A loan agreement is a document that outlines the terms and conditions under which one party borrows money from another. Like a promissory note for a car, it includes details such as the loan amount, interest rate, repayment schedule, and consequences for default. Both documents serve as a legal commitment to repay borrowed funds, providing security for the lender while establishing clear expectations for the borrower.

A mortgage agreement is similar to a promissory note in that it is a legally binding document that outlines the terms of a loan secured by real property. While a promissory note for a car pertains to vehicle financing, a mortgage agreement involves real estate. Both documents include payment terms, interest rates, and consequences for non-payment, ensuring that lenders have recourse in case of default.

An installment agreement is another document that shares similarities with a promissory note. This type of agreement outlines the terms for repaying a debt in regular installments over time. Like a promissory note for a car, it specifies the total amount owed, payment schedule, and interest rates. Both documents aim to clarify the obligations of the borrower and the rights of the lender.

A personal loan agreement is akin to a promissory note as it formalizes the borrowing of money for personal use. This document details the loan amount, interest rate, repayment terms, and any collateral involved. Just as with a car promissory note, the personal loan agreement serves as a record of the borrower's commitment to repay the loan under specified conditions.

A lease agreement, particularly for vehicles, is similar to a promissory note in that it outlines the terms under which one party can use property owned by another. While a promissory note involves financing a purchase, a lease agreement typically involves renting a vehicle. Both documents specify payment amounts, duration, and responsibilities, ensuring clarity in the financial relationship.

A credit agreement is another document that resembles a promissory note. It establishes the terms under which credit is extended to a borrower. This document includes the credit limit, interest rates, and repayment terms. Like a car promissory note, it serves to protect the lender's interests while detailing the obligations of the borrower.

An unsecured loan agreement is similar in function to a promissory note, as it outlines the terms of a loan not backed by collateral. This document specifies the loan amount, interest rate, and repayment schedule. Both agreements are legally binding and provide a framework for the lender to recover funds in case of default.

A business loan agreement also shares characteristics with a promissory note. It details the terms under which a business borrows money, including loan amount, interest rates, and repayment terms. Like a car promissory note, it serves as a formal record of the debt and the obligations of the borrower, ensuring that both parties understand their rights and responsibilities.

A student loan agreement is another document that is similar to a promissory note. It outlines the terms of a loan taken out to finance education, detailing the amount borrowed, interest rate, and repayment schedule. Both types of documents serve to formalize the borrowing process and establish the obligations of the borrower to repay the funds according to specified terms.

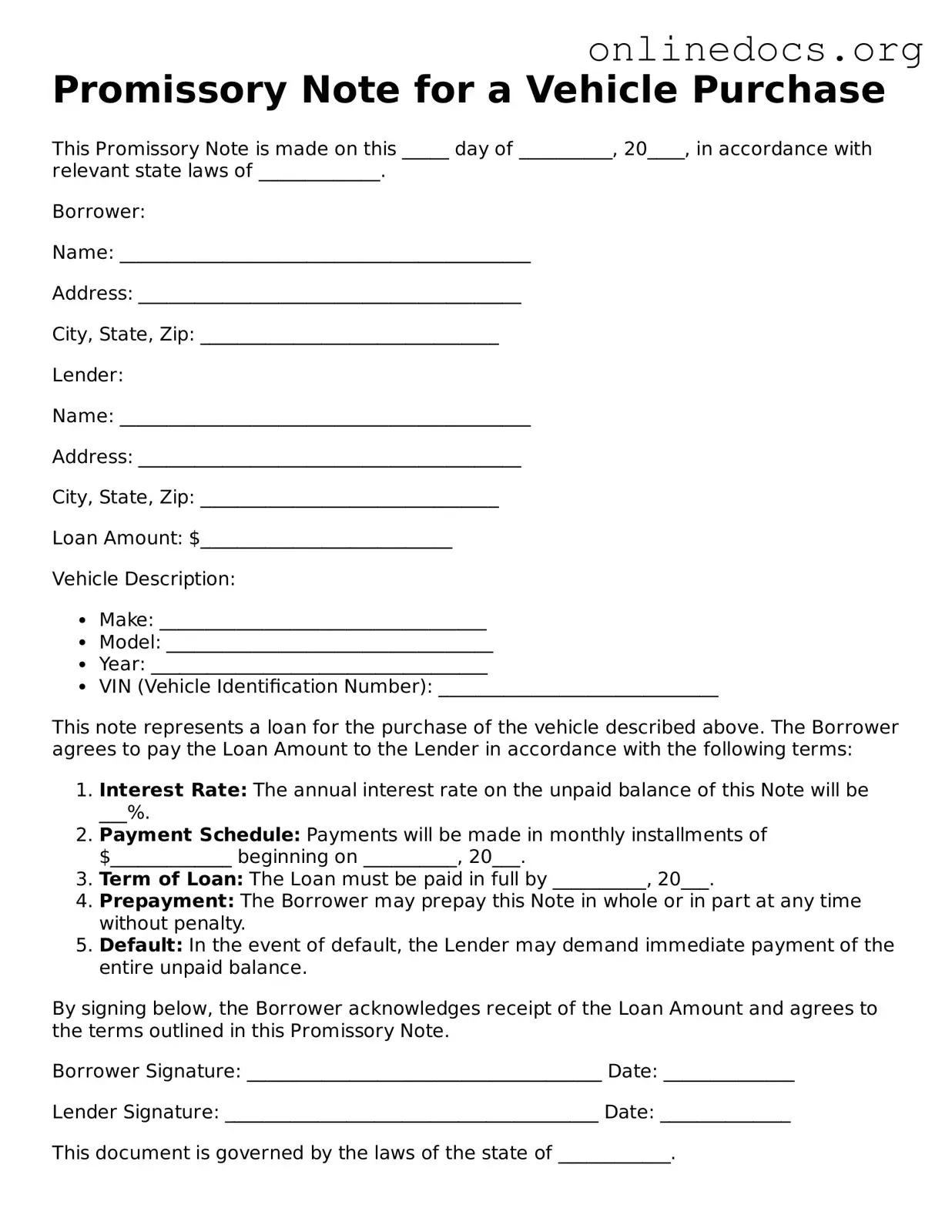

For those looking to understand the ins and outs of a customizable Promissory Note template, it's essential to examine its specific features and uses in various financial transactions. This template can help streamline the lending process and ensure that all parties are aligned on the loan's terms.

A debt settlement agreement is also comparable to a promissory note. This document outlines the terms under which a borrower agrees to pay a reduced amount to settle a debt. While it differs in purpose, both documents involve a commitment to repay funds, detailing the amount owed and the terms of repayment. Each serves to protect the interests of the lender while providing a clear framework for the borrower.