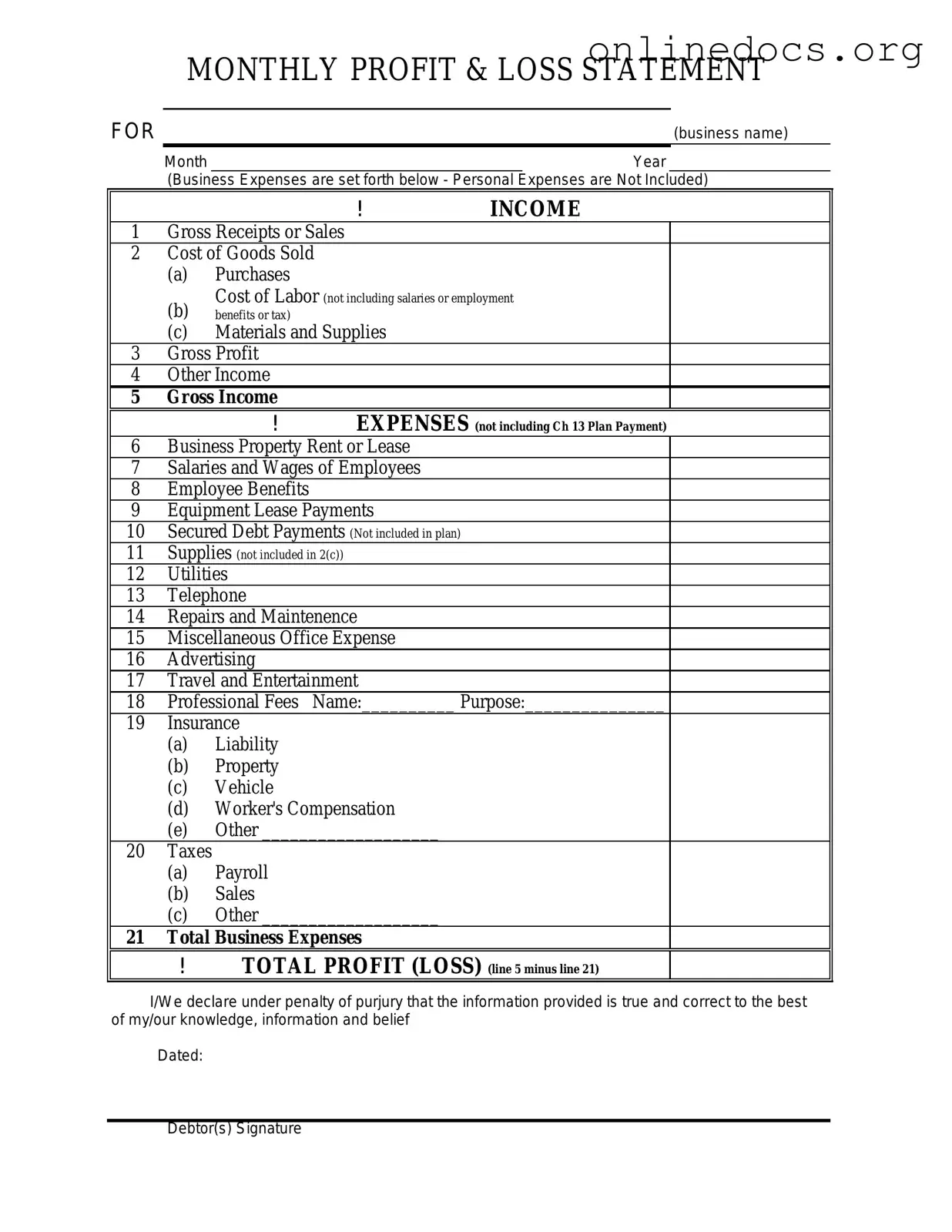

The Profit and Loss (P&L) statement, also known as the income statement, shares similarities with the Balance Sheet. Both documents provide insights into a company's financial health, but they do so from different perspectives. The Balance Sheet presents a snapshot of a company's assets, liabilities, and equity at a specific point in time, while the P&L summarizes revenues and expenses over a period. Together, these documents help stakeholders assess profitability and financial stability.

The Cash Flow Statement is another document closely related to the Profit and Loss form. While the P&L focuses on revenues and expenses, the Cash Flow Statement tracks the inflow and outflow of cash within a business. It categorizes cash flows into operating, investing, and financing activities. By analyzing both documents, stakeholders can understand how operational performance translates into cash generation or consumption.

The Statement of Retained Earnings also shares a connection with the Profit and Loss statement. The P&L indicates net income or loss for a specific period, which directly impacts retained earnings. This statement outlines changes in retained earnings, including adjustments for dividends paid and the net income from the P&L. It provides a clearer picture of how profits are reinvested in the business or distributed to shareholders.

The Budget is another relevant document that complements the Profit and Loss form. While the P&L reflects actual financial performance, the Budget serves as a financial plan for future periods. It outlines projected revenues and expenses, allowing businesses to set targets and monitor performance against those goals. Comparing actual results from the P&L with the Budget can help identify variances and inform strategic decision-making.

In addition to financial documents, understanding leasing procedures is vital for both landlords and potential tenants. One essential resource in this process is the Rental Application form, which collects important details that help ensure a smooth rental experience for all parties involved.

Lastly, the Financial Forecast serves as a forward-looking counterpart to the Profit and Loss statement. While the P&L reports historical performance, the Financial Forecast estimates future revenues and expenses based on various assumptions. This document is crucial for strategic planning and can help businesses anticipate financial outcomes, manage resources effectively, and attract investors.