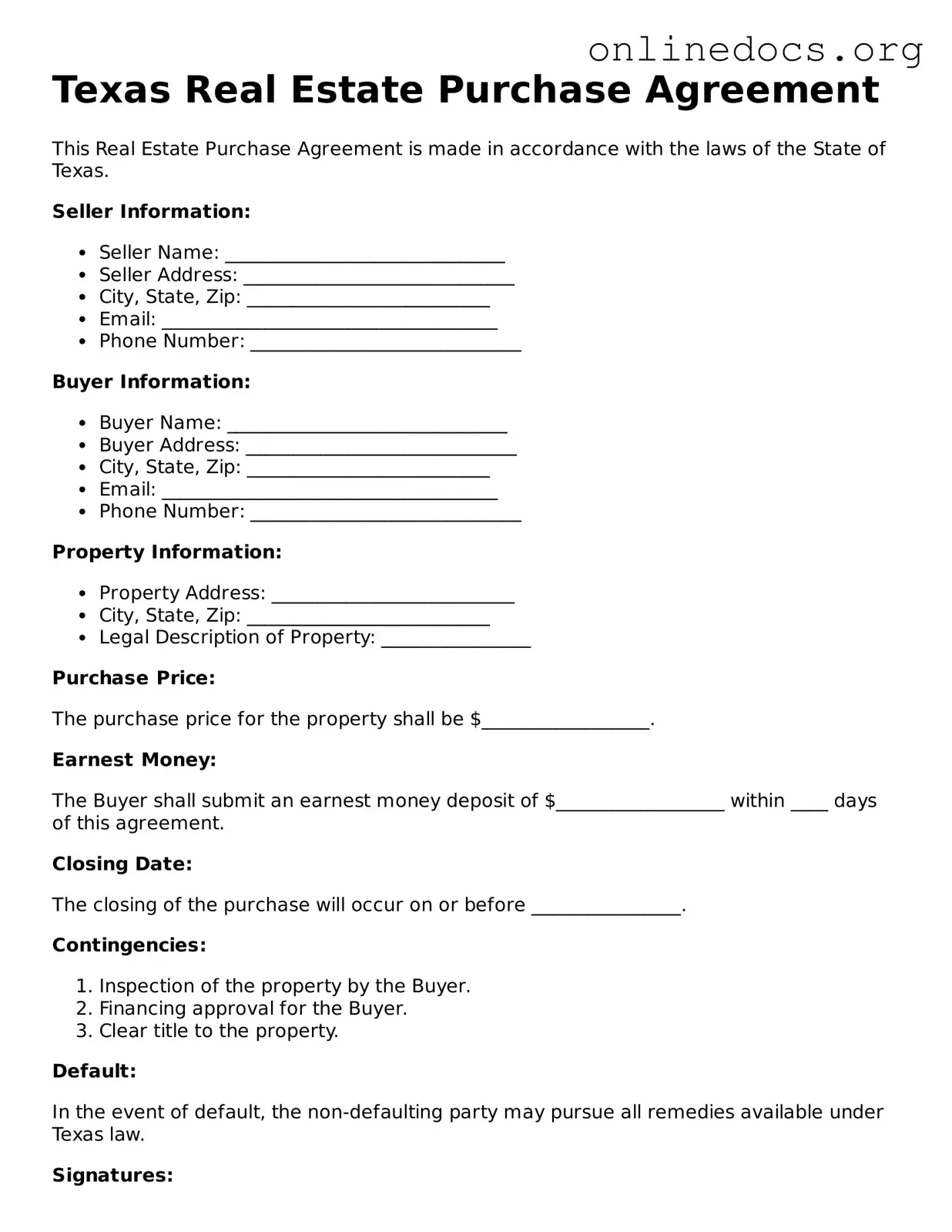

When filling out the Texas Real Estate Purchase Agreement form, many individuals make common mistakes that can lead to complications down the line. Understanding these pitfalls can help ensure a smoother transaction. One frequent error is failing to include all necessary parties. It’s crucial to list all buyers and sellers accurately. Omitting a party can create legal issues and disputes later on.

Another common mistake is neglecting to specify the property address clearly. Providing a complete and precise description of the property is essential. Without this, confusion can arise about which property is being sold, potentially leading to disputes between the buyer and seller.

Many people also overlook the importance of the purchase price. It’s vital to state the agreed-upon price explicitly. If this information is missing or unclear, it could result in misunderstandings regarding the financial aspects of the transaction.

Additionally, buyers and sellers often forget to include any contingencies. Contingencies are conditions that must be met for the sale to proceed. Common contingencies include financing, inspections, and the sale of another property. Without them, a buyer might find themselves obligated to complete a purchase under unfavorable circumstances.

Another mistake involves the earnest money deposit. Failing to specify the amount of earnest money can lead to confusion. This deposit shows the buyer’s serious intent to purchase and protects the seller. If not clearly defined, it may create issues regarding the security of the transaction.

People sometimes make errors in the closing date as well. It’s important to agree on a specific date for closing the sale. Vague terms can lead to delays and frustrations for both parties. A clear timeline helps everyone stay on track.

Misunderstanding the terms of financing is another area where mistakes occur. Buyers should ensure they understand whether they are obtaining a mortgage, using cash, or engaging in seller financing. Inaccuracies in this section can create complications and affect the transaction’s viability.

Moreover, individuals often fail to read the entire agreement thoroughly. Overlooking specific clauses or terms can lead to unexpected obligations or rights. Taking the time to review the document carefully can prevent future disputes and misunderstandings.

Finally, not seeking legal advice can be a significant oversight. While many people feel confident filling out forms, real estate transactions can be complex. Consulting with a legal professional can provide clarity and ensure that all aspects of the agreement are correctly addressed.