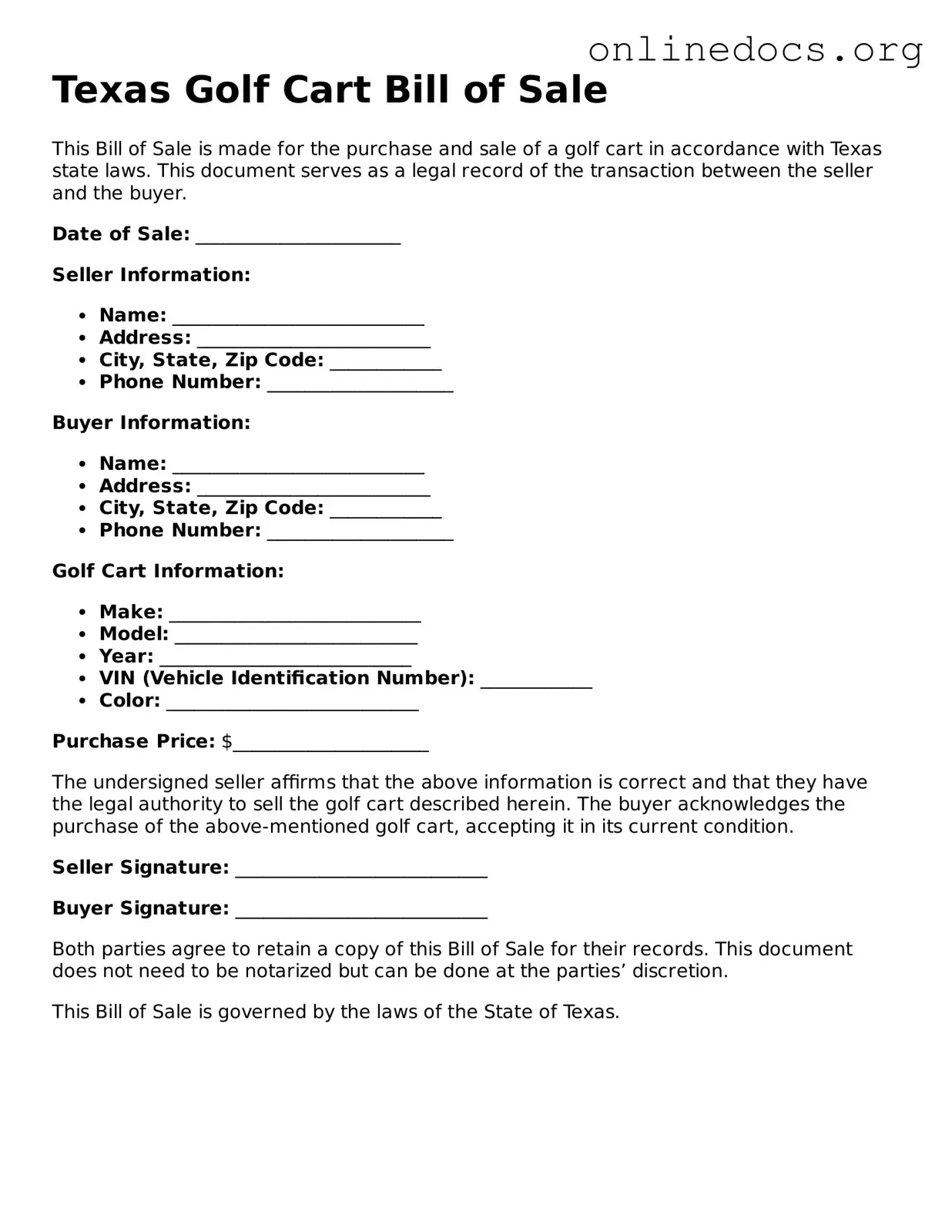

When filling out the Texas Golf Cart Bill of Sale form, individuals often overlook critical details that can lead to complications later on. One common mistake is failing to provide accurate information about the golf cart itself. This includes the make, model, year, and vehicle identification number (VIN). Missing or incorrect details can cause issues with registration and ownership verification.

Another frequent error is neglecting to include the seller’s and buyer’s full names and addresses. This information is essential for establishing a clear record of the transaction. Without complete contact details, future correspondence regarding the sale may become problematic, especially if disputes arise.

Many people also forget to specify the sale price. This is a crucial component of the bill of sale, as it serves as proof of the transaction. Leaving this section blank or entering an incorrect amount can lead to misunderstandings or complications when it comes to taxes or registration.

Additionally, individuals may not date the document properly. Including the date of the transaction is vital for legal purposes. It helps establish when the sale occurred and can be important for record-keeping and tax reasons. An undated form can lead to confusion about the timeline of ownership.

Another mistake is not having both parties sign the document. A bill of sale is only valid when it is signed by both the seller and the buyer. This signature serves as a confirmation of the agreement and protects both parties in case of future disputes. Failing to secure signatures can render the document ineffective.

Lastly, some individuals overlook the need for a witness or notarization. While not always required, having a witness or a notary public can add an extra layer of legitimacy to the transaction. This can be especially important if the sale is contested later on. Ensuring all necessary signatures and validations are in place can save time and trouble in the future.