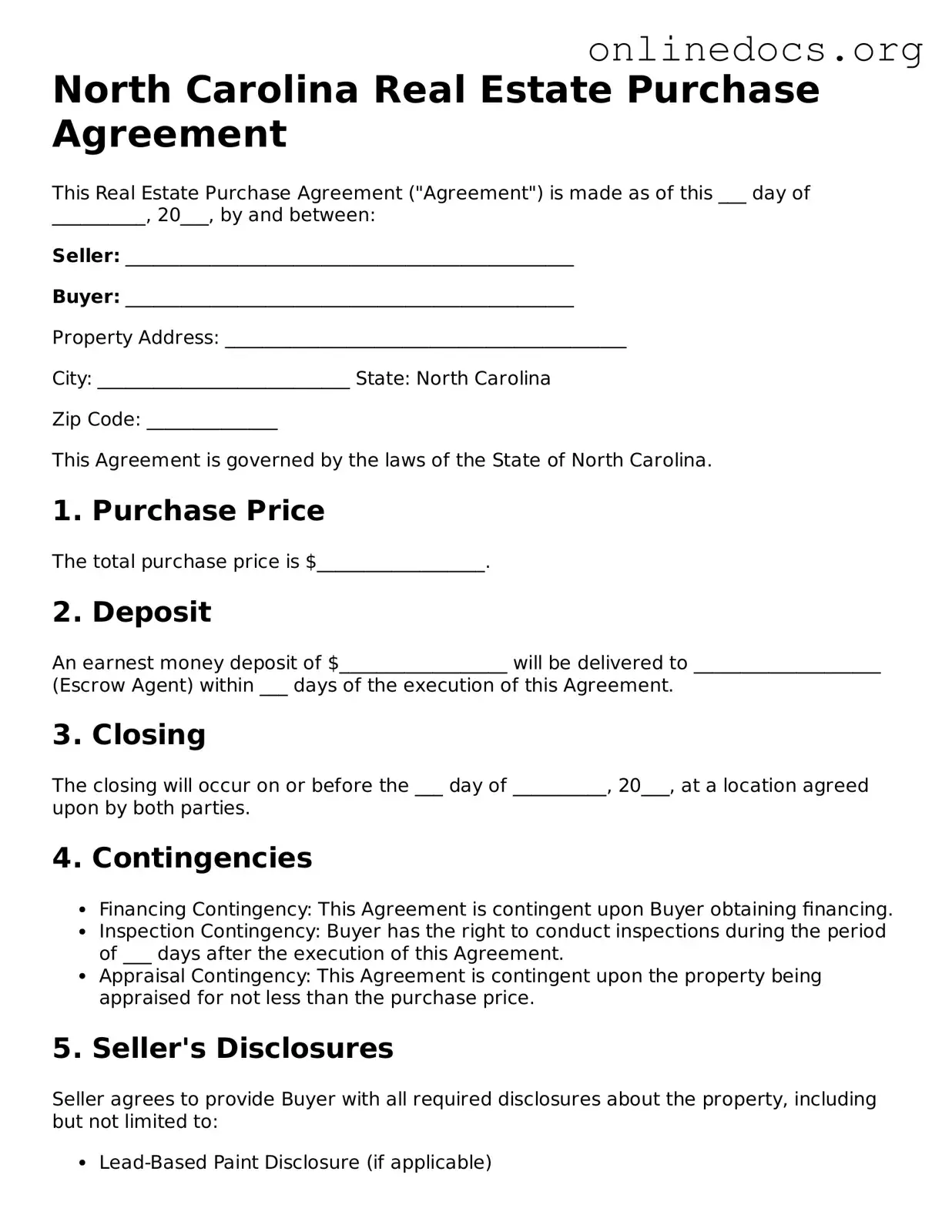

The North Carolina Real Estate Purchase Agreement form shares similarities with the Residential Purchase Agreement commonly used in many states. Both documents outline the terms and conditions under which a buyer agrees to purchase a property from a seller. They typically include essential details such as the purchase price, property description, and contingencies that must be met before the sale can be finalized. Each agreement aims to protect the interests of both parties while providing a clear framework for the transaction.

Another document that resembles the North Carolina Real Estate Purchase Agreement is the Offer to Purchase and Contract, often used in real estate transactions. This document serves as a formal offer from the buyer to the seller, indicating the buyer's intent to purchase the property. Like the North Carolina agreement, it includes terms such as the sale price, earnest money deposit, and conditions for closing. The Offer to Purchase and Contract is a critical step in the buying process, as it lays the groundwork for negotiations and final agreements.

The Commercial Purchase Agreement is another document that aligns closely with the North Carolina Real Estate Purchase Agreement, particularly in the context of commercial properties. This agreement encompasses similar elements, such as purchase price, property description, and contingencies, but it often includes additional considerations relevant to commercial transactions, like zoning laws and lease agreements. Both documents aim to facilitate a smooth transaction while addressing the specific needs of the buyer and seller.

To ensure your protection during activities, consider utilizing a comprehensive Release of Liability form. This document serves to safeguard you from potential claims related to injuries or damages, providing peace of mind as you participate in various events.

In addition, the Land Contract, also known as a Contract for Deed, bears resemblance to the North Carolina Real Estate Purchase Agreement. This document allows the buyer to make payments directly to the seller over time, rather than obtaining traditional financing. While it includes many of the same elements as a purchase agreement, the Land Contract emphasizes the payment structure and the transfer of ownership rights only after the full purchase price has been paid. This arrangement can be beneficial for buyers who may not qualify for conventional loans.

Lastly, the Lease Purchase Agreement is another document that shares key features with the North Carolina Real Estate Purchase Agreement. This agreement allows a tenant to lease a property with the option to purchase it at a later date. Like the purchase agreement, it outlines terms such as the purchase price and any contingencies. The Lease Purchase Agreement provides flexibility for buyers who may need time to secure financing or improve their credit while still locking in a future purchase.