Filling out a Last Will and Testament in Texas can be straightforward, but many people make common mistakes that can lead to complications later. One frequent error is not properly identifying the beneficiaries. It’s essential to clearly state who will inherit your assets. If names are misspelled or relationships are unclear, this can create confusion and disputes among family members.

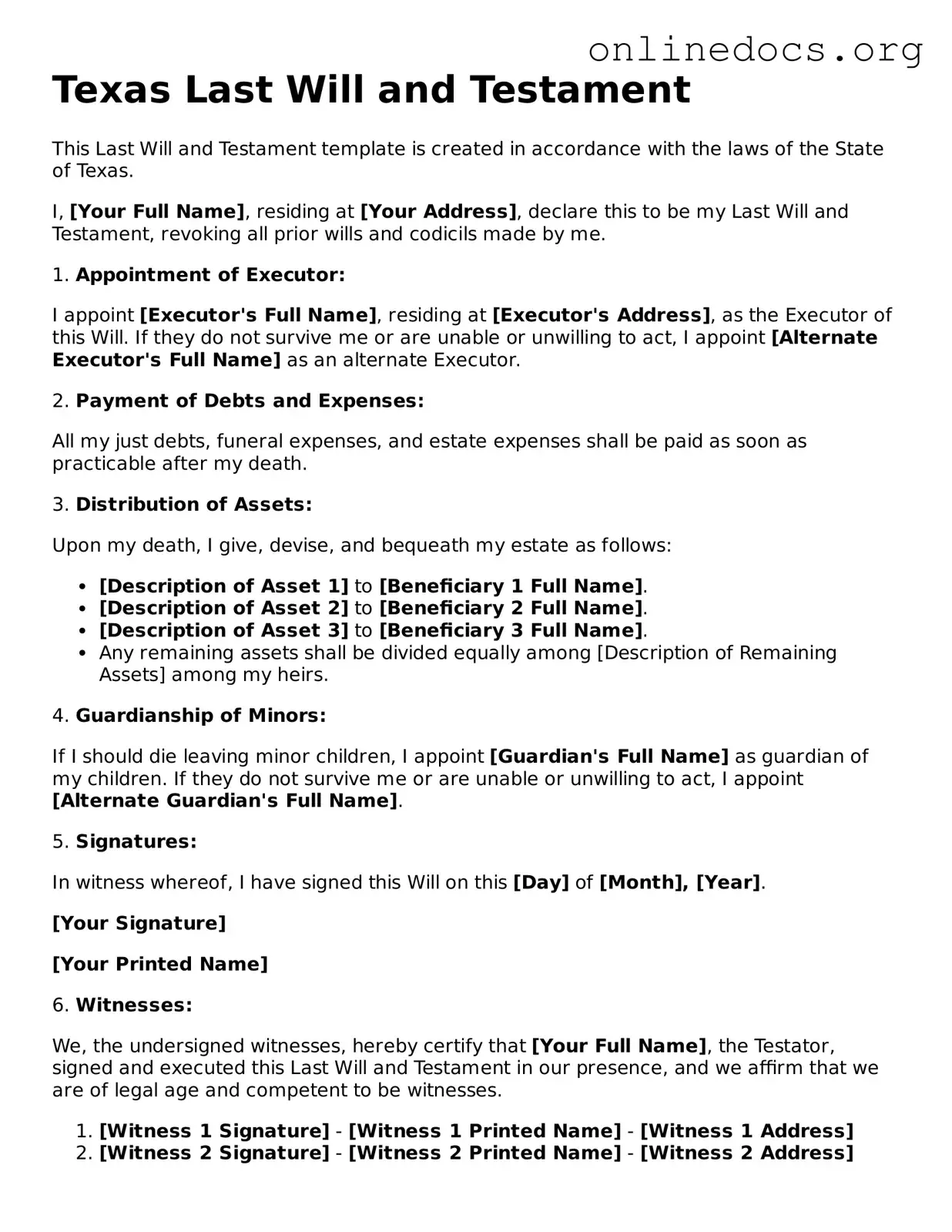

Another common mistake is failing to sign the document correctly. In Texas, a will must be signed by the person making the will, known as the testator. If the signature is missing or not placed at the end of the document, it may be deemed invalid. Additionally, having witnesses sign the will is crucial. Without at least two witnesses present during the signing, the will may not hold up in court.

People often overlook the importance of being specific about asset distribution. Vague language can lead to misunderstandings. For example, saying “my belongings” without detailing what those are can create disputes. It’s better to be explicit about what each beneficiary will receive.

Many also forget to update their will after major life events, such as marriage, divorce, or the birth of a child. A will that doesn’t reflect your current situation may not serve your intended purpose. Regularly reviewing and updating your will ensures that it aligns with your current wishes.

Another mistake involves not revoking old wills. If you create a new will, it’s important to explicitly state that it revokes any previous wills. Otherwise, confusion may arise, and your wishes might not be honored as you intended.

Some individuals neglect to consider the appointment of an executor. This person will be responsible for carrying out the terms of your will. Choosing someone who is not trustworthy or capable can lead to issues. It’s vital to select someone reliable and willing to take on this responsibility.

Additionally, many people fail to keep their will in a safe but accessible place. If your loved ones cannot find the will after your passing, your wishes may not be followed. Storing the will in a safe deposit box or with a trusted family member can help avoid this issue.

Lastly, individuals sometimes forget to seek legal advice. While it’s possible to create a will on your own, consulting with a legal professional can help ensure that all requirements are met. This guidance can prevent costly mistakes and provide peace of mind that your will is valid and enforceable.