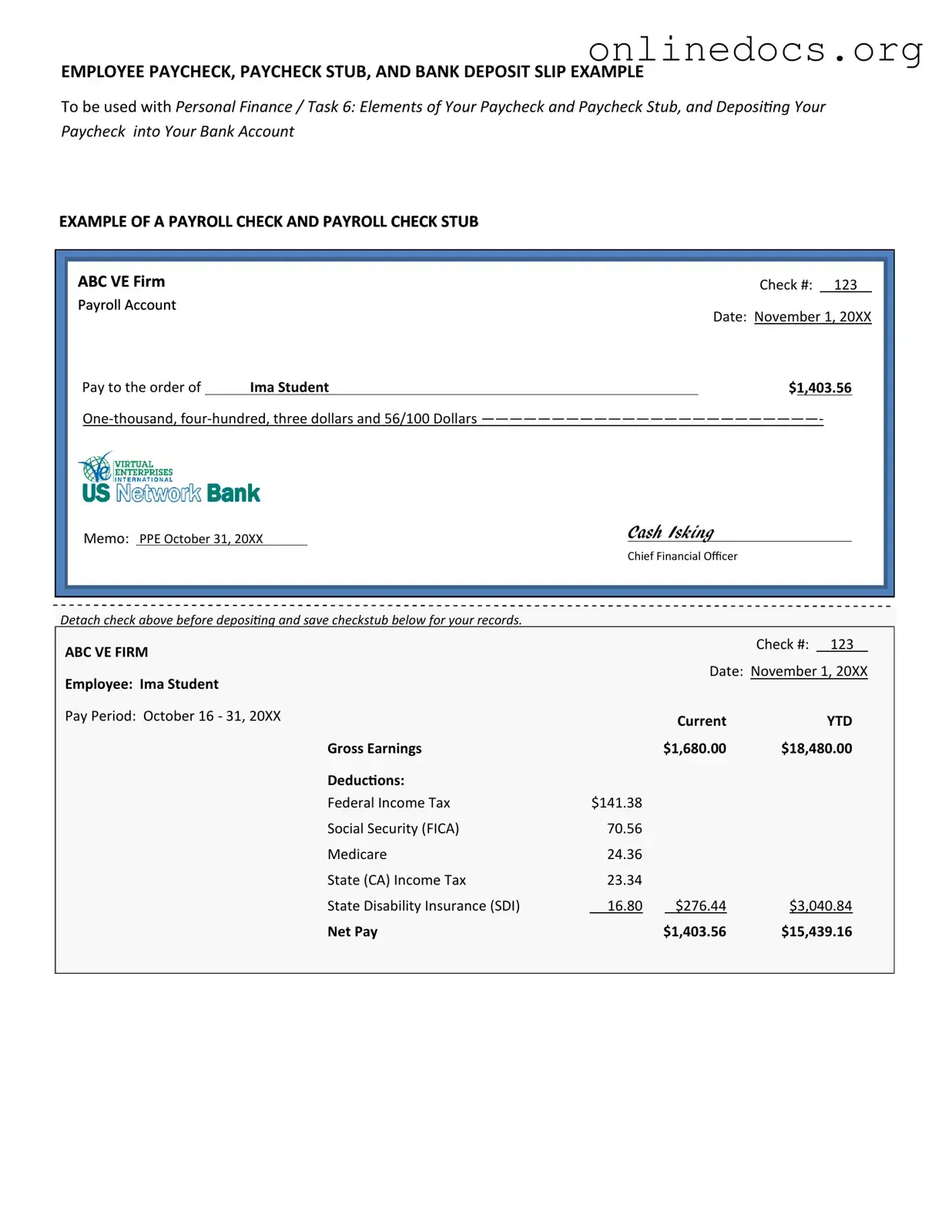

The payroll check form serves a critical function in the payment process for employees. A similar document is the pay stub. A pay stub provides a detailed breakdown of an employee's earnings for a specific pay period, including gross pay, deductions, and net pay. While the payroll check form is the actual payment instrument, the pay stub offers transparency and clarity regarding how the payment was calculated.

Another related document is the direct deposit authorization form. This form allows employees to authorize their employer to deposit their paycheck directly into their bank account. Like the payroll check form, it is essential for ensuring that employees receive their compensation in a timely manner, but it eliminates the need for physical checks.

To further streamline your job application process, you can access the Chick Fil A Job Application form through this link: fillpdf-forms.com/. This resource is designed to assist you in efficiently completing your application and ensuring all necessary information is accurately provided.

The W-2 form is also closely associated with the payroll check process. This document summarizes an employee's annual earnings and the taxes withheld. While the payroll check form deals with individual pay periods, the W-2 provides a comprehensive view of an employee's earnings over the entire year, making it crucial for tax filing purposes.

Similarly, the 1099 form is relevant for independent contractors. This form reports payments made to individuals who are not classified as employees. It differs from the payroll check form in that it pertains to non-employee compensation, but both documents are vital for tax reporting and compliance.

The employee timesheet is another document that aligns with the payroll check form. Timesheets track the hours worked by employees, which directly impacts their pay. While the payroll check form is the result of this tracking, the timesheet serves as the foundational record that determines how much an employee will earn.

Payroll registers are also similar in nature. A payroll register is a detailed record of all payroll transactions for a specific pay period. It includes information such as employee names, hours worked, and total pay. The payroll check form is derived from this register, making it an essential component of the payroll process.

The employment contract is another important document. It outlines the terms of employment, including salary and payment frequency. While the payroll check form executes the payment, the employment contract establishes the agreement under which that payment is made, ensuring both parties understand their obligations.

The tax withholding form, such as the W-4, is also significant. This form allows employees to specify how much tax should be withheld from their paychecks. It directly influences the amount reflected on the payroll check form, as accurate withholding ensures compliance with tax laws and prevents underpayment or overpayment of taxes.

Another document that is similar is the benefits enrollment form. This form allows employees to select their benefits, such as health insurance and retirement plans. The deductions from these benefits are reflected on the payroll check form, making it essential for understanding the net pay an employee receives.

Lastly, the garnishment order is relevant. This legal document instructs an employer to withhold a portion of an employee's earnings to satisfy a debt. While the payroll check form is the means of payment, the garnishment order directly affects the amount an employee receives, highlighting the interplay between various payroll-related documents.