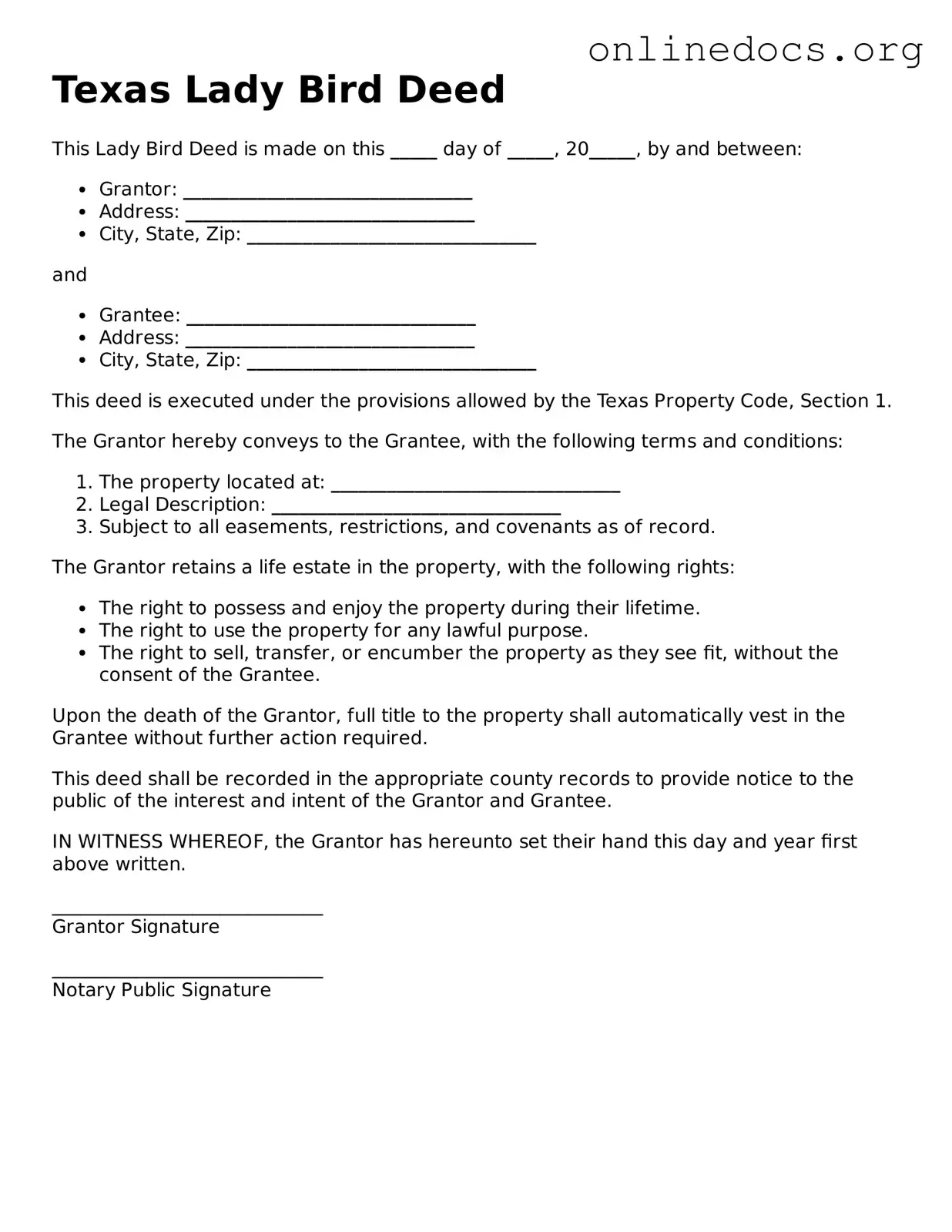

The Lady Bird Deed, also known as an enhanced life estate deed, allows property owners in Texas to transfer real estate while retaining certain rights during their lifetime. This deed is similar to a traditional life estate deed, which also grants the owner the right to live on and use the property until death. However, with a traditional life estate deed, the owner cannot sell or mortgage the property without the consent of the remaindermen, those who will inherit the property after the owner passes. In contrast, the Lady Bird Deed provides more flexibility, allowing the owner to sell or encumber the property without needing permission from anyone else.

In the landscape of property transactions, understanding the various legal documents like the Colorado Bill of Sale form is essential for ensuring clarity and security in ownership transfers. For those looking to streamline their transactions further, resources such as All Colorado Forms provide valuable templates and information to facilitate the process and protect all parties involved.

A quitclaim deed is another document that shares similarities with the Lady Bird Deed. This type of deed transfers whatever interest the grantor has in the property to the grantee without any warranties. While a quitclaim deed can be used for various purposes, it does not provide the same lifetime rights or retainment of control as a Lady Bird Deed. The Lady Bird Deed is more comprehensive, as it allows the original owner to maintain their rights while transferring future interests.

The warranty deed is also comparable to the Lady Bird Deed. A warranty deed provides a guarantee that the property title is clear of any claims or encumbrances. Unlike the Lady Bird Deed, which allows the owner to maintain control over the property during their lifetime, a warranty deed typically transfers full ownership and rights immediately. This means the new owner can do as they please with the property, while the original owner loses all rights upon transfer.

The general power of attorney can also be likened to the Lady Bird Deed in terms of granting rights. A general power of attorney allows one person to act on behalf of another in various legal and financial matters, including property transactions. However, this document does not transfer ownership or rights to the property itself, whereas the Lady Bird Deed effectively transfers future interests while allowing the original owner to retain control during their life.

The special warranty deed is another document that bears resemblance to the Lady Bird Deed. This type of deed guarantees that the grantor holds title to the property and has the right to convey it, but only for the period they owned it. While a special warranty deed limits the grantor's liability for any issues that arose before their ownership, the Lady Bird Deed allows for ongoing control and use of the property by the original owner, making it a more advantageous option for retaining rights.

A revocable living trust is similar in that it allows for the management and transfer of property during and after the owner's lifetime. The trust can hold property and provide instructions for its distribution upon death, much like the Lady Bird Deed. However, a Lady Bird Deed allows for more straightforward control over the property while the owner is alive, whereas a trust may involve more complex management and administration.

The life estate with remainder deed is another document that resembles the Lady Bird Deed. This deed creates a life estate for one party while designating another party as the remainderman who will inherit the property upon the death of the life tenant. However, the Lady Bird Deed allows for greater flexibility, permitting the owner to sell or mortgage the property without needing consent from the remainderman, which is not the case with a traditional life estate with remainder deed.

A mortgage can also be compared to the Lady Bird Deed in terms of property rights. A mortgage allows a property owner to borrow money using the property as collateral. While a mortgage does not transfer ownership, it does create a financial interest in the property. The Lady Bird Deed, on the other hand, allows the owner to retain control and rights while also enabling them to manage their property as they see fit, including obtaining financing.

Lastly, a deed in lieu of foreclosure is somewhat similar to the Lady Bird Deed in that it involves transferring property ownership. This document allows a homeowner facing foreclosure to voluntarily transfer the property to the lender to avoid the foreclosure process. While both documents involve transferring rights, the Lady Bird Deed focuses on retaining rights during the owner's lifetime, while a deed in lieu of foreclosure results in an immediate loss of ownership and control over the property.