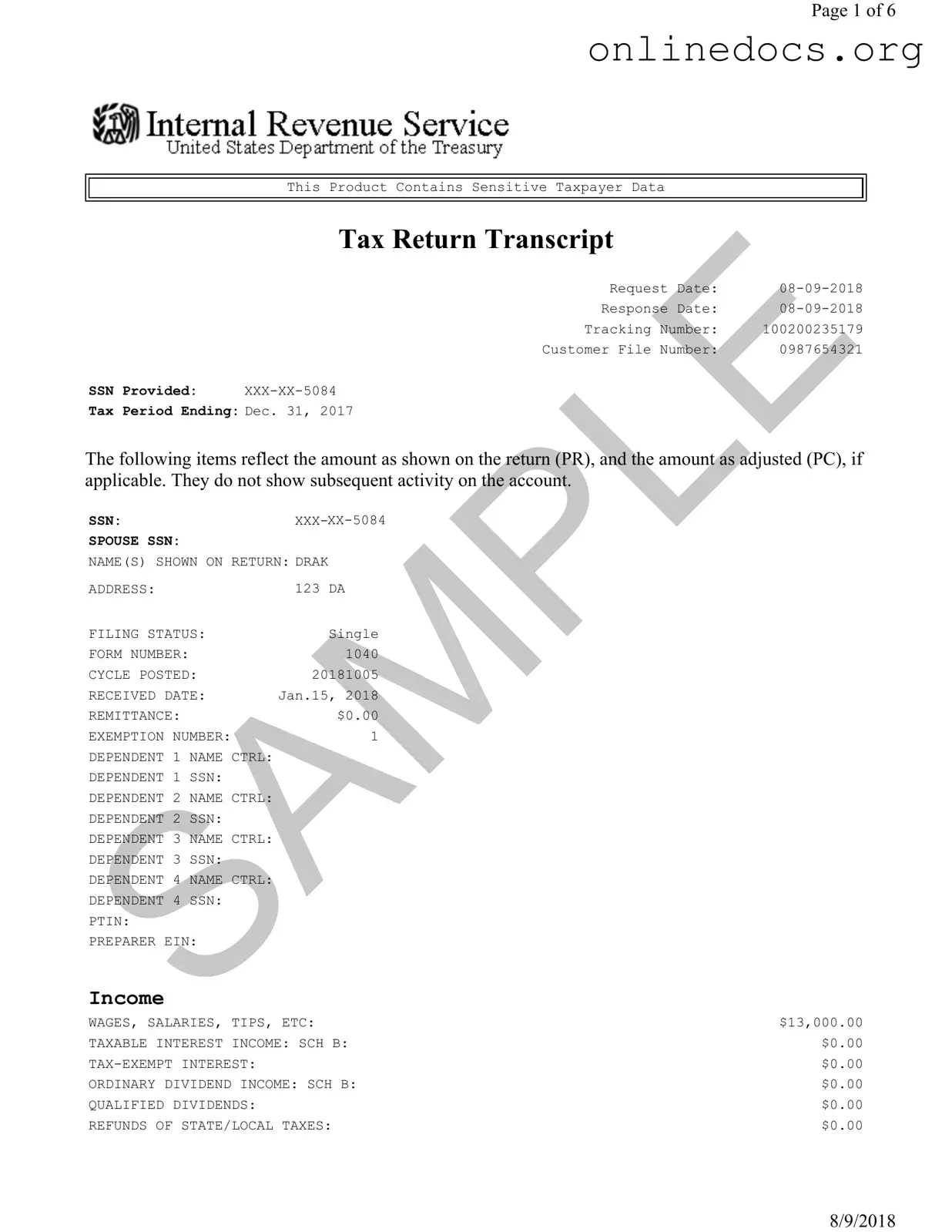

The Sample Tax Return Transcript is quite similar to the IRS Form 1040, which is the standard individual income tax return form used by U.S. taxpayers. Both documents provide a comprehensive summary of an individual's financial situation for a specific tax year. They detail income sources, deductions, and credits, allowing taxpayers to understand their tax obligations. The Form 1040 is the original document filed by the taxpayer, while the transcript serves as a summary that reflects the information as reported to the IRS.

Another document that shares similarities is the IRS Form 1040A. This form is a simplified version of the 1040, designed for taxpayers with straightforward financial situations. Like the Sample Tax Return Transcript, it summarizes income, deductions, and credits, but it has fewer lines and is easier to complete. Both forms aim to provide a clear picture of an individual's tax obligations, making it easier for taxpayers to understand their financial responsibilities.

The IRS Form 1040EZ is another closely related document. This is the simplest of the three forms, intended for single or married taxpayers with no dependents and a limited income. The Sample Tax Return Transcript and the 1040EZ both serve to summarize tax information in a straightforward manner. They highlight key income figures and tax liabilities, making it easy for taxpayers to grasp their financial standing quickly.

Next, the IRS Form W-2 is a document that employers send to their employees, detailing the amount of money earned and the taxes withheld during the year. While the Sample Tax Return Transcript summarizes the overall tax situation, the W-2 provides specific income information from an employer. Both documents are crucial for completing tax returns, as they reflect income and tax withholdings that impact the final tax obligation.

The IRS Form 1099 is another important document that relates to the Sample Tax Return Transcript. This form is used to report various types of income other than wages, salaries, and tips. Freelancers and independent contractors commonly receive 1099s for their work. Both the 1099 and the tax return transcript provide insight into an individual's income sources, helping to ensure that all income is reported accurately for tax purposes.

The California Boat Bill of Sale form is an essential tool for anyone engaged in the buying or selling of a boat in California, as it acts as an official record of the transaction. This document plays a vital role in safeguarding the interests of both the buyer and the seller, providing clarity and legal protection in the agreement. To facilitate this process, you can find a useful resource at All Templates PDF, which offers templates to streamline the completion of this crucial form.

Lastly, the IRS Form 4506-T is a request for a transcript of a tax return, which is similar to the Sample Tax Return Transcript in that it allows taxpayers to obtain their tax information from the IRS. While the transcript provides a summary, Form 4506-T is a tool for requesting that summary. Both documents facilitate access to important tax information, ensuring that taxpayers can verify their financial details when needed.